South Sea Petroleum Investment & Trading Corporation (NSH Petro, code PSH) has just sent a document to the State Securities Commission (SSC) and the Ho Chi Minh Stock Exchange (HoSE) explaining the sharp decline in stock prices for 05 consecutive sessions.

Previously, PSH’s share price recorded a sharp decline during the period from April 4 to April 16, with the share price decreasing at the maximum amplitude of 7/9 sessions, of which a 5-session consecutive decline from April 10 to April 16, resulting in its drop to the range of VND4,390 per share, equivalent to a 44% loss in value.

NSH Petro said that the stock price has been declining continuously because PSH shares have been sold for liquidation and due to investor sentiment in the market. The company does not have any direct impact on the trading price of shares on the stock market.

It is known that during the period from April 8 to April 12, Mr. Mai Van Huy, Chairman of the Board of Directors of PSH, reported on the sale of a total of nearly 4 million PSH shares with the reason being forced liquidation of shares. Mr. Huy currently holds more than 75.3 million PSH shares, corresponding to a ratio of 59.69% of capital, and is still the largest shareholder in the enterprise.

However, positive information surprisingly came to PSH shareholders in the session on April 17 after the explanatory document was released. PSH shares, although opening lower and even hitting the floor, suddenly reversed and climbed up to the ceiling price of VND4,690 per share. The ceiling buy-in orders amounted to nearly 900,000 units, but there were no corresponding sell orders. At the close of the morning session, the PSH share price remained at the “purple” level.

Not only skyrocketing in price, PSH’s liquidity also exploded with nearly 20 million units traded in the morning session, equivalent to about 1/6 of the company’s outstanding shares.

It must be said that the company’s situation cannot change as quickly as the stock price. PSH’s 2023 audited financial statements are a minus point as they contain an exception note from the auditors. The auditors believe that the outstanding amounts payable to the state budget and the overdue debts show the existence of material uncertainties that may raise significant doubt about NSH Petro’s ability to continue operating. Therefore, the auditors cannot determine whether adjustments to the financial statements are necessary in the event that the company cannot continue operating.

In addition, as of December 31, 2023, TTP Audit did not participate in witnessing the inventory of goods stored at the Dong Phuong Petroleum Joint Stock Company (VND131 billion), Can Tho warehouse (VND51 billion), and Tra Vinh branch warehouse (VND26 billion). Through audit procedures, the auditor could not determine the existence of the value of the above inventory and could not determine whether adjustments to the financial statements were necessary.

For this reason, PSH shares have been put on the warning list since April 10 and have had their margin trading cut by HOSE.

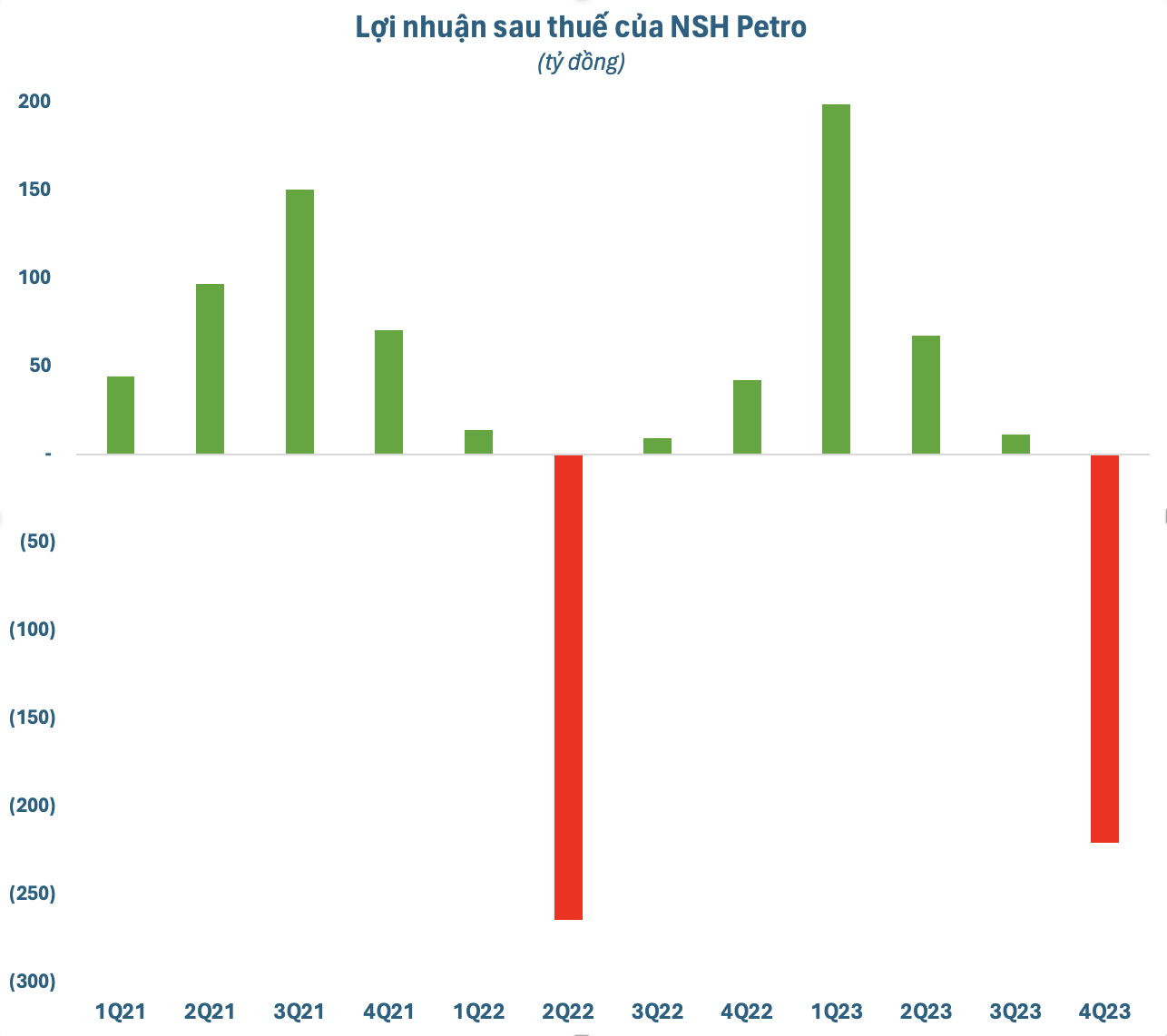

In terms of business results, NSH Petro’s business situation was relatively positive in the first half of 2023, but it suffered a heavy loss of VND220 billion in the fourth quarter. Thus, for the whole year of 2023, NSH Petro recorded a revenue of VND6,099 billion, down 17% compared to 2022. After deducting expenses, the enterprise still recorded a net profit of VND51 billion, while in the same period, the loss was up to VND236 billion.