Land Use Fee Calculation for Issuance of Land Title Certificates

As per the Ministry of Finance, the Land Law of 2024 stipulates regulations for the issuance of land use rights and ownership certificates (land title certificates) to households, individuals, and communities utilizing land without proper documentation or with illegal land use origins prior to July 1, 2014, or obtained through unauthorized allocation. Consequently, specific cases require payment of land-related financial obligations upon issuance of certificates.

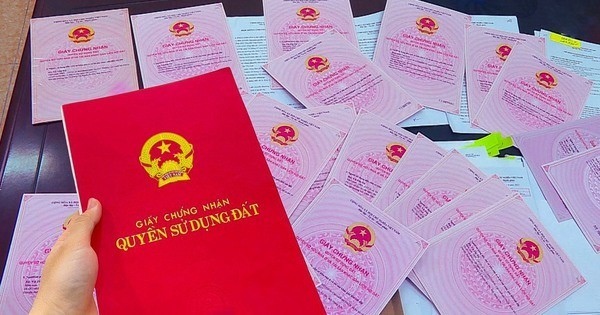

Proposed new regulations for calculating land use fees upon issuance of land use rights certificates. Illustrative photo.

Articles 9, 10, 11, and 12 of the draft decree specifically outline the fees for each case of certificate issuance under the Land Law, inheriting the land use fee regulations from the 2013 Land Law.

However, adjustments have been made to balance land use cases based on duration and origin of land ownership. The land price used for calculating fees is based on land price tables as per the provisions of the 2013 Land Law.

For households and individuals utilizing land with residential structures built prior to December 18, 1980, the recognized land area for residential purposes is capped at the maximum allowed for residential land, and no land use fee is payable upon issuance of the certificate for this area.

Upon issuance of a certificate for land area exceeding the residential land limit on a plot with residential structures, as per Article 138, Clause 1(a) of the 2024 Land Law, land use fees must be paid.

However, the 2013 Land Law allowed for the recognition of a residential land area of up to five times the maximum residential land allocation without any land use fees.

After reviewing previous fee structures, the Ministry of Finance recommended adjusting the fee for this scenario in Article 9, Clause 1(a) of the draft decree: “For land area exceeding the residential land limit on a plot with residential structures, as per Article 138, Clause 1(a) of the Land Law, the land user shall pay 20% land use fee calculated based on residential land price.”

The 2024 Land Law eliminates land price frameworks and instead mandates land price tables based on region, location, or individual plots, using price zones, standard plots, and expanding the scenarios for applying land price tables to calculate financial obligations related to land.

Consequently, the draft decree considers the cases for certificate issuance and existing regulations to balance land use fee rates and percentages, ensuring accessible land title certificates for households and individuals while maintaining social welfare.

New Regulations for Land Rental Exemptions and Reductions

A significant aspect of the draft decree is the stipulation of land rental exemptions and reductions.

The Ministry of Finance noted that the 2024 Land Law does not explicitly define land rental exemptions or reductions.

However, the drafting process of the Land Law and the provisions outlining cases requiring competitive bidding or tendering for land-related projects demonstrate that land rental exemptions allow land users to avoid paying rent for the entire rental period, while reductions refer to partial waivers.

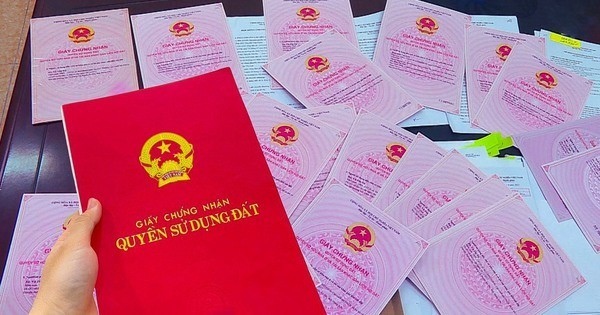

The Ministry of Finance is soliciting feedback on the draft Government Decree on land use and rental fees in line with the 2024 Land Law. Illustrative photo.

|

Therefore, Articles 39 and 40 of the draft decree establish regulations for land rental exemptions and reductions based on the following principles: (i) Land rental exemption allows land users to avoid rental payments for the entire lease period; (ii) Land rental reduction allows land users to avoid paying specific amounts calculated as a percentage of the applicable rent.

Article 157, Clauses 1 and 2 of the 2024 Land Law specify cases eligible for land use fee and land rental exemptions and reductions. Furthermore, Article 157, Clause 1 authorizes the government to determine additional exemption and reduction scenarios not explicitly outlined in the clause with the approval of the National Assembly Standing Committee.

The draft decree outlines precise exemption cases and establishes tiered land rental reductions for prioritized investment sectors and locations, aligning largely with existing rates in Decree 46/2014/ND-CP (amended by Decrees 135/2016/ND-CP and 123/2017/ND-CP).

Moreover, Article 157 of the 2024 Land Law solely addresses land use fee and land rental exemptions and reductions for land utilization in manufacturing, business, or investment-prioritized sectors or locations (without distinguishing between socialized sectors like the 2013 Land Law).

Therefore, Articles 39 and 40 of the draft decree only provide general guidelines for land use fee reductions and exemptions for projects in preferred sectors and locations, without specific benefits for land used to construct commercial public facilities (socialized).

Additionally, Article 50, Clause 6 outlines transitional provisions for land use fees, while Article 51, Clause 14 establishes transitional provisions for rental fee payments, revoking preferential land rental reductions for projects within the social sector as per Government Decrees 69 of May 30, 2008 and 59 of June 16, 2014.

Phan Thiên