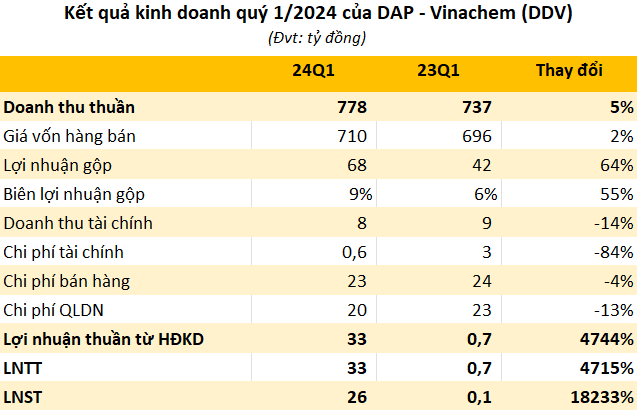

DAP – VINACHEM Joint Stock Company (code DDV) has announced its Q1/2024 financial statements with net revenue increasing by 5% year-over-year to VND 778 billion. The cost of goods sold rose by a modest 2% to VND 710 billion, resulting in a 64% increase in gross profit to VND 68 billion.

DDV attributed the revenue growth primarily to a 7,840 billion (16%) increase in sales volume to 57,836 billion, partially offset by an 8% decrease in average selling price to VND 1.18 million/ton. Furthermore, the cost of capital was significantly lower compared to production due to reduced input costs for key raw materials such as circulation and ammonia, coupled with the reversal of inventory provisions, leading to a decrease in the cost of goods sold year-over-year.

Financial revenue declined by 14% to VND 8 billion, while financial expenses plummeted by 84% to less than VND 600 million. The reduction in financial expenses was primarily attributed to lower payment discounts and foreign exchange differences.

Other expenses also decreased during the period. Selling expenses fell by 4% to VND 23 billion, and administrative expenses decreased by 14% to VND 20 billion.

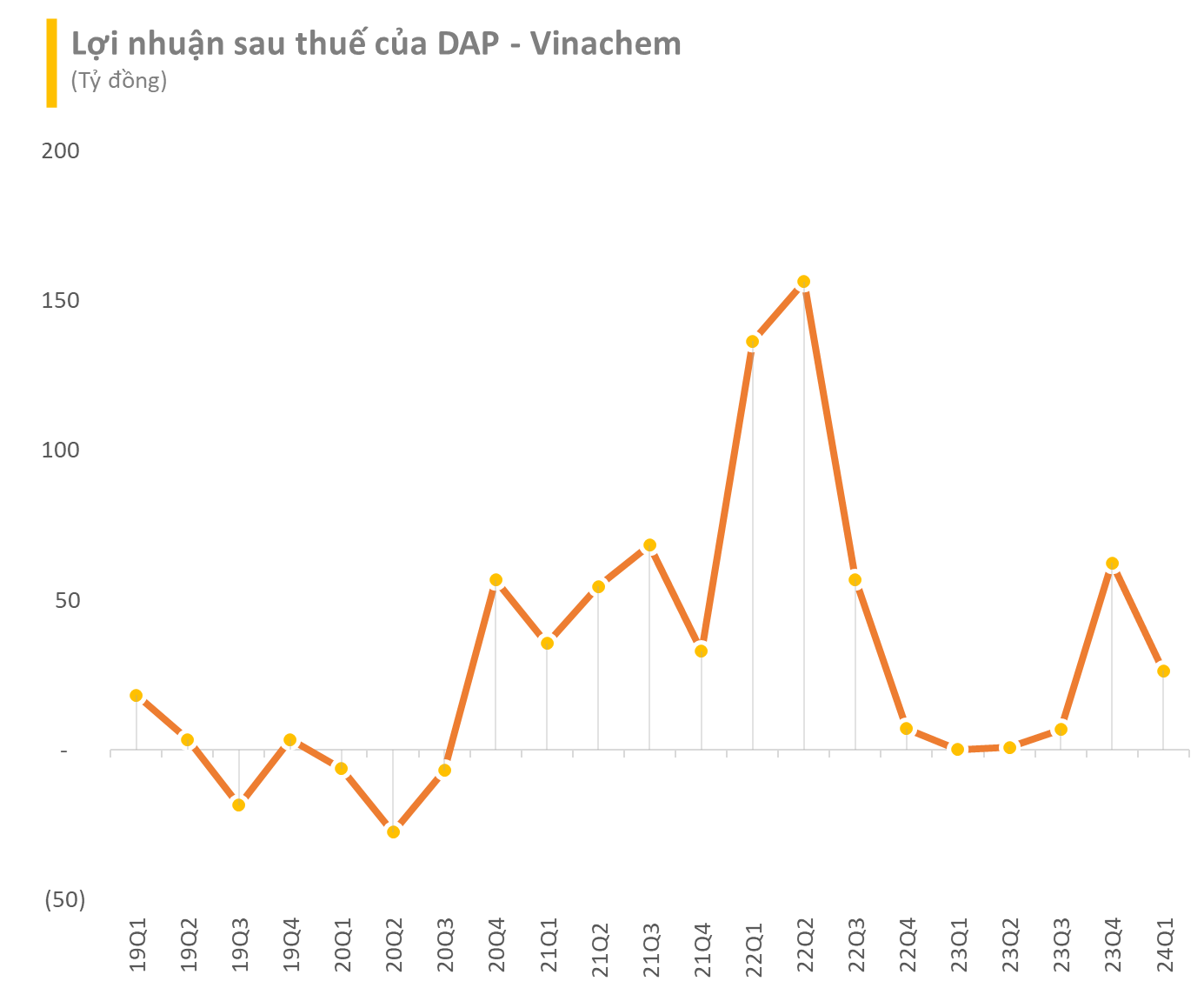

Consequently, DAP-Vinachem reported a 4,715% surge in pre-tax profit to VND 33 billion. Net income for Q1 increased by a staggering 18,233% year-over-year, from over VND 140 million to VND 26 billion.

As of March 31, total assets amounted to VND 2,019 billion, a 93 billion (5%) increase from the beginning of the year. Current assets accounted for 71% with VND 1,432 billion. The company had VND 911 billion in cash, cash equivalents, and bank deposits. Inventories decreased by VND 33 billion from the beginning of the year to VND 318 billion.

Regarding capital structure, DAP-Vinachem has no financial borrowings. Equity amounted to VND 1,728 billion, including VND 156 billion in retained earnings.

In the stock market, DDV closed at VND 14,300 per share on April 17.