Annual General Meeting 2024 of Savitech was held at the hall of the American International School in Ho Chi Minh City on April 20 – Photo: Huy Khai.

|

Business plan goes sideways, focus on education investment

Looking ahead to 2024, SVT predicts that the domestic and international situation will witness intertwined challenges, difficulties, advantages and opportunities. The domestic economy is expected to gradually recover towards the end of the year, as major export markets and global investment flows gradually improve in line with the Fed’s and the State Bank’s interest rate cut path. However, the recovery level in 2024 is still forecasted to be modest.

SVT‘s core strategic activity in 2024 is to invest in the education sector through a system of 15 schools under the American International School (VAschools) brand, providing education from kindergarten to grade 12 in Ho Chi Minh City and major urban areas in the Southern provinces.

“Savitech aims to enhance its business and investment activities, especially in the education sector, which is currently yielding high and stable results with low risk,” said Pham Thi Như Ngoc, Chairwoman of the Board of Directors.

For 2024, SVT sets a plan of VND98 billion for total revenue and other income, down slightly by 0.5% compared to the implementation in 2023; pre-tax profit of VND27 billion, up 4%. The plan is generally not high compared to recent years, but it is almost similar to the implementation in 2023.

Looking back at 2023, SVT brought in VND98.5 billion in total revenue and other income, down 48% compared to 2022 and only achieved 51% of the annual plan. Of which, net revenue was over VND71 billion, down 57%, mainly impacted by commercial paper trading activities, which only reached VND68.3 billion, down 58% due to both output and selling price declines; the remaining business is leasing of warehouses and offices for cooperation in the field of education, which has remained constant over the years, bringing in over VND2.7 billion.

However, pre-tax profit increased slightly by 1% to nearly VND26 billion and fulfilled 86% of the annual plan; net profit reached VND25.5 billion, up 3%. The growth was attributed to the bright spot from financial activities, with revenue increasing by 15% to over VND27 billion, mostly from dividends from the American International School system, at nearly VND17 billion, and Toan Luc Paper Joint Stock Company, at over VND8 billion.

As of December 31, 2023, SVT recorded an investment value of nearly VND159 billion in 2 associated companies and 5 other units, accounting for 68% of total assets.

Source: SVT‘s 2023 Annual Financial Report

|

At the general meeting, discussing the challenges faced, Chairwoman of the Board of Directors, Pham Thi Như Ngoc, pointed out 2 major challenges. Firstly, many new schools have been opened in recent years, with prestigious equipment, quality and competitive tuition fees.

Secondly, parents are increasingly informed and have a higher ability to learn about the quality of education, resulting in more stringent requirements for the quality of school education.

In the face of challenges, she said that SVT has developed some solutions to cope with, including using a market research team to understand what competitors are doing, thereby continuously adjusting to compete. In addition, it focuses on developing quality human resources to create a competitive advantage.

Ms. Ngoc also shared about the roadmap for the future: “Corresponding to the improvement of education quality, tuition fees in the coming years are expected to increase by 30-40% compared to the present, aiming at higher segments, but will be cautious, not hasty in implementation and have an appropriate roadmap. The overall growth target for the next 5 years could reach 7,000 students.”

Addressing a shareholder’s concern about the difficulties in commercial paper trading, Mr. Bui Quang Khoa – Vice Chairman of the Board of Directors and General Director of SVT shared: “The age of SVT‘s participation in the paper industry is still very young, and its scale is still small when compared to other giants in the industry, therefore, it is necessary to be cautious with market signals, especially in the current economic downturn.” He also emphasized that SVT is determined not to race for sales in this segment and will focus on the education sector.

Back to cash dividends

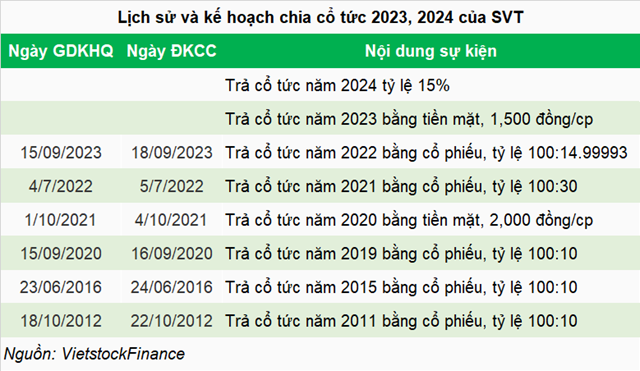

With the results achieved in 2023 and the consensus of shareholders at the general meeting, SVT will distribute 2023 dividends in cash at a rate of 15%, equivalent to VND1,500 per share. Thus, SVT has returned to cash dividends after 2 consecutive years of distributing stock dividends.

In 2024, the dividend payout ratio is expected to remain at 15% but the form has not been finalized. For the further future, the SVT leadership team left open the possibility of issuing shares to employees in the company (ESOP).