The US dollar continuously exerts pressure on other domestic currencies, including Vietnam. Illustrative photo: L.V. |

Uptrend

Exchange rates have been continuing to experience substantial upward pressure since the beginning of last week, breaking records and trading at historically high prices.

As of the morning of April 17, the listed bid rate at Vietcombank was VND25,440 per US dollar, up 92 dong compared to yesterday. Meanwhile, the central bank’s announced interbank rate was VND24,431 per US dollar, also up 90 dong. The unofficial market offered a higher price than the banking market, at VND25,663 per US dollar yesterday.

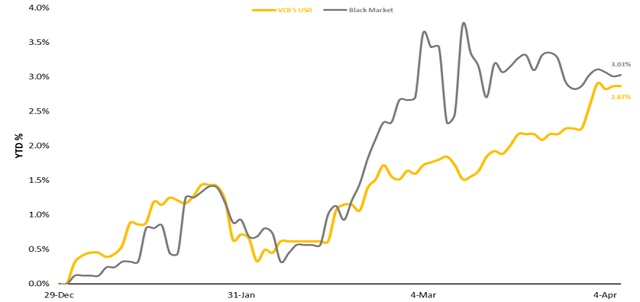

Last week, interbank exchange rates rose sharply by 1.3%, and have increased by 3.1% compared to the end of 2023. This trading range is not so far from the selling price of the US dollar set by the State Bank (SBV), according to last week’s currency market report by SSI Securities Company.

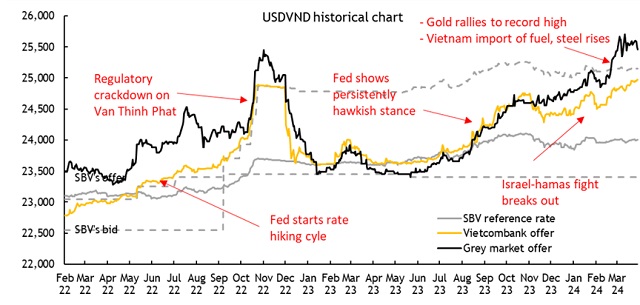

The pressure on exchange rates is largely attributed to the international market, with the focus being on higher-than-expected US inflation and consumer price index figures. The DXY index measuring the strength of the US dollar against a basket of other major currencies increased by 2.6% last week.

The overall consequence is that a series of major currencies around the world have depreciated, not only the Vietnamese dong. “The 3% devaluation of the Vietnamese dong since the beginning of 2024 is part of a general trend and is considered average,” said Đinh Đức Quang, Director of Treasury at UOB Vietnam.

In the latest update report, the analyst team of Dragon Capital also assessed that macroeconomic factors (remittances, disbursed FDI capital, trade surplus) continue to support the Vietnamese dong, but that the pressure from other stories is stronger.

“The persistent negative interest rate differential between the US dollar and the Vietnamese dong has created conditions for domestic enterprises to actively swap debts, repay foreign currency debts ahead of schedule, or for FDI businesses to transfer profits overseas,” the report stated.

Exchange rate trend in the official and unofficial markets. Exchange rate pressure started to increase sharply from mid-February. Source: MSVN.

|

In addition, another reason for the high pressure on exchange rates is the fluctuation in gold prices. Not only in Vietnam, but international gold prices are rising strongly because governments around the world are stockpiling gold to ensure national security in the context of increasing geopolitical risks, especially China has been buying gold for 16 months, and individuals are also buying gold for safe haven and speculation.

“When global gold prices skyrocket, gold prices in Vietnam also rise to new record highs, putting pressure on the black market exchange rate and ultimately affecting the official market,” commented the analyst team at Maybank Investment Bank (MSVN).

Exchange Rate Scenario

In fact, the trend of increasing exchange rates has been happening for a long time, pressured since the beginning of this year, when the global financial market has experienced many large fluctuations, and the prices of commodities continue to be affected. When the world’s concerns are not over, the Vietnamese dong will remain under pressure.

Even expectations of a US dollar interest rate cut are becoming less optimistic over time. Last week, the FedWatch tool showed that the probability of the Fed cutting rates at the June meeting has fallen sharply from 55% last month to just 20%. For the whole of 2024, the probability that the Fed will cut once (25 basis points) has increased sharply from 10% to nearly 30%, while the probability of a 75 basis point cut has decreased from 34% to only 17%.

International variables have a significant impact on recent currency rate increases. Source: MSVN.

|

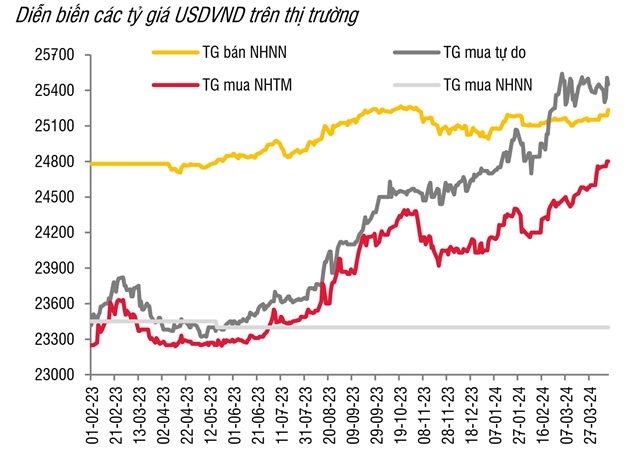

In terms of management policy, the MSVN analyst team assessed that after efforts to narrow the interest rate differential in the interbank market, exchange rate pressure has been reduced. Since the beginning of the year, interbank interest rates with a term of 1 month have increased from the 1.5% range to the 4.5% range as it is today. The interest rate differential has narrowed to only around 70 basis points, according to SSI data.

However, there are also opinions that the regulation of liquidity through the credit note channel has not been effective in the goal of cooling down the exchange rate. According to the assessment of the analyst team of ACBS Securities Company, the SBV will soon have to use other tools, such as forward foreign exchange sales.

In related developments, the SBV is currently revising Circular 02/2021 of the SBV on adjusting forward exchange rates, which is explained as being aimed at increasing flexibility and proactiveness in foreign exchange market management, adapting to the rapidly changing domestic and international market developments. In a recent speech, the SBV’s leader said that it had prepared a plan to stabilize the gold market, and could also intervene in the foreign exchange market when necessary.

Currently, most analysts believe that the pressure on exchange rates will continue. According to Dragon Capital, Q2 is the peak of the dividend payment season and the divergence in central bank policies with the Fed will increase at the end of the rate hike cycle, meaning that the US dollar is likely to continue to strengthen.

“In a worst-case scenario, the Vietnamese dong could depreciate by around 3-3.5%. However, the situation could improve, especially when the Fed is expected to cut rates in late 2024,” the group predicted.

The bid price in the official market is starting to approach the bid price of the SBV. Source: SSI. |

Similarly, MSVN’s analyst team believes that from now until June, the outlook will become uncertain due to the complexity of both factors from the foreign market (the timing of the Fed’s interest rate cut, strong fluctuations in gold prices) and factors from the domestic market.

Accordingly, the “good” scenario is that the Fed cuts rates in June and the SBV may not need to take strong action (intervene to sell foreign currency, etc.) and monetary policy continues to ease. If the Fed postpones cutting rates until Q3, the exchange rate pressure will continue to persist, but expectations of foreign currency inflows (from remittances, FDI, trade, etc.) will support the balance in the context of strong SBV intervention. The worse scenario is that it does not receive the support of macroeconomic stability in the country.

In this context, short-term or medium-term fluctuations could lead to exchange rates rising above target. However, MSVN also believes that in macroeconomic terms (including fundamental factors such as current account surplus, foreign exchange reserves, inflation, etc.), it is still feasible to control the exchange rate at 3%.

Meanwhile, according to a UOB Vietnam representative, the general scenario is that the Vietnamese dong and other currencies are likely to appreciate against the US dollar in the second half of 2024 when US dollar interest rates could be cut.

“We also expect the domestic economic recovery to be stronger, especially in the manufacturing and retail consumer sectors, which will support the Vietnamese dong interest rate to approach a more reasonable level compared to overall growth and inflation in a growing market like Vietnam,” said Quang.

Dũng Nguyễn