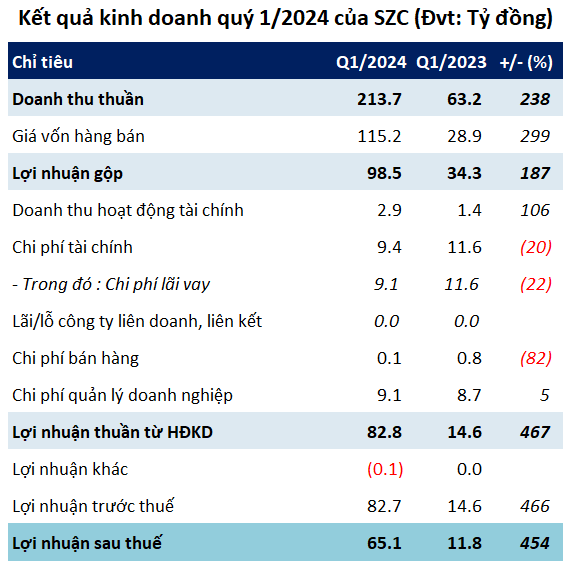

In the first quarter of 2024, Sonadezi Chau Duc recorded net revenue of nearly VND 214 billion and net income of over VND 65 billion, which were 3.4 times and 5.5 times year-over-year, respectively.

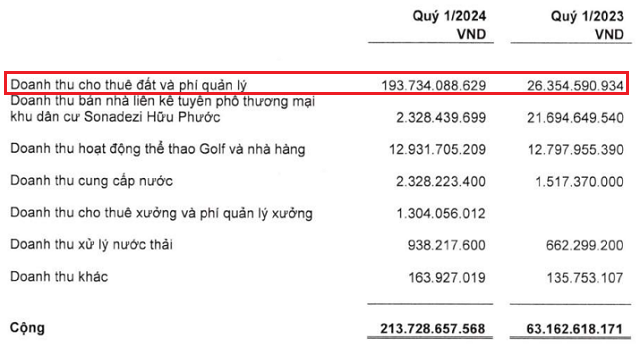

The impressive growth of SZC in the first quarter of this year was driven by a surge in rental and management fees by nearly VND 194 billion, nearly 7.4 times higher year-over-year, and accounting for 91% of total revenue. In addition, financial revenue reached nearly VND 3 billion, an increase of 106%.

Source: SZC

|

SZC‘s total expenses in the period were VND 19 billion, a decrease of 12%. In which, the majority was interest expense of over VND 9 billion, down by 22%.

Source: VietstockFinance

|

In 2024, SZC set a modest business growth target, with revenue of over VND 881 billion and after-tax profit of over VND 228 billion, up by 5% and 4% compared to 2023, respectively. As of the plan, SZC has achieved 24% of its revenue target and 29% after-tax profit.

Sonadezi Chau Duc plans to earn VND 228 billion in profit, dividend rate of 10%

Nearly VND 1,300 billion deposited in banks

SZC‘s total assets as of March 31, 2024 reached over VND 3,142 billion, an increase of 52% compared to the beginning of the year. Notably, cash and cash equivalents increased by nearly 6 times since the beginning of the year to over VND 1,295 billion, out of which VND 1,292 billion was non-term deposits at Joint Stock Commercial Bank for Foreign Trade of Vietnam (HOSE: VCB) – only VND 179 billion at the beginning of the period.

Inventory stood at VND 1,632 billion, a slight increase of 1% compared to the beginning of the period, with most of it being in the form of production and business costs in progress at the Chau Duc urban area project of over VND 1,484 billion and the Huu Phuoc residential area project of nearly VND 148 billion.

Long-term construction in progress was nearly VND 2,992 billion, up by 2%, mainly focused on the Chau Duc industrial park project (over VND 2,858 billion), including compensation for site clearance, construction costs and project investment costs. SZC said that the future assets of this industrial park project have been used as collateral for loans.

On the other side of the balance sheet, SZC still owes more than VND 5,086 billion, a decrease of 3% compared to the beginning of the year. Of which, total short-term and long-term financial debts were over VND 2,674 billion, accounting for 53% of total debts and 33% of the company’s capital.