On April 19, the State Bank announced the central USD/VND exchange rate at 24,260, an increase of 29 dong compared to the previous day’s session.

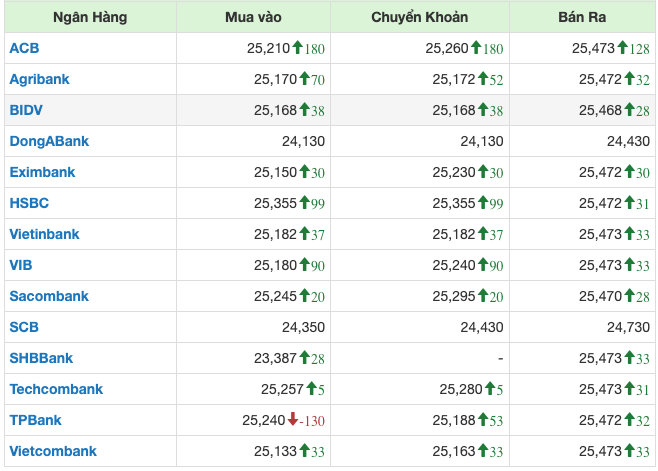

Exchange rates at banks continued to be adjusted up in unison from 33 to 128 dong for the selling price.

Vietcombank listed the buy price at 1 USD for 25,133 VND; selling at 25,473 VND per USD.

ACB strongly increased the purchase price at 1 USD to 25,210 VND, an increase of 180 dong compared to the session on April 18; the selling price increased by 128 dong, trading at 25/473 VND/USD.

On April 19, answering the press at a press conference on banking activities in the first quarter, Mr. Pham Chi Quang, Director of the Monetary Policy Department (State Bank) said that as the international USD value index increased very rapidly by more than 5% in the first 3 months of the year, leading to great pressure on other currencies in the world.

From today (April 19), the State Bank’s website will publish the plan for selling foreign currencies to credit institutions with negative foreign exchange status to foreign exchange status of 0 at a price of 25,450 VND/USD.

(Mr. Pham Chi Quang, Director of Monetary Policy Department – State Bank)

According to Mr. Quang, the exchange rate has increased rapidly in recent days due to huge demand for buying foreign currencies, especially the demand for importing raw materials for steel, gasoline, and production increasing. To prevent exchange rate risks, businesses tend to sharply increase buying forward foreign currencies, leading to a shift in future foreign currency demand to the present.

The Director of the Monetary Policy Department (State Bank) informed that from today, April 19, the State Bank’s website will publish the plan for selling foreign currencies to credit institutions with negative foreign exchange status to a foreign exchange status of 0 with a price of 25,450 VND/USD.

In the latest announcement sent to credit institutions, the State Bank said that the maximum foreign currency sale for each credit institution each time is equivalent to the level to bring the foreign currency status of the credit institution, foreign bank branch to a balanced level. The foreign exchange status considered for approval to sell foreign exchange is the foreign exchange status of the credit institution, foreign bank branch at the end of the working day immediately preceding the day the State Bank sells foreign exchange.

Analysts said that this is a very strong intervention measure by the State Bank to ensure the release of market sentiment, unblock market supply, ensure the liquidity of the foreign exchange market, and meet the economy’s foreign exchange needs.

![[Infographic] A Mid-Year Review: Banking Sector Performance in 2025](https://xe.today/wp-content/uploads/2025/09/info-ngan-hang-quy-2-218x150.jpg)