Today, some bank leaders led quite positive recovery indicators, and many stocks also recovered. However, only a few were strong enough to exceed the reference and red still dominates. This is a signal that the cash flow to catch the bottom is still actively halting the pursuit of price increases.

The VNI fell the deepest today at the beginning of the afternoon, losing 2.05% and then shrinking to a decrease of 0.08%. Such recovery margins are incredible. Usually, pillar stocks will lead to the recovery rhythm, the important thing is to observe the level of spread in other stocks as well as the liquidity.

In the times of shock drops, it is normal for prices to fall deeply, so the matter of concern is the amplitude of recovery since the bottom. In other words, when sellers are extremely fearful, new money coming in shows strength because that is the money that was preserved throughout the previous decline. The more panicked the market is, the easier it is to recognize the stocks that are on the list to be collected.

In general, today can be divided into 3 types: pioneering leading stocks such as some bank codes or good increasing codes; stocks that recover escape the bottom with high liquidity; At the end of the day, the codes are still flat or recovering very little, and they are not much interested by cash flow. Cash flow will choose to buy with different perspectives and different scales, so there will be no similar recovery. The number of red codes today is still very high despite the bank codes leading the VN30 up quite quickly. The spread is limited, and cash flow is not caught up in the recovery rhythm shown in the index.

The rapid rate of decline is pushing indices and many stocks closer to technical support levels. For example, today’s VNI bottom of 1190 is equivalent to about 38.2% of the increase in the recent wave. The VN30 has a bottom equivalent to the bottom on August 13. Many stocks are falling to the price levels of the beginning of the year or some rest rhythm in the uptrend. Usually, at technical support levels – regardless of whether they are actually in effect or not – a certain amount of bottom-catching demand is likely to appear. In essence, support levels should only be considered an area of higher probability, not an area where the market is forced to stop. Therefore, catching “all-in” bottoms is a type of gamble, not a collection strategy.

Still holding the view that the market is very good for those who hold money, it is possible to buy gradually. The initial signals are only a slowdown in selling, not yet creating a reliable equilibrium zone. Therefore, it is necessary to disburse slowly. After the panic stage will be the differentiation stage and the “testing” of supply and demand. When the big players have not finished collecting, the market cannot go anywhere.

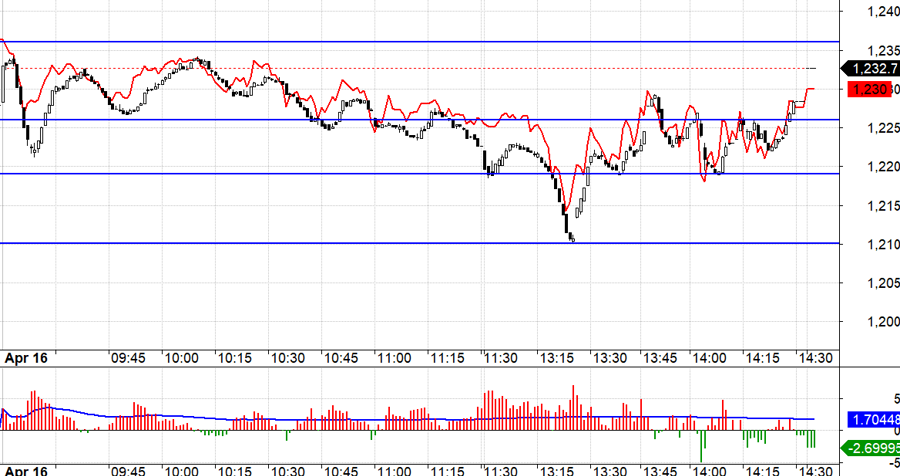

F1 is about to expire and yesterday maintaining a very wide positive basis is a good Short opportunity. The VN30 recovers but does not reach the first resistance around 1236.xx. Some bank codes are the positive but dim signals of the VN30 and the demand to catch the bottom is waiting very deeply. With the narrow width and most stocks decreasing with a large amplitude, the margin pressure will increase. Therefore, the best bottom catching point with a basis and Long swaps in derivatives must wait until there is this squeeze. The VN30 fell the deepest to touch 1210.xx and then bounced up.

With the signal that there is cash flow waiting for today’s price to catch the bottom, the recovery potential tomorrow is high. F1’s OI is decreasing very rapidly, and foreigners are massively closing positions, so it is possible that the profit of the Short party has been realized quite a lot. Derivatives do not necessarily have to put pressure on the expiration date anymore. The strategy is to watch for buying stocks, watching for Long derivatives.

The VN30 closed today at 1232.7. The nearest resistance tomorrow is 1238; 1245; 1250; 1258. Support 1227; 1220; 1209; 1202; 1197.

”Stock Market Blog” is personal in nature and does not represent the opinion of VnEconomy. The views and assessments belong to the individual investor, and VnEconomy respects the author’s观点as well as writing style. VnEconomy and the author are not responsible for any problems arising related to the investment assessments and views that are posted.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)