The market resumed its downward trajectory in today’s session, marked by a fresh wave of selling. Buyers remained cautious, as the advantage in price negotiations currently lies with them. Ample “rescue” funds are available; the primary concern is the price.

The price decline this afternoon further exposed short-term positions to increasing risk. This highlights the extreme danger of bottom fishing in a downtrend, especially when going “all-in.” Support levels are merely subjective perceptions; whether the market respects them is another matter entirely. In a rapidly declining market, any support level can be breached.

The market is currently in a corrective phase from its medium-term peak, with over a month of massive distribution. We must anticipate a worst-case scenario in which the correction’s amplitude could be even more profound. Conserving resources is a form of investment in the future, as it allows for the purchase of a larger volume of stocks with the same amount of money.

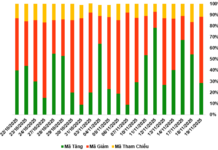

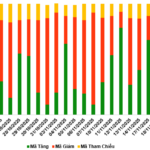

Today, we witnessed a clear indication of the strategy of prioritizing cash preservation. After yesterday’s “bearish engulfing” candlestick pattern, the market created an illusion of a bottom. However, the weak liquidity and declining stock prices this morning signal a halt in cash flow. The weight of the accumulating stocks in accounts, coupled with mounting losses, will exert natural downward pressure on prices. With the patience of cash-holders, those holding stocks will eventually capitulate. Today could have been a day of narrow, balanced fluctuations, but the anxiety of stock-holders has accelerated the resumption of the decline. Indexes closed at their daily lows, erasing yesterday afternoon’s recovery.

The market will be closed tomorrow, but this will only heighten feelings of anxiety and anticipation. This week promises to be the most turbulent correction since October of last year. It’s crucial to recognize that the transfer of stocks must be accelerated, resulting in a massive surge in liquidity. While it may seem counterintuitive that a sharp decline in prices accompanied by high volume is negative, in reality, it’s beneficial because what the chart depicts is already in the past. When the market is not in a state of crisis, the fundamental aspect of a correction is the transfer of stocks and expectations. The only remaining question is how to execute the trading strategy.

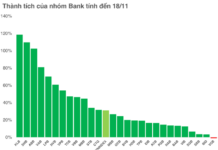

We maintain our view that the market remains attractive, with selective buying opportunities in individual stocks based on price zones. It’s not yet time for a “bloodbath” but rather a cautious exploration of different levels. A panicking market presents an ideal opportunity to observe the reactions of various parties. Certain stocks will stabilize sooner than the indices.

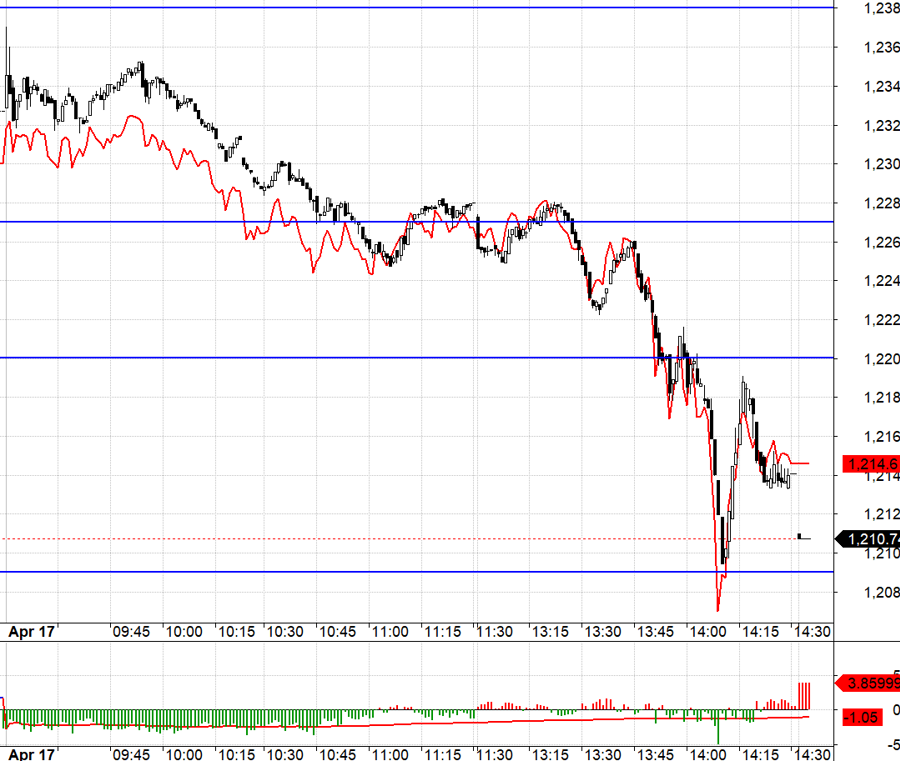

In the derivatives market, we anticipate a long position, assuming that there will be increased demand following yesterday’s rebound and the promise of banks leading the way. However, the VN30 index’s lackluster performance in early trading, hovering between 1227.xx and 1238.xx, coupled with poor liquidity and weak key stocks, raises concerns. By early afternoon, the VN30 remained confined within the 1227.xx range, unable to break out. The most favorable opportunity for an increase was in the morning, riding on existing market sentiment; failure to ascend would result in significant losses once stocks are delivered in the afternoon. The third time the VN30 fell below 1227.xx presented a solid shorting opportunity, with a stop-loss set at the point where the index surpasses 1227.xx again, as there is no need to consider basis today due to the expiration. The initial target would be 7 points to 1220.xx, and if this level is breached, the next support zone would be at 1209.xx. The VN30 indeed touched this level before rebounding, with F1 even accepting a discount of 1207.

Following the market holiday, buying strategies are unlikely to change significantly. As a result, demand during a rebound will be limited, while selling pressure from newly purchased stocks will intensify. The strategy is to short first and long later or adjust based on the prevailing market conditions.

The VN30 closed today at 1210.74. Resistance levels for the final trading day of the week are 1220; 1229; 1237; 1245. Support levels are 1208; 1200; 1191; 1185; 1174; 1168.

“Securities Blog” is personal in nature and does not represent the views of VnEconomy. The opinions and assessments expressed are those of the individual investor, and VnEconomy respects the opinions and writing style of the author. VnEconomy and the author bear no responsibility for any issues arising from the investment opinions and views published.