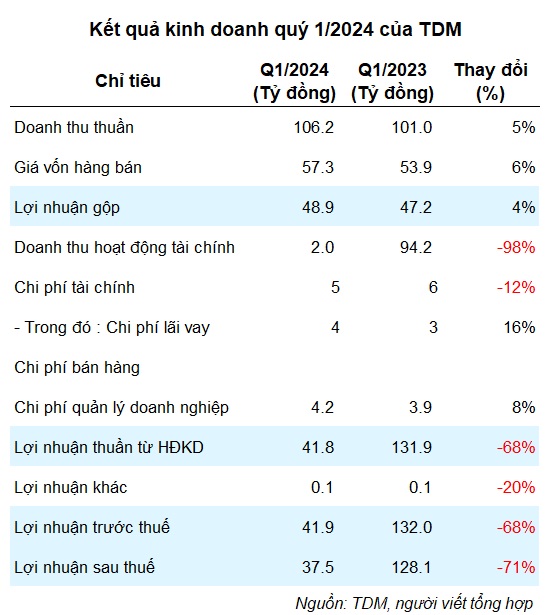

TDM reported a revenue of over VND 106 billion in Q1/2024, a 5% increase compared to the same period last year. After deducting expenses and the cost of goods sold, the post-tax profit has decreased by 71% to VND 37.5 billion. This is the lowest profit recorded in the last 10 quarters since Q4/2021.

According to the company, the absence of cash dividends from Binh Duong Water Environment Corporation (Biwase, HOSE: BWE) during the period had an impact on the financial results. In contrast, Q1/2023 recorded financial revenue from Biwase’s dividends worth nearly VND 94 billion.

This year, Biwase plans to pay the 2023 dividend in shares. This is the basis for TDM to project an 82% decrease in financial revenue to VND 23 billion. The estimated post-tax profit is also expected to decrease by 32% to VND 193 billion, which would be the lowest level in the past four years since 2021. Thus, after the first quarter, the company has achieved over 19% of its annual profit target.

On the balance sheet, as of March 31, 2024, TDM‘s total assets exceeded VND 3,033 billion, an increase of VND 430 billion compared to the beginning of the year. Cash and cash equivalents have increased by more than 4.6 times to nearly VND 512 billion. Inventory has also surged from over VND 2 billion at the beginning of the year to nearly VND 86 billion.

On the other side of the balance sheet, accounts payable are about VND 682 billion, an increase of VND 115 billion compared to the beginning of the year. Short-term and long-term financial debt is VND 411 billion, accounting for over 60% of total debt.

|

TDM Share Price Since the Beginning of the Year |

In the stock market, TDM‘s share price has been on a steady upward trend and is currently at an all-time high. At the close of trading on April 19, TDM was trading at VND 45,100 per share, a 15% increase compared to the beginning of the year, with a market capitalization of nearly VND 5,000 billion.

Amidst this growth, Vietcap Securities Corporation (HOSE: VCI) announced that it has become a major shareholder of TDM after purchasing over 10.2 million shares on April 11. As a result, its ownership has increased from 4.81% to 14.1% (15.5 million shares). The total transaction value is estimated to be over VND 442 billion, with an average price of VND 43,300 per share.