At 2:10 PM on April 16, USD exchange rate listed at Vietcombank increased by 118 VND/USD in both directions, to 24,978 VND/USD (buying in) and 25,348 VND/USD (selling out), breaking the peak of 24,860-25,230 VND/USD (buying in – selling out) set yesterday (April 15).

This was also the highest USD selling price in Vietcombank’s history from 2000 to present. This level also exceeded the spot USD selling price issued by the State Bank of Vietnam (SBV) on the same day, of 25,298 VND/USD.

|

USD-Index fluctuations in the last 5 years

Source: tradingview

|

The peak USD exchange rate at banks was continuously broken due to the sharp increase in USD prices in the international market, caused by geopolitical tensions in the Middle East showing no sign of cooling down, increasing the demand for holding safe assets such as the US dollar and gold.

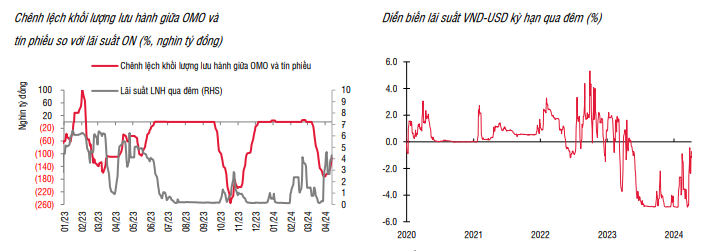

In the currency market report released on April 15, an analyst of SSI Securities Company said that last week, the system’s liquidity faced pressure and the SBV had to continue to activate the term purchase channel in the trading session on Thursday (12/04). Specifically, the SBV provided 10,000 billion dong with a 7-day term and a 4% interest rate for two participating members. At the same time, the SBV issued 25.25 trillion dong of Treasury bonds, with a higher interest rate (3.5%) on the total of 75 trillion dong maturing last week. Thus, the SBV net injected 51.24 trillion dong into the market last week through the open market channel, the volume of SBV Treasury bonds outstanding decreased to 123 trillion dong, and the outstanding volume on the term purchase channel was 10 trillion dong. Overnight interbank interest rates followed a similar trend, gradually increasing towards the end of the week, and liquidity gradually increased. At the close of trading on April 12, the overnight interbank interest rate reached 4.3% – an increase of 160 basis points compared to the previous session. The VND-USD interest rate differential narrowed to only about -70 basis points.

Source: SSI Research

|

According to experts from KBSV Securities (KBSV), the interbank exchange rate in the first quarter of 2024 increased sharply, mainly due to the increase in the DXY index, increased import demand, and activities of hoarding USD as well as “carry trade” (currency interest rate differential transactions). The SBV, although recognizing the pressures right at the beginning of the year, has proactively issued Treasury bonds since the beginning of March, but it did not achieve the desired results. KBSV said that the reason why this Treasury bond issuance became less effective was that this move only affected the “carry trade” activities of banks, while the demand for USD payment was high.

In the baseline scenario, KBSV experts predict that the USD/VND exchange rate will still face great pressure in the rest of 2024, increasing by 3% to reach 25,000 VND/USD, although the overall balance of payments is expected to be more positive but pressured by the DXY and the negative interest rate differential between USD and VND that continues to persist.

“With external pressures from the increase in the DXY, US bond yields and gold prices, the SBV will still focus on issuing Treasury bonds. However, if these pressures continue to increase, especially in the scenario of Brent oil prices exceeding 93, and the US 10-year government bond yield exceeding 4.7%, the SBV may have to intervene by selling terms or selling foreign exchange reserves outright to stabilize the exchange rate.”, said KBSV experts.