**Market Liquidity Witnesses Slight Decline**

Market liquidity decreased slightly compared to the previous trading session, with a transaction volume of approximately 996 million shares on the VN-Index, corresponding to a value of over 25 trillion VND; the HNX-Index traded more than 120 million shares, equivalent to a value of over 2.8 trillion VND.

**VN-Index Resumes Bearish Trend After Midday**

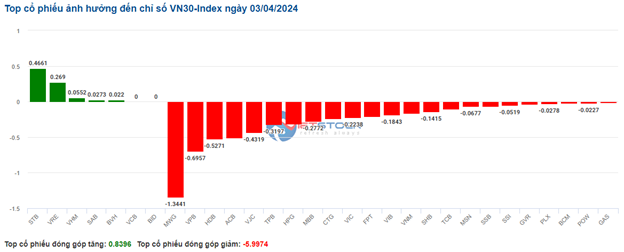

After a period of indecision below the reference level throughout the first half of the afternoon session, the VN-Index resumed its decline and closed at its lowest point of the day. In terms of impact, BID, CTG, GVR, and VCB were the stocks with the most negative influence, collectively deducting over 4.4 points from the index. Conversely, CMG, DCM, DPM, and VCF were the stocks with the most positive impact on the VN-Index, adding approximately 0.4 points to its value.

**Top 10 Stocks with the Highest Impact on the VN-Index for the Session of April 3, 2024**

**HNX-Index Follows Similar Trend**

The HNX-Index also exhibited a similar trend, impacted negatively by stocks such as L18 (-7.05%), NRC (-3.77%), NDN (-3.25%), and TIG (-2.96%), among others.

**Industry Performances**

The electrical equipment sector experienced the steepest decline in the market, dropping by 2.53%, largely attributed to GEX (-3.73%), CAV (-1.4%), and RAL (-9.17%). It was followed by the consulting, support services sector and the retail sector, which declined by 2.39% and 2.22%, respectively. In contrast, the seafood processing sector posted the strongest recovery at 0.73%, primarily due to VHC (+0.66%), ANV (+0.87%), FMC (+1.5%), and IDI (+0.78%).

**Vĩnh Hoàn Plans Investment Expansion**

According to supplemental documents, Vĩnh Hoàn Corporation (HOSE: VHC) intends to present a plan to its 2024 Annual General Meeting of Shareholders to invest 930 billion VND in capacity expansion. Specifically, VHC will upgrade and expand its collagen production capacity and renovate its factory at Vĩnh Hoàn Collagen Company. The company also intends to invest in warehousing and additional machinery for phase 1 of the Thành Ngọc fruit processing plant; expand the warehouse and increase the production capacity of the Feedone and Sa Giang seafood processing plants.

**Foreign Trading Activity**

Foreign entities continued their net selling, amounting to approximately 1.245 billion VND on the HOSE, primarily in VHM (160.85 billion), VNM (148.76 billion), SSI (130.15 billion), and KBC (91.48 billion). On the HNX, foreign entities sold a net value of approximately 3 billion VND, mainly in IDC (17.38 billion), MBS (6.7 billion), GKM (4.48 billion), and PVS (4.39 billion).

**Morning Session: Indecision Ends, VN-Index Turns Red**

**After hovering around the reference level throughout the first half of the morning session, the VN-Index resumed its decline. Additionally, foreign entities maintained their net selling, indicating a worsening situation. At the close of the morning session, the VN-Index had lost 5.17 points, corresponding to a 0.4% decrease. The HNX-Index declined by 0.43 points, equivalent to a 0.17% loss.**

**Most industry groups were in the red by the end of the morning session, including the construction and securities sectors, despite their positive start to the day. Some large-cap industry groups, such as retail, wholesale, and construction materials, experienced even steeper declines.**

**The Ho Chi Minh City Stock Exchange (HOSE) recently announced the compulsory delisting of POM shares after issuing a reminder regarding the steel company’s delay in submitting its 2023 audited financial report on April 2. According to HOSE, this was Pomina’s third delay, resulting in its mandatory delisting pursuant to point i of clause 1 of Article 120 of Decree 155/2020/ND-CP dated December 31, 2020.**

**In light of this news, POM shares experienced a significant decline during the morning session, closing with a loss of over 3%. Other stocks in the steel industry group also performed poorly, with HPG, HSG, and NKG all trading in the red.**

**The retail sector continued its negative trend, leading to sharp declines in stocks such as MWG and PNJ, which fell by 2.91% and 2.61%, respectively.**

**The seafood processing sector was the most positive performer, leading the market during the morning session. Stocks in this sector were all in the green, including VHC, ANV, ASM, FMC, IDI, and CMX.**

**10:45 AM: Indecision Continues**

**The overall market trend remained indecisive as buying and selling forces were relatively balanced, preventing the key indices from making significant gains. As of 10:40 AM, the VN-Index had lost over 3 points, trading around 1,283 points. The HNX-Index had declined by 0.02 points, hovering around 245 points.**

**The majority of the VN30 index basket was in the red, with over 20 stocks facing significant selling pressure. MWG, VPB, HDB, and ACB collectively took away 1.34 points, 0.70 points, 0.53 points, and 0.51 points from the VN30-Index, respectively. Conversely, STB, VRE, VHM, and SAB were among the few stocks that maintained their gains from the beginning of the session, offering some support to the index, though it was insufficient to prevent its overall decline.**

**Banking Sector Performance**

In the banking sector, over 50% of the stocks were trading in the red, but the declines were not yet causing excessive pessimism among investors. For instance, notable stocks such as CTG lost 0.86%, VPB lost 0.77%, MBB lost 0.4%, and ACB lost 0.53%. Only a few stocks remained in the green, including major players like VCB with a gain of 0.21% and BID with a gain of 0.39%. Notably, STB shares maintained their positive trend after the Ministry of Public Security confirmed that Sacombank Chairman Dương Công Minh was not subject to an exit ban, dismissing rumors that had negatively impacted investor sentiment during the previous trading session.

**Contrasting Performance in Real Estate Sector**

The real estate sector exhibited a contrasting trend, with a positive green hue. Currently, this sector leads in transaction value, exceeding 1,729 billion VND, with over 73 million units traded as of 10:40 AM, indicating that investors were actively trading in a few large-cap stocks. However, the sector was experiencing significant divergence, with a mix of red and green stocks reflecting the indecisive sentiment among investors