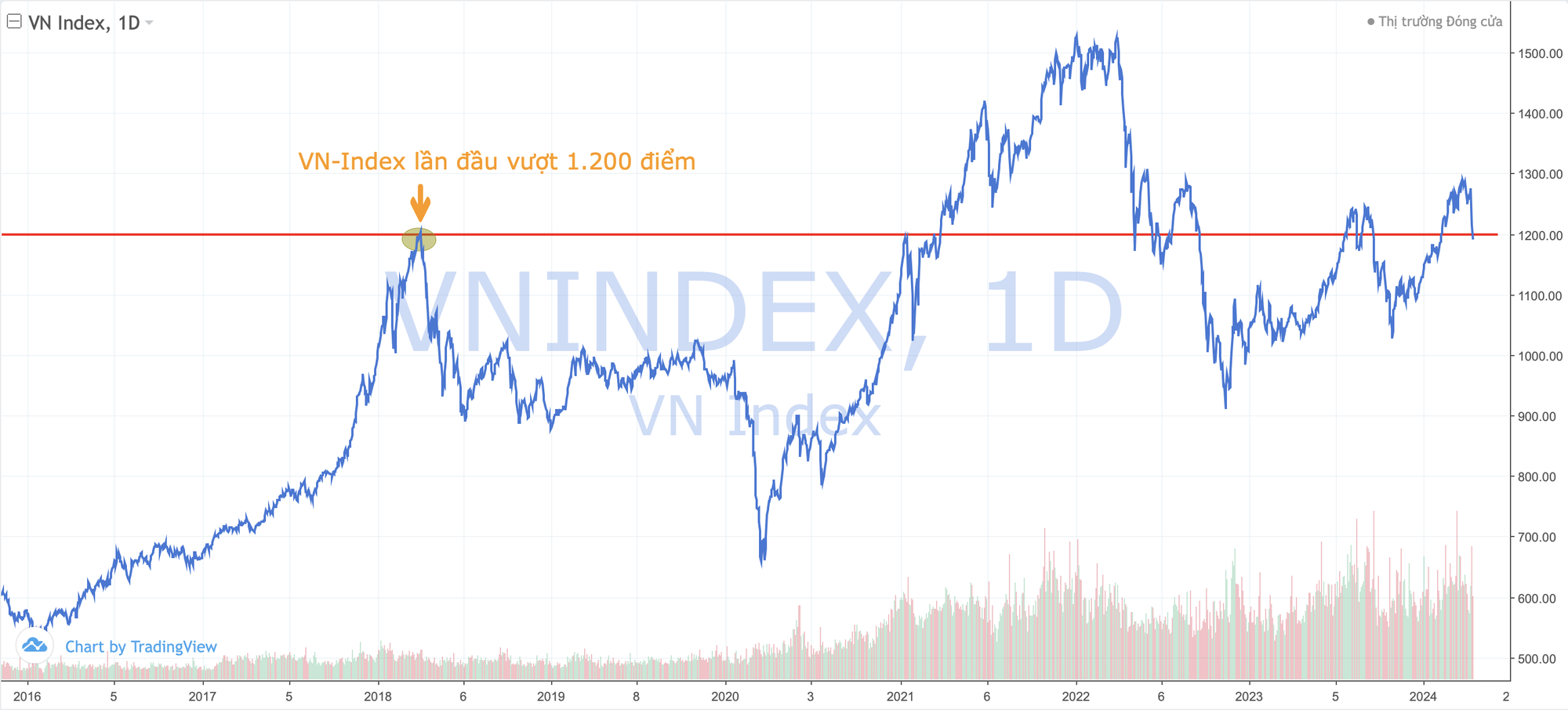

Throughout the 24-year history of the Vietnamese stock market, the 1,200 mark has perhaps been one of the most “haunting” figures for investors. Since the VN-Index first officially crossed 1,200 points in April 2018, the index has fluctuated above and below this mark eight times.

Notably, the periods when the VN-Index has remained above 1,200 points have generally been very short-lived. The longest period the index held above 1,200 was from April 2021 to mid-May 2022. The majority of the remaining time has been in terms of weeks.

Conversely, the VN-Index has often remained below the 1,200 mark for extended periods. These periods often last for months or even years. The longest stretch was the period from the initial crossing of 1,200 in early April 2018 to early April 2021, a span of three years before the Vietnamese “stock market” saw this mark again.

In the past, the VN-Index came very close to the 1,200 mark in March 2007. At that time, the Vietnamese stock market was still very rudimentary, with a limited number of listed stocks (107) that were prone to excessive “inflation.” The VN-Index’s P/E ratio, according to the International Monetary Fund (IMF), even reached 73 times.

The global financial crisis of 2008 dealt a heavy blow to the global stock market, and Vietnam was no exception. The excessively high valuations at that time further exacerbated the decline of the Vietnamese stock market. The VN-Index fell to a historic low of 235 points in 2009 and took nine years to recover to the 1,200 mark.

Imbalances and cyclical “roller coaster” stock market driven by liquidity injections and withdrawals

It is important to emphasize that while the VN-Index may be at the same point level, the capitalization of the HoSE has grown significantly over the years. However, sustainability remains a major question mark as the Vietnamese stock market has become increasingly out of sync with economic growth and corporate fundamentals. This is partly due to the market’s high speculative nature, which follows cycles of liquidity injections and withdrawals.

During periods of economic difficulty, monetary policy is often eased to support business production and operations. Low interest rates create an environment of cheap money, but the limited absorption capacity of the economy leads to a portion of idle money flowing into high-risk investment channels. The stock market also heats up with skyrocketing liquidity.

As the economy enters a recovery phase and high-risk investment channels overheat, monetary policy gradually shifts towards tightening. The environment of cheap money disappears, causing liquidity to dry up rapidly and the stock market to decline. This cycle will continue to repeat itself unless there is a real qualitative change in the market.

The issue of the Vietnamese stock market lacking new quality products has been raised repeatedly over the years, but there is still no truly effective solution to address this problem. In reality, there are not many potential “blockbuster” companies, either state-owned or private. This has led to an imbalance in the structure of the stock market.

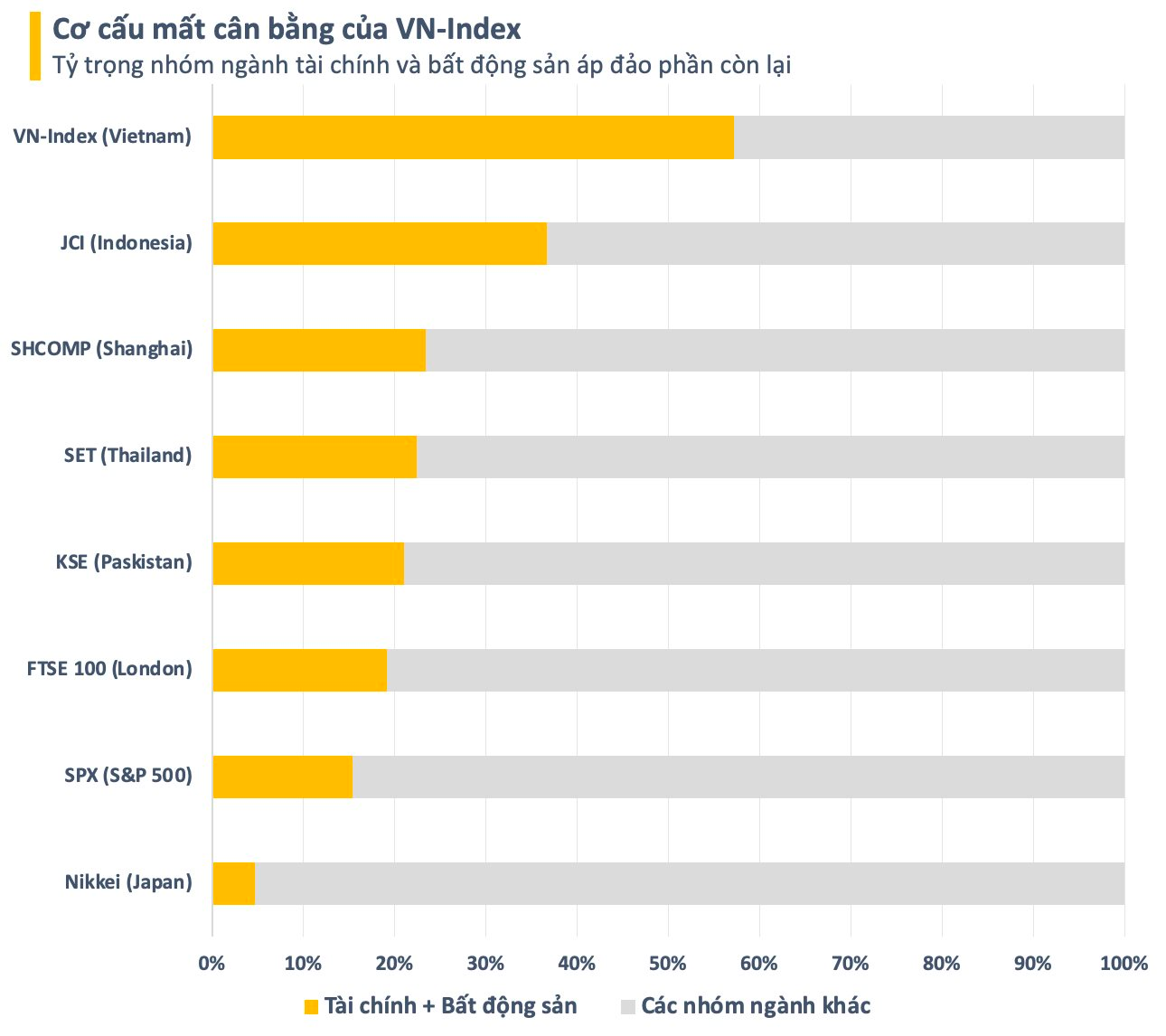

In developed markets such as the US, the structure of the stock market is relatively balanced, with sectors such as technology, healthcare, and energy being relatively evenly distributed with high weightings. These are sectors with great appeal to long-term capital flows and are even predicted to be the trends of the future.

In contrast, the Vietnamese stock market is dominated by the financial sector (banking, securities, insurance, and financial companies) and real estate, which together account for more than 60% of the total market capitalization. These sectors are highly cyclical and heavily dependent on monetary policy. This makes it difficult for the Vietnamese stock market to attract long-term capital flows, especially from foreign investors. Instead, short-term trading and speculation have become prevalent.