Q1 2024 Business Results of VIX

|

Q1 2024 Business Results of VIX

Source: VietstockFinance

|

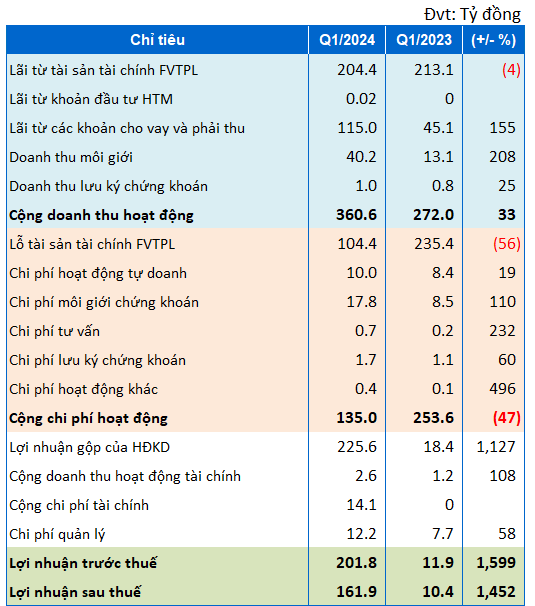

VIX‘s operating revenue grew significantly in Q1 2024 driven by increases in core business segments such as brokerage and lending. Specifically, brokerage revenue during this period reached over 40 billion VND, three times higher than the same period last year. Interest from loans and receivables amounted to 115 billion VND, more than 2.5 times higher than the same period.

During the period, the company’s recognized interest income from financial assets recorded through fair value changes (FVTPL) decreased by 4%, reaching 204.4 billion VND.

With the aforementioned changes, the operating revenue of VIX increased by 33%, reaching over 360 billion VND.

Despite the decrease in FVTPL asset gains, the FVTPL financial asset loss of VIX during this period decreased by more than 56% to over 104 billion VND. Accordingly, the proprietary trading segment reported a profit of over 90 billion VND in Q1, compared to a loss of over 30 billion VND in the same period last year.

At the end of Q1, VIX reported pre-tax profit of nearly 202 billion VND, 17 times higher than the same period last year. Accordingly, post-tax profit reached 162 billion VND, more than 15 times higher.

In 2024, the company set a pre-tax profit target of 1,320 billion VND and a post-tax profit target of 1,056 billion VND, representing increases of 110% and 9%, respectively, compared to the actual results of 2023. With the Q1 results, the company has achieved more than 15% of its post-tax profit plan.

| VIX Quarterly Net Income |

As of the end of Q1 2023, VIX’s total assets reached nearly 10.3 trillion VND, an increase of 13% compared to the beginning of the year. During Q1, the company incurred nearly 1 trillion VND in short-term loans, which were not recorded at the beginning of the year.

The company’s loan balance increased by more than 1.1 trillion VND, or more than 38%, to 4.1 trillion VND.

The company does not use much financial leverage, as its liabilities account for only 12.5% of its capital sources. At the end of Q1, VIX held over 700 billion VND in cash, five times more than at the beginning of the year.

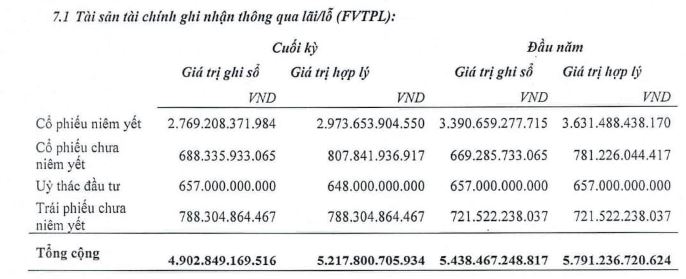

The company’s FVTPL financial asset portfolio decreased by 10% to 5,217.8 billion VND. Of which, listed stocks (nearly 2.8 trillion VND) accounted for the largest proportion of the portfolio. The company recorded a 5% gain on these investments.

In Q1, VIX earned nearly 120 billion VND in net income from the sale of listed stocks.

|

FVTPL Asset Portfolio of VIX

Source: VIX

|