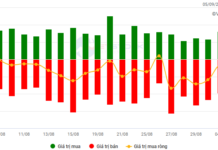

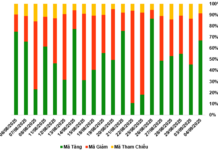

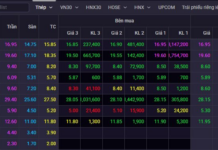

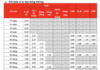

At the end of the trading session on April 19, the VN-Index recorded a decrease of 18.16 points (-1.52%), closing at 1,174.85 points. Although the decline narrowed compared to the 25-point drop during the session, it remained significant.

Consequently, the VN-Index has declined for four consecutive sessions, losing nearly 102 points, or almost 10% compared to the end of last week. During this period, several stocks have lost 15-20% of their value. Many investor accounts have incurred substantial losses, triggering margin calls and forced liquidations by brokerage firms. Even the banking sector, previously considered relatively resilient, has experienced a steep decline.

In a brief interview with Bao Nguoi Lao Dong on the afternoon of April 19, Mr. Nguyen The Minh, Head of Research and Retail Clients at Yuanta Securities Vietnam, suggested that the current decline in the VN-Index presents an opportunity for investors to begin purchasing stocks, particularly in promising sectors.

In just four volatile sessions, the stock market has lost over 100 points

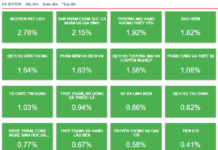

Specifically, Mr. Minh believes that the oil and gas and technology sectors offer long-term growth potential, albeit at a gradual pace.

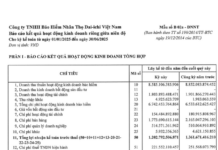

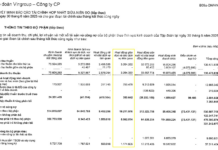

“In the short term, investors could consider exploring investments in the banking sector, where valuations based on book value (P/B) remain relatively low. The securities sector is another potential target, given their strong performance in the first quarter of 2024. I have started buying with a 20% allocation.

In the worst-case scenario, the market may decline further to 1,120-1150 points before rebounding. From a long-term perspective, the market is expected to grow, although short-term volatility is inevitable. Therefore, it is prudent to adopt a cautious approach, increasing the investment allocation to 30% and avoiding the use of margin. Notably, market valuations are currently attractive,” Mr. Minh stated.

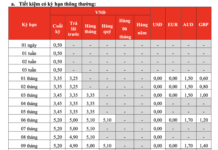

Regarding the factors influencing the current market conditions, several brokerage firms have highlighted international developments, including the conflict in the Middle East between Israel and Iran, as well as domestic factors such as the State Bank of Vietnam’s announcement of USD sales to intervene in the exchange rate. These developments have negatively impacted the stock market and investor sentiment.

VPS Securities advises investors to focus on portfolio management rather than speculating on further market declines. By ensuring a secure portfolio, investors can mitigate the impact of market volatility. The stock market has historically experienced significant corrections followed by recoveries, although these recoveries can take time.

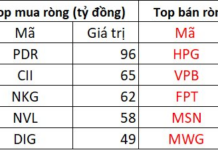

Mr. Vo Kim Phung, Deputy Head of Analysis at BETA Securities, expressed concern over the selling pressure exerted by foreign investors. In the past year alone, foreign investors have sold approximately VND 50,000 billion worth of stocks, while domestic institutions have only bought back around VND 8,000 billion.

According to experts from brokerage firms, the positive news amidst the current market volatility is the attractive valuations after significant discounts in recent trading sessions. As listed companies enter their annual general meeting season, dividend distribution plans are being announced, potentially attracting investments from sideline investors.

Quoc Cuong Gia Lai stocks defy the trend with strong gains

While the stock market experienced a sharp decline, causing many stocks to hit their daily trading limits, several stocks managed to close at their ceiling prices, including QCG, TCM, PSH, and QBS. Among these, QCG (Quoc Cuong Gia Lai Corporation) has been on a steady upward trajectory since April 9, rising from VND 13,500 to VND 17,850 per share, a notable increase of 32%. PSH (Petrochemical Southern Joint Stock Company) also posted two consecutive ceiling-breaking sessions, gaining nearly 14%.