**Margin Trading in the Stock Market**

Margin trading refers to the practice where investors use their stocks as collateral to borrow money from brokerage firms, enabling them to increase their stock purchasing power.

When the market takes a downturn, and the collateral ratio (the ratio of collateral to portfolio value) falls below the allowable maintenance margin ratio, the brokerage firm will issue a margin call, requiring additional collateral (in the form of cash or additional stocks) to increase the collateral value.

If the investor fails to meet this demand within the specified timeframe, the brokerage firm has the authority to liquidate the investor’s securities (force sell) without seeking their consent. In essence, this is a form of foreclosure on the collateralized assets.

Different brokerage firms have varying procedures for margin calls. Typically, investors will receive a phone call or text message notification of the decision. Others use email to send multiple notifications based on the client’s margin ratio.

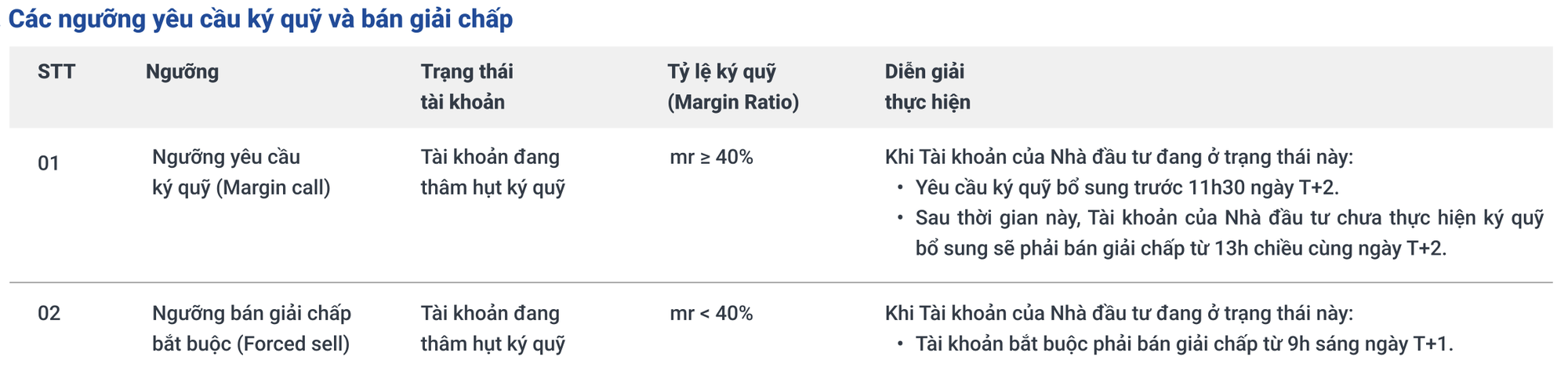

For instance, at HSC Securities, an investor’s account triggers a margin call when the margin ratio reaches or exceeds 40%. The firm will then request additional collateral by 11:30 AM on T+2. After this time, investor accounts without sufficient collateral will be subject to forced liquidation from 1:00 PM on T+2. The investor’s account reaches a mandatory liquidation threshold when the margin ratio falls below 40%. HSC will execute a force sell from 9:00 AM on T+1.

In the case of Pinetree, a margin call is triggered when the investor’s margin ratio falls to 35%. The investor must sell stocks or deposit funds into their account to meet the required 40% maintenance margin ratio. Force-sell occurs when the investor’s margin ratio falls to 30% and they must sell stocks or deposit funds to meet the safe margin ratio of 50%.

When an account receives a margin call, Pinetree contacts the client to develop an action plan for increasing the margin ratio to the required level. If the investor fails to take action within 3 trading days, Pinetree will be obligated to sell the client’s stocks to bring the ratio to the regulatory level.

In cases where the client’s margin ratio falls below the force-sell level, Pinetree will sell the client’s stocks in the next trading session to meet the regulatory level if the client has not taken proactive measures.

Similarly, at MBS Securities, margin calls are activated when the investor’s margin ratio falls to 35% and force-sell occurs when the margin ratio falls to 30%.

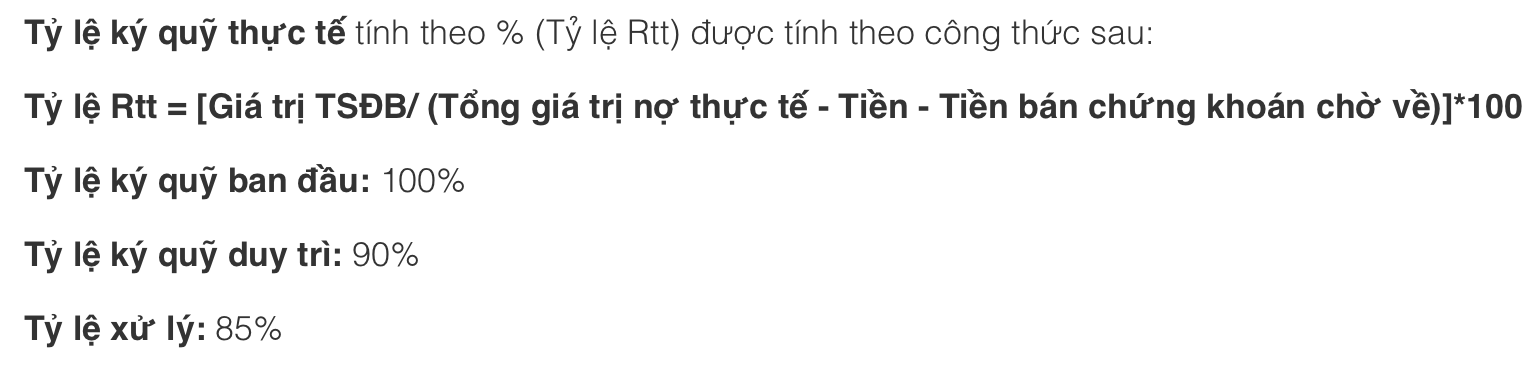

For VNDIRECT, a margin call is issued when the “Net Asset Value/Securities Value” ratio falls below the maintenance margin ratio set by the brokerage firm. Specifically, the actual margin ratio (Rtt) at VNDIRECT is calculated as Net Asset Value / Total Net Debt – Cash – Cash from pending stock sales. According to the firm’s regulations, the maintenance margin ratio is 90%, and the processing ratio is 85%.

In general, margin trading can assist investors in increasing their profits rapidly when stock prices rise, but it also carries the risk of rapid asset loss when stock prices fall. As such, investors considering this tool need to carefully evaluate both the timing of its use and conduct detailed analysis to identify the most promising stocks.