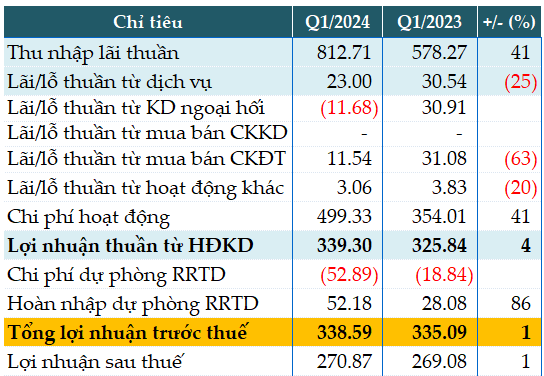

In the first quarter, net interest income had the most contribution to BAB‘s growth with an increase of 41% to approximately VND 813 billion.

On the contrary, other sources of income declined, such as service revenue (-25%), profit from trading in investment securities (-63%), profit from other operation (-20%), and foreign exchange trading with a loss of nearly 12 billion while recording a profit of 31 billion in the same period.

Despite a provision reversal of more than VND 52 billion in this quarter, an 86% increase YoY, BAB reported a slight 1% increase in profit before tax, reaching nearly VND 339 billion.

Compared to the plan of VND 1,100 billion in pre-tax profit set for the whole year which is expected to be presented to the AGM on April 27, BAB has achieved 31% after the first quarter.

|

BAB‘s business results in the first quarter of 2024. Unit: billion VND

Source: VietstockFinance

|

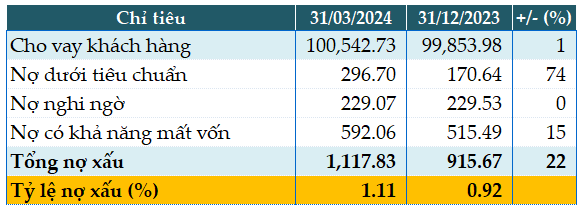

Total assets at the end of the first quarter decreased by 2% compared to the beginning of the year, reaching only VND 149,352 billion. Loans to customers slightly increased by 1% to VND 100,542 billion, while customer deposits remained stable at VND 118,124 billion.

BAB‘s loan quality deteriorated as total bad debts as of March 31, 2024 were recorded at nearly VND 1,118 billion, an increase of 22% from the beginning of the year, with the sharpest increase in substandard loans (+74%). The ratio of bad debts to outstanding loans increased from 0.92% to 1.11%.

|

BAB‘s loan quality as of March 31, 2024. Unit: billion VND

Source: VietstockFinance

|