Halving is a pivotal event in the Bitcoin system that occurs every four years. Following a halving event, the number of new Bitcoins minted through the process of Bitcoin mining is reduced by half.

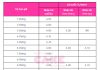

On the evening of April 19 (US time), Bitcoin completed this upgrade, according to data from mempool.space and blockchain.com. This is the fourth halving since 2012, and the miner’s reward has been reduced to 3.125 Bitcoins. The price of Bitcoin has remained nearly flat at $64,000 USD following this news.

The reduction in miner rewards has been programmed into Bitcoin’s blockchain. Bitcoin’s creator, Satoshi Nakamoto, implemented this mechanism to ensure a finite supply of 21 million Bitcoins and shield the currency from inflation.

Bitcoin advocates are looking towards this halving event to bolster the market, as it will reduce the supply of new Bitcoins while demand increases due to the introduction of Bitcoin ETFs. As a prominent player in the Bitcoin market, MicroStrategy CEO Michael Saylor has praised Bitcoin as a superior store of value to fiat currencies, stating that they are vulnerable to inflation.

Historically Bitcoin has rallied following halving events, however analysts from JPMorgan Chase & Co. and Deutsche Bank AG have stated that this event has already been priced into Bitcoin.

“As expected, this halving has been fully priced in,” said Kok Kee Chong, the managing director at AsiaNext. “The real question for the crypto market now is whether it can rally in the coming weeks amid continued institutional demand.”

The bullish sentiment surrounding Bitcoin in the short term could be impacted by negative macroeconomic factors, such as the Fed delaying interest rate hikes or ongoing geopolitical conflicts in the Middle East, said Edward Chin, co-founder of Parataxis Capital.

“The market could be choppy over the next quarter or so until the macro environment becomes clearer,” said Chin. “In the meantime, the main driver of price action will be ETF inflows.”

A Blow to Bitcoin Miners

In reality, Bitcoin miners are the party most directly impacted by halving events due to the significant reduction in rewards.

This upgrade is projected to eliminate billions of US dollars in miner revenue, though this impact may be offset if the price of Bitcoin continues to rise.

Bitcoin mining is an energy-intensive process that involves specialized computers solving complex equations to verify and validate transactions on a blockchain. Major crypto mining companies like Marathon Digital Holdings Inc. and Riot Platforms Inc. have spent billions of US dollars on energy purchases, mining equipment, and data center construction.

“Publicly traded Bitcoin miners are well positioned in this new environment, largely because of their access to capital and equity financing,” said analysts at JPMorgan. “This will allow them to expand their operations and invest in more efficient machines.”

The next Bitcoin halving is expected to occur in 2028, with the block reward decreasing from 3.125 to 1.5625 Bitcoins.

Vu Hao (According to Bloomberg)