According to CBRE Vietnam’s market report, retail sales revenue in Vietnam is projected to grow by 9.6% in 2023, lower than the 19.8% growth rate recorded in the previous year, but still positive compared to many other countries in the region.

Statistics according to CBRE Vietnam’s market report.

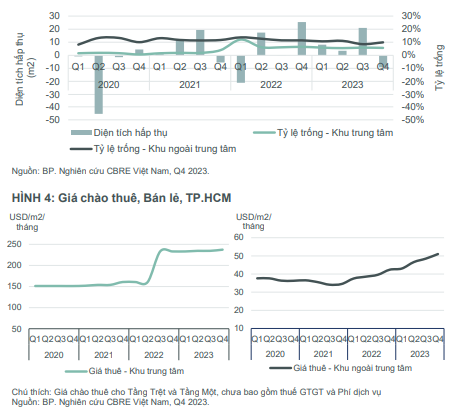

The retail real estate market in Ho Chi Minh City shows signs of recovery with sustained strong rental growth due to the active participation and expansion of luxury and high-end brands. Retail space for lease with high quality and prime locations in Vietnam are still scarce, even in the two largest cities.

In Ho Chi Minh City, the average rental price in the central area is close to the threshold of $240/m2/month, an increase of 6% compared to the previous year. The limited supply has led to a significant increase in rental prices in the non-central areas, with an average of $51/m2/month, a 28% increase from the previous year. The average occupancy rate across the market is approximately 91%, an increase of 2 percentage points from the previous year.

Shopping malls are relatively well-performing with a consistently high occupancy rate. International retail brands, especially luxury and high-end brands, have reported good revenue in the Asia-Pacific region compared to other regions, encouraging further expansion. Retail space for lease with high quality and prime locations in Vietnam are still scarce, even in the two largest cities.

According to Savills Vietnam’s Commercial Leasing Department, economic growth and an increasing middle class have driven retail demand. In 2023, retail goods and services revenue in Ho Chi Minh City is projected to increase by 6% to reach $50 billion. Retail goods revenue accounts for 59% of the market share, an 8% increase from the previous year, but lower than the national growth rate of 12%.

The sectors experiencing a decline in revenue in Ho Chi Minh City are mainly transportation (7%), other fuels excluding petroleum (4%), and timber and construction materials (2%). According to Savills’ survey of leasing transactions from 41 key projects, fashion and F&B continue to dominate, accounting for 57% of the total leased area with an average leasing area of 257 m2.

Another important factor that contributes to the attractiveness of the retail market in Vietnam is the limited presence of international brands compared to neighboring countries like Singapore, Thailand, and Indonesia. This creates great potential for brands seeking to expand their market presence, especially those looking for the first move.

In 2024, several major international brands such as Macy’s, Sephora, Cartier, Tiffany & Co., are also expected to open their first stores in Vietnam.

In 2024, two Vincom Mega Mall Grand Park projects will open in Ho Chi Minh City.

Ms. Cao Thi Thanh Huong, Senior Manager, Market Research Department, Savills Ho Chi Minh City stated, “The economy continues to develop well despite the slowdown, consumer confidence is increasing again, signaling positive prospects for the upcoming development cycle.”

However, the current challenge for retail brands, especially luxury retailers, lies in the supply of retail space. According to experts, the expansion and new openings of luxury brands in Vietnam are growing. The number of premium products and brands in Vietnam remains small compared to markets in Bangkok, Singapore, or Indonesia. The shortage of supply has resulted in price competition and pushed rental prices high in some areas.

To address this challenge, retail real estate developers both domestic and international are making continuous efforts to increase the supply of retail space to the market. With 6 new shopping centers slated to open in 2024, including two Vincom Mega Mall Grand Park projects in Ho Chi Minh City and Vincom Mega Mall Ocean Park 2 in the Hanoi area, Vincom Retail will provide hundreds of thousands of square meters of retail space to meet the supply needs of the Vietnamese retail market.

According to the Ministry of Finance, retail revenue in Vietnam is expected to increase by 8% in 2024 amidst the target of keeping the consumer price index below 3.5%. To boost purchasing power, the 2% VAT reduction policy is still maintained until June 2024.