An analyst director reviews the story of creating high-quality products for the Vietnam stock market.

Billion-dollar companies gradually increase over the years

Vietnam’s stock market has been booming, increasing the number of billion-dollar companies in the market. However, among them, the number of entities that “stand at the end point” is not small when financial institutions or corporations have advantages in terms of shares, state assets, or joint venture models with foreign partners.

Meanwhile, the number of companies developing over the years into billion-dollar companies, even creating ecosystems with a scale close to 10 billion USD in the market, is not much.

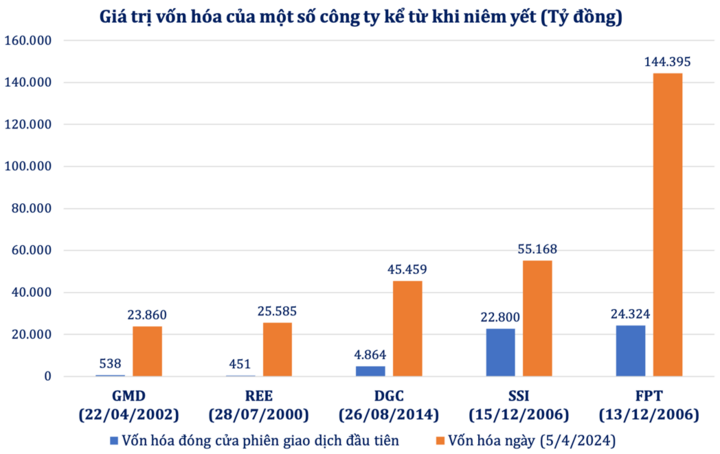

Cases of companies increasing their capitalization by tens of thousands of billions of VND, many times higher than the time of listing, can be mentioned such as FPT, SSI Securities, Duc Giang Chemicals Group, Refrigeration REE, Gemadept. These companies have different starting points, may start with a smaller position in the industry, but now they are all leading companies in their fields.

For example, with REE, one of the first two units listed on the HoSE, the company’s capitalization increased from 451 billion VND in July 2000 to nearly 25,600 billion VND in early April 2024. The major logistics company Gemadept (HoSE: GMD) also achieved similar growth. With a larger scale, FPT’s capitalization recorded on April 5, 2024 was 6 times higher than when the company listed its shares on the stock exchange – 2006.

Listed at a time when the stock market was soaring to welcome Vietnam’s entry into the WTO, the current capitalization of FPT Corporation has skyrocketed.

In addition to the parent corporation, as of the first week of April 2024, many other “F” units on the stock market have large capitalization such as FPT Telecom (28,073 billion VND), FPT Retail (Associate Company of FPT Corporation, 20,164 billion VND).

The rapid growth of companies that have become industry leaders not only create value for owners and shareholders but also create a source of quality products for foreign investors when pouring money into Vietnam.

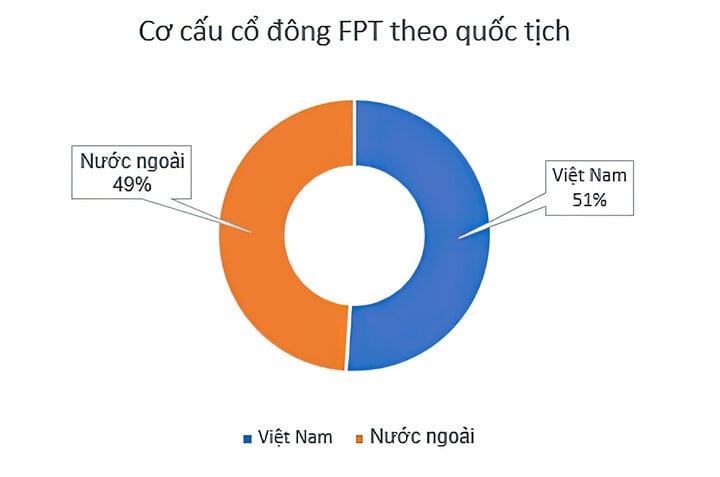

In fact, the above companies have always attracted cash flow from foreign organizations. FPT said that it is always in a state of closing the foreign “room”, and maintains it even during the period when foreign funds net sell on the Vietnamese stock market as it is now.

Formula for forming billion-dollar organizations, ecosystems worth hundreds of trillions of VND

If observing the above cases, one interesting point is the appearance of similar characteristics in many organizations, which can be condensed into formulas.

The first is a stable business model that generates huge cash flow. The fact that organizations maintain profit growth creates a large amount of cash for the company to pay cash dividends to shareholders regularly over the past years and resources for re-investment to develop business models.

Second, strong financial resources based on retained earnings help units with a healthy financial structure to develop both in depth and scale when it is necessary to “extend the octopus tentacles” to other fields or markets. The above ecosystems are constantly implementing M&A deals.

Not only stopping at the domestic market like Duc Giang, SSI, REE or Gemadept, FPT is constantly buying and merging organizations around the world to expand its business model such as in Japan, the United States, and South America.

Despite rapid growth, the management of companies is cautious in their business strategies. For example, careful observation shows that large organizations often set modest business plans but always complete and exceed them at a high rate.

Finally, it is the generational transition to sustain growth momentum. The next generation of enthusiastic and sharp leaders is gradually demonstrating their leading roles.

Along with development strategy, this is the fulcrum for investors to expect the trains to go further and more importantly, to connect more coaches, the formula from midcap to bluechip from the parent corporation will be multiplied to create a source of quality for the Vietnam stock market.

This is a bright spot when the Vietnamese stock market needs more quality products when the story of upgrading from marginal to an emerging market is about to unfold.