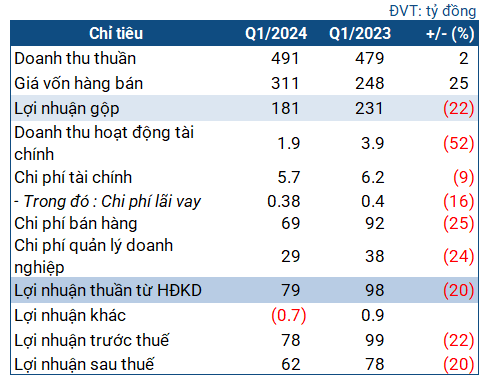

Imexpharm’s Q1 2024 Business Indicators

|

Imexpharm’s business indicators in Q1 2024

Source: VietstockFinance

|

In Q1, IMP achieved a slight revenue growth to VND 491 billion. However, the cost of goods sold surged to VND 311 billion, an increase of 25% year-over-year. After deduction, gross profit was VND 181 billion, down 22%.

The most significant factors affecting the performance were a decrease in selling and administrative expenses by over 24%. However, the sharp increase in the cost of goods sold led to a decline in the company’s performance. At the end of Q1, IMP‘s profit after tax was VND 62 billion, 20% lower than the same period last year.

IMP‘s explanation attributed the weaker business performance to rising raw material prices. In addition, increased competition in the market and the commencement of operations at the IMP4 factory (from Q3 2023) have resulted in higher depreciation and operating costs.

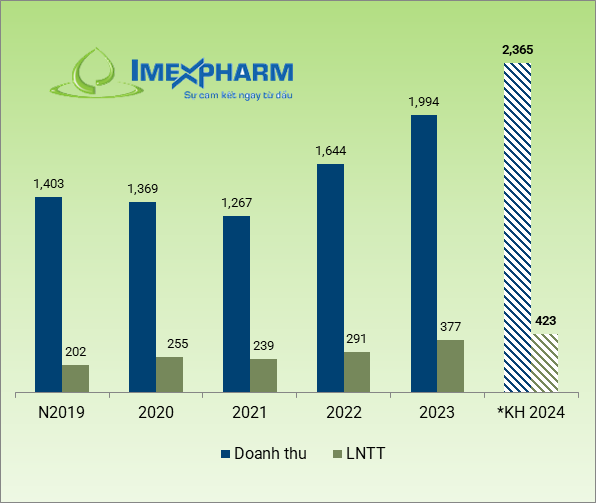

According to the IMP‘s 2024 AGM documents (scheduled for the morning of April 26, 2024), the company has set a pre-tax profit target of VND 423 billion, 12% higher than the record achieved in the previous year. With the decline in Q1 performance, the company has only achieved 18% of its full-year pre-tax profit target, implying significant efforts are needed to meet its goal.

|

IMP‘s business results over the years and 2024 plan

Source: VietstockFinance

|

At the end of Q1, IMP‘s balance sheet remained relatively solid. Total assets increased slightly from the beginning of the year to nearly VND 2.5 trillion, with short-term assets accounting for more than VND 1.3 trillion (up 9%). Cash and cash equivalents at the end of the period increased by 21% to VND 241 billion. Inventories increased slightly to VND 706 billion.

On the other side of the balance sheet, all liabilities were short-term, totaling VND 327 billion, up 6% from the beginning of the year. The current ratio was close to 4 times. The company’s only loan is from Shinhan Bank, with a balance of nearly VND 119 billion, 2.4 times higher than at the beginning of the year.