With fresh momentum emerging since the end of 2023, the Vietnamese stock market has recorded impressive growth of 13.6% in the first quarter of 2024. However, recent developments in the global and Vietnamese macroeconomic landscape, as well as the movement of capital flows in the market, are causing concern among many investors.

At the recent “Investor Day: Tracking Capital Flows, Seizing Opportunities” event hosted by Dragon Capital, Mr. Le Anh Tuan – Director of Dragon Capital’s Investment Division offered perspectives on both the global and domestic economic scenarios.

Regarding the global outlook, data indicates that the US economy remains very robust, and a recession is unlikely. In contrast, countries in the Eurozone are facing their own challenges, with economic growth falling short of expectations.

This has widened the gap in monetary policy between various countries. Fed members are becoming increasingly cautious about the extent and frequency of interest rate cuts in 2024. Many predict that the Fed may only reduce rates a maximum of twice in 2024. Meanwhile, the Swiss National Bank has been a frontrunner in cutting rates, and central banks in Europe, the UK, and Canada may implement rate cuts earlier and more aggressively than the Fed.

During the latter stages of an interest rate hike cycle, the US dollar tends to strengthen, affecting currencies in emerging markets. Regarding geopolitical tensions in the Middle East, Mr. Tuan believes that while the conflict may not escalate, it will create new dynamics in oil prices. If oil prices remain elevated for longer than expected, it will directly impact inflation.

In terms of the domestic macroeconomic outlook, the Vietnamese economy is recovering with clear positive signals in many sectors. The GDP growth for the year could reach 6-6.5%. The government’s clear direction to continue easing and supporting economic recovery is another positive factor.

However, in the short term, global uncertainties could impact Vietnam. Negative interest rate differentials, volatility in the gold market, and cryptocurrency fluctuations may put pressure on the exchange rate. Due to exchange rate pressures, Dragon Capital experts believe that interest rates could bottom out in March, after declining by 70-90 basis points since the beginning of 2024.

Market unlikely to correct by 15-20%

Mr. Le Anh Tuan identifies three pillars of stability for the economy and the stock market: macroeconomic stability, monetary policy, and earnings growth.

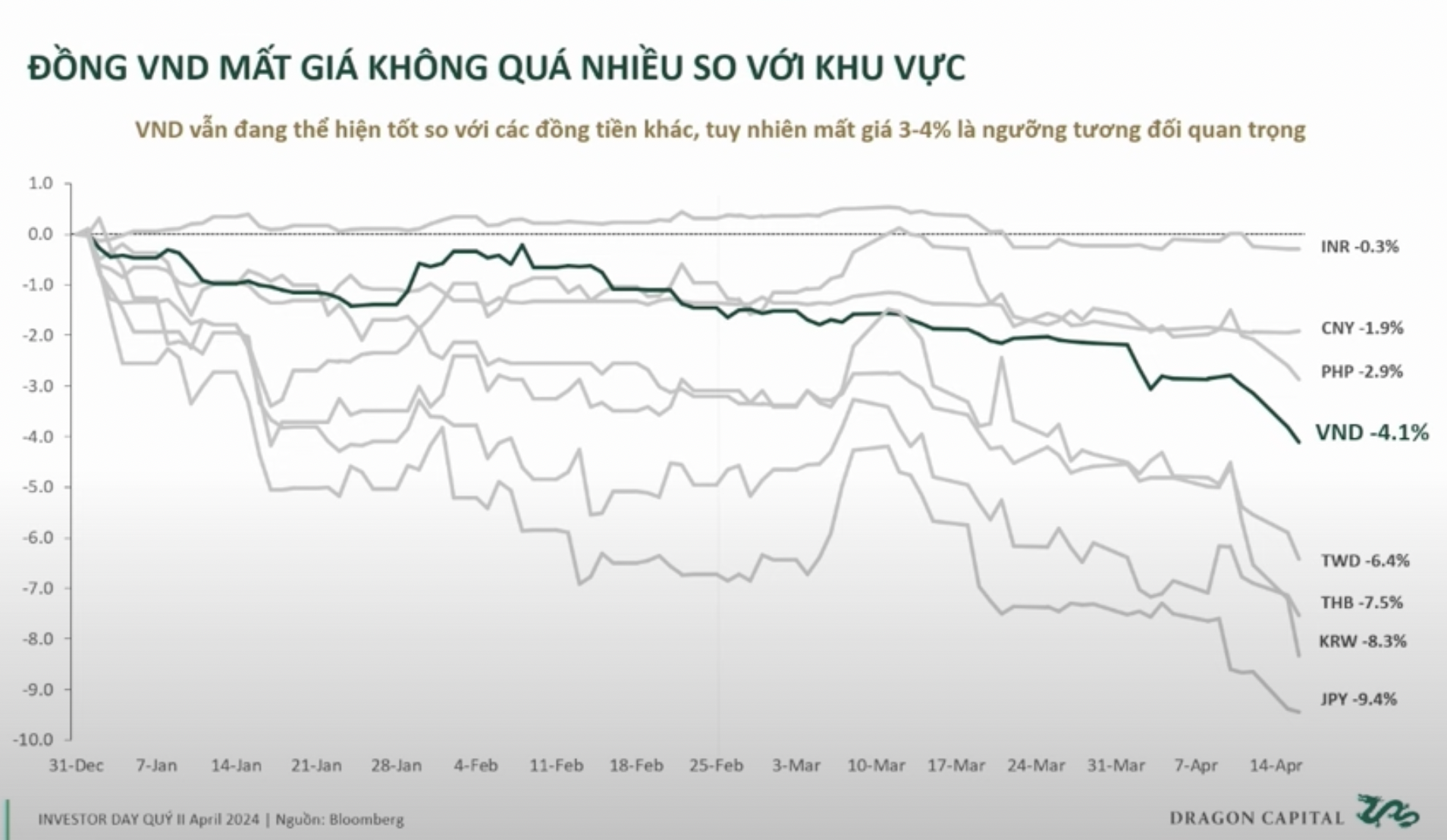

Firstly, macroeconomic stability is apparent in economic indicators such as airport service capacity, essential, and non-essential consumption, which have all begun to recover since Q3 2023. However, the exchange rate is facing pressure due to the negative interest rate differential between the VND and USD, as well as volatility in the gold and cryptocurrency markets. While the VND has not depreciated significantly compared to regional currencies, a depreciation of 3-4% is worth monitoring.

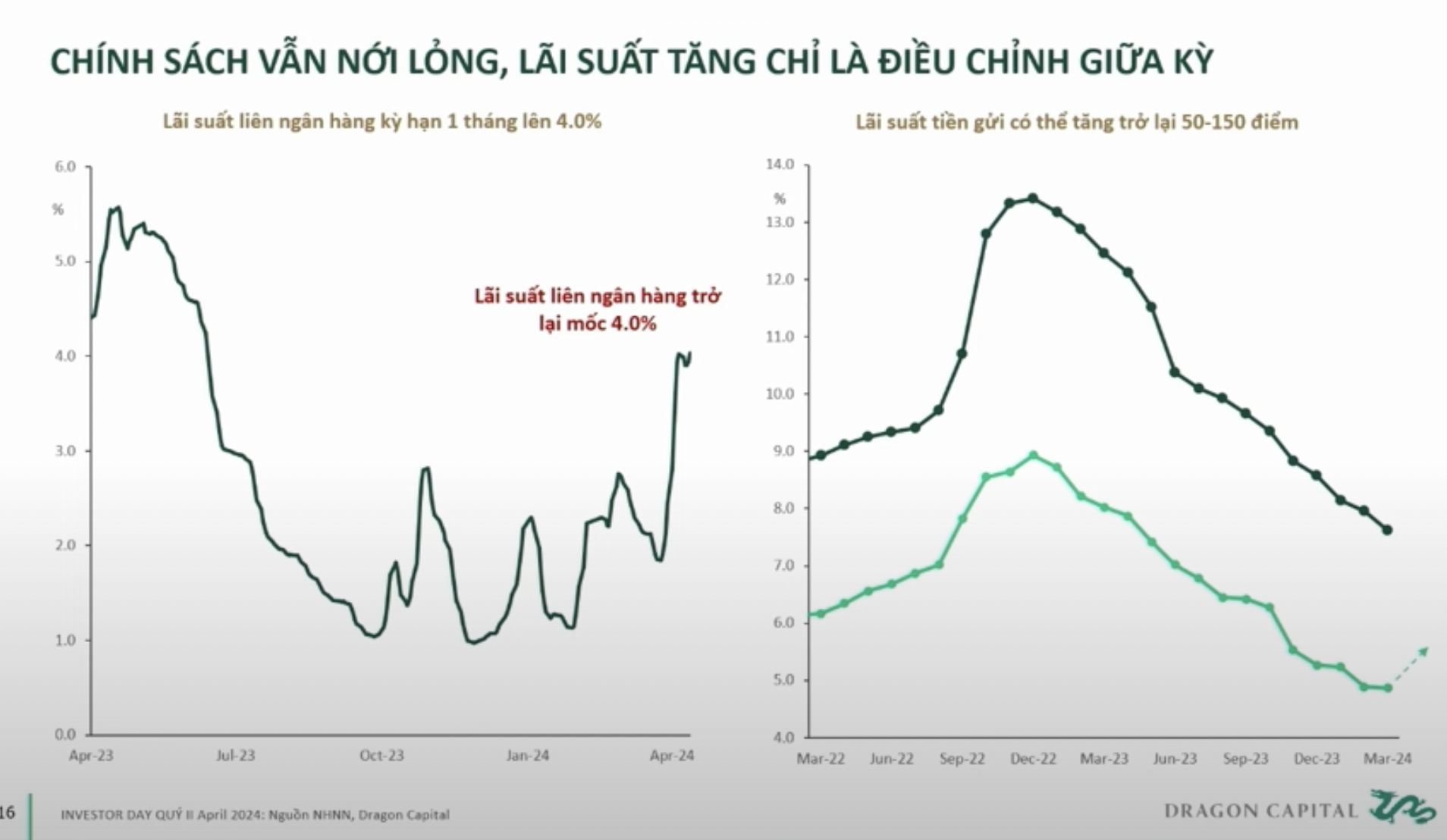

Secondly, monetary policy. Exchange rate pressures have prompted the State Bank of Vietnam (SBV) to resume issuing government bonds, causing OMO market interest rates to increase from 1% to 4%. Dragon Capital believes that this interest rate level will persist for quite some time, potentially for 1-2 months until there are signals of easing inflation in the US. To strike a balance between exchange rates and interest rates, domestic deposit interest rates could rise by 50-150 basis points in the next 3-6 months. However, Mr. Le Anh Tuan emphasizes that the monetary policy stance remains accommodative, with interest rates moving from “extremely low” levels to “low” levels.

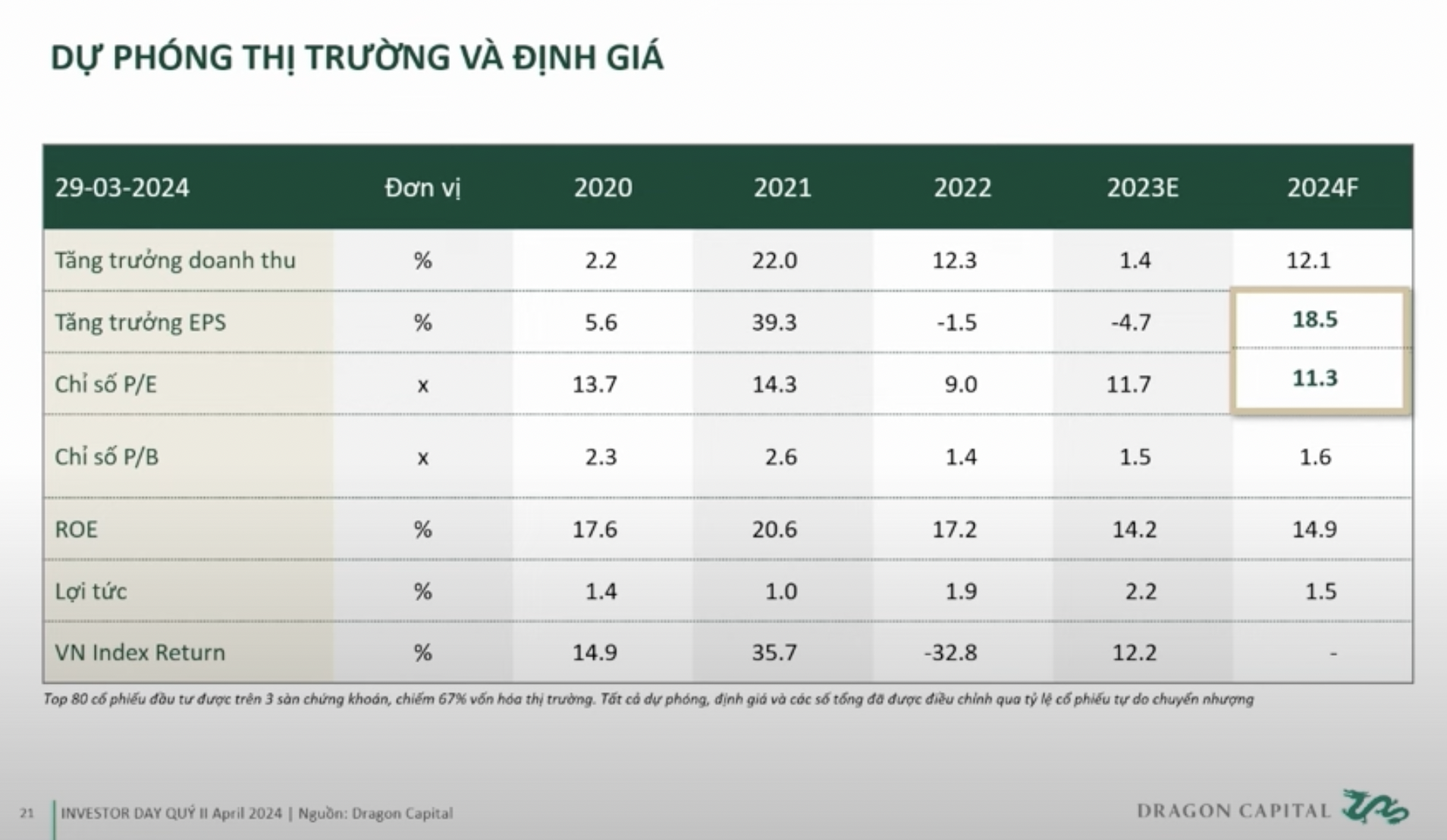

Thirdly, corporate earnings growth. According to Dragon Capital experts, the Vietnamese economy continues to show clear signs of recovery, supported by expansionary monetary and fiscal policies. Corporate earnings reflect this economic recovery. The projected profit after tax for the top 80 companies is expected to grow by 15-18% in 2024. Preliminary results for the first quarter from 40 companies in the top 80 show a 21% increase in profit compared to the same period last year.

“These three factors combined will drive a period of strong growth similar to 2020-2021. In 2023, we had macroeconomic stability and accommodative monetary policy, but earnings growth was weak, so the VN-Index only rose by 13%. From October 2023 to the present, while earnings growth has improved, exchange rates and interbank interest rates have been unfavorable factors, preventing the stock market from following a linear path,” explained the expert.

Regarding market valuations, Dragon Capital’s analysis suggests that the top 80 companies are trading at a price-to-earnings (P/E) ratio of 11 times, while earnings per share (EPS) are growing by 18.5%. This indicates that the valuations are relatively attractive from a medium-term perspective. Therefore, any period of correction should not be seen as an opportunity for investors to exit the market but rather as a chance to make investments with a medium- to long-term outlook.

“At such attractive valuations, the probability of the market declining by another 10-15-20% is low. A 10% decline is possible, but if it falls by more than 15%, investors should make decisive moves,” advised the Director of Dragon Capital.