In session 16/4, VN-Index continued to face selling pressure and at times retreated to the 1,200-point zone. However, the buying force increased immediately afterwards, helping to significantly narrow the decline towards the end of the session. VN-Index closed the session with a slight decrease of 0.93 points (-0.08%) at 1,215 points.

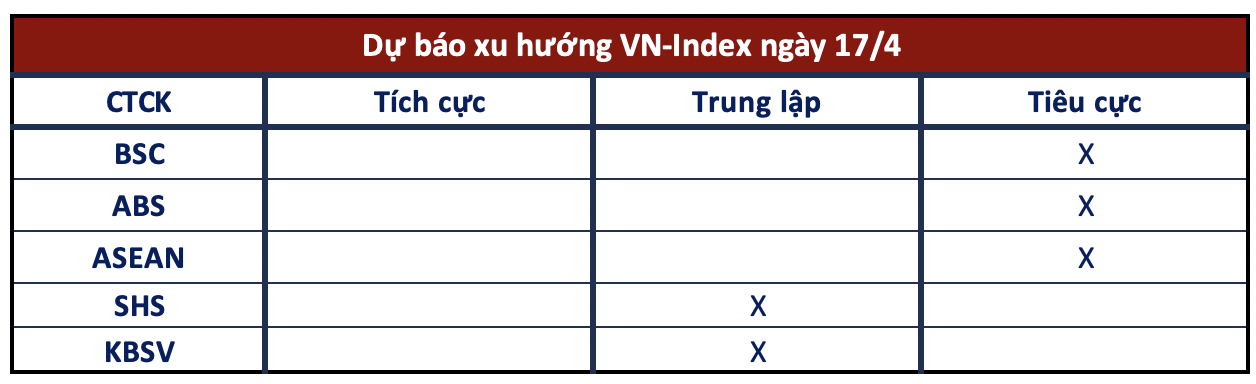

In their assessments of the market in the upcoming sessions, most securities companies believed that market risks remained high and investors should exercise caution.

High risk of correction

BSC Securities

The short-term risk of the market is still quite high. The index may continue its downward trend in the short term, with support at 1,200 points. Investors should trade cautiously.

ABS Securities

In terms of the overall trend, the supply and demand factors of the market are showing a lack of consensus among the cash flows participating in the market in various industry groups. On the daily chart, the market has lost the short-term uptrend channel in the recent past, and VN-Index is likely to enter a short-term correction phase with an amplitude that could reach 120-160 points from the recent peak. The next support level for the index is in the 1,187–1,173 point zone.

Asean Securities

Although cash flow has returned with relatively good volume, it has only focused on the Bluechip stock group and lacked the spread to indicate that the market’s short-term downtrend is still present, despite signs of the market “pulling back”. Therefore, this is just a technical recovery session after the decline since late March. Investors should continue to observe, avoid new purchases, and maintain a low to medium stock ratio.

Limit new purchases

SHS Securities

In the short term, the market may technically recover in the coming sessions, however, the risk of VN-Index returning to a downtrend with a new support level at a low of 1,150 points will persist as long as the index fails to regain the 1,250-point mark to consolidate the 1,250 to 1,300-point accumulation zone after the sharp decline on April 15.

KBSV Securities

The index formed a “Dragonfly doji” candlestick pattern, indicating that demand has started to respond again. The effort to push the price close to the reference threshold under selling pressure on the midcap group improved market sentiment. However, the recovery remains quite divergent, and there is a high probability that downward pressure will increase again around the resistance near 1.22x. Investors are advised to limit new purchases for positions they are holding, prioritize risk management, and reduce positions and restructure their portfolios during early recovery periods.