On the morning of April 19, the Vietnamese stock market continued its decline when, after more than an hour of trading, the VN-Index had fallen by more than 13 points to 1,179 points. Thus, in the past week, the VN-Index has lost nearly 100 points.

In stark contrast to the market over the past week, QCG shares have gained for four consecutive sessions. Notably, on the morning of April 19, the stock’s price also reached the ceiling price of VND 17,850 per share, with a remaining buy volume of 545,500 units. Furthermore, since the beginning of the year, this stock has increased by 77.6%, and compared to a year ago, QCG’s price has increased by 329%.

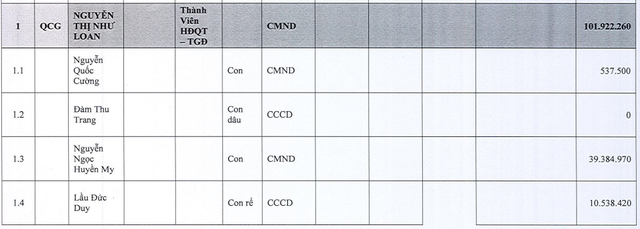

The strong increase in QCG’s share price in recent times has brought joy to the family members of Ms. Nguyen Thi Như Loan, Member of the Board of Directors and General Director of the company. Currently, Ms. Loan holds 101.9 million QCG shares, equivalent to 37.05% of the capital. Thus, the value of Ms. Loan’s shares has increased by VND 795 billion.

Her famous son, Mr. Nguyen Quoc Cuong (also known as Cuong Do La), also holds 537,500 shares. As such, the value of the shares held by this businessman has also increased by more than VND 4 billion. Cuong Do La’s wife, Ms. Dam Thu Trang, does not hold any QCG shares.

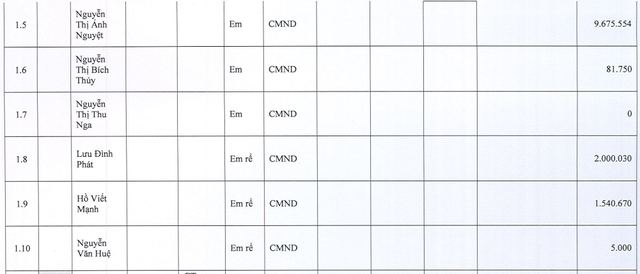

As for other family members, Ms. Nguyen Ngoc Huyen My, Ms. Loan’s daughter, currently holds more than 39 million shares, while her son-in-law Lau Duc Duy holds more than 10.5 million QCG shares. In addition, Ms. Loan’s sisters include Nguyen Thi Anh Nguyet, who holds 9.7 million shares, and Nguyen Thi Bich Thuy, who holds 81,750 shares.

The total number of shares owned by Ms. Loan’s family amounts to 166 million QCG shares. Thus, since the beginning of the year, the total assets of this family have increased by approximately VND 1,300 billion.

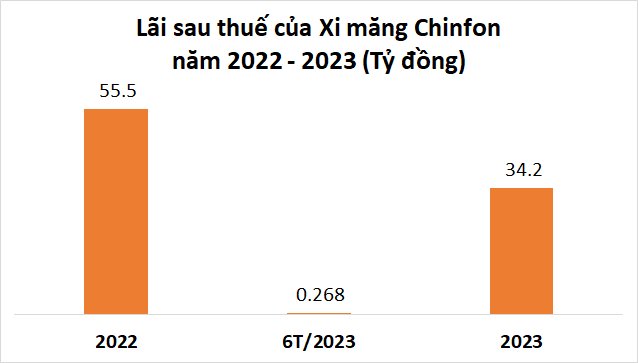

Regarding the 2023 business situation, Quoc Cuong Gia Lai recorded VND 432 billion, a 66% decrease compared to the same period in 2022. The profit after tax was only VND 3.2 billion, equivalent to 1/10 of the result achieved in the previous year. The net cash flow from operating activities in 2023 was nearly VND 33 billion, while in 2022 it was also negative by more than VND 121 billion.

As of December 31, 2023, QCGL’s total assets reached nearly VND 9,600 billion, of which the majority was inventory with an ending balance of over VND 7,000 billion (accounting for nearly 75%). Notably, this business had only VND 28 billion in cash. In addition, QCGL also had financial debts of more than VND 4,500 billion, accounting for nearly half of the total capital sources, mainly short-term debts.