Prosperity & Development Joint-Stock Bank (PGBank – Code: PGB) has just disclosed documents in preparation for its 2024 Annual General Meeting of Shareholders. The meeting is scheduled to be held on the morning of April 20 at the Clubhouse Hall, The Five Villas & Resort Ninh Binh, Yen Thang Commune, Yen Mo District, Ninh Binh.

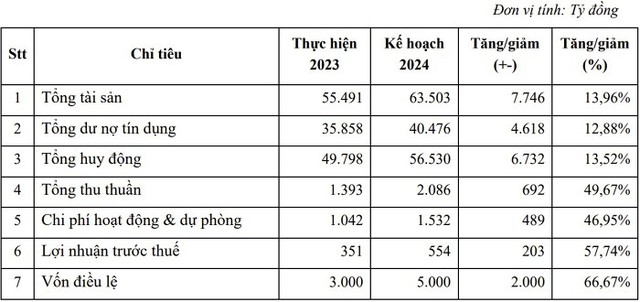

At this year’s AGM, the Board of Directors (BOD) of PGBank will present a business plan targeting total revenue of VND 2,086 billion, a significant increase of nearly 49.7% compared to 2023. Operating expenses and provisions are projected to increase by 46.9% to VND 1,532 billion.

After deducting all expenses, PGBank’s pre-tax profit for 2024 is expected to reach VND 554 billion, a significant increase of nearly 58% compared to the 2023 result.

Total assets will increase to VND 63,503 billion by the end of 2024, an increase of nearly 14% compared to the end of 2023. Notably, outstanding credit is projected to increase by 12.9% to VND 40,476 billion. Mobilization is expected to reach VND 56,530 billion, an increase of 13.5%.

PGBank’s 2024 Business Plan. (Source: PGBank)

Registered capital is expected to reach VND 5,000 billion upon completion of the capital increase plan. PGBank has completed the first phase of the capital increase plan by issuing 120 million shares from its equity.

PGBank plans to increase capital by an additional VND 800 billion through a rights issue. Due to changes in equity, the bank has adjusted the exercise ratio to 21:4 (i.e., each share at the record date will receive one warrant, and 21 warrants will allow the purchase of 4 new shares).

In 2023, PGBank recorded a post-tax profit of VND 279.9 billion. After allocating funds to increase charter capital, financial reserve, bonuses, and welfare, the distributable profit from 2023 was VND 200.4 billion. PGBank proposes not to issue dividends in 2024.

At the 2024 Annual General Meeting of Shareholders, PGBank will also submit to shareholders resolutions on remuneration, salary, and bonuses for the BOD and Supervisory Board, as well as amendments to the charter and regulations to align them with the 2024 Law on Credit Institutions and the selection of an audit organization.

Previously, at the Extraordinary General Meeting of Shareholders held in October 2023, PGBank approved a plan to increase charter capital and change the bank’s name to Thinh Vuong va Phat Trien Joint Stock Commercial Bank.

According to PGBank’s leadership, the reason for the name change is that the previous name was associated with its former major shareholder, Petrolimex. Petrolimex has now divested from PGBank and requested PGBank to cease using Petrolimex’s trademarks by December 31, 2023. Therefore, the name change and rebranding are necessary to align with the current situation and the bank’s restructuring direction.

In addition, PGBank has also approved a change of its headquarters to HEAC Building, 14-16 Ham Long, Phan Chu Trinh Ward, Hoan Kiem District, Hanoi. Previously, the bank’s headquarters were located on the 16th, 23rd, and 24th floors of Mipec Building, 229 Tay Son, Nga Tu So Ward, Dong Da District, Hanoi.