Mr. V.T.N (living in Thu Duc City, Ho Chi Minh City) reported to Nguoi Lao Dong Newspaper that in 2018, he took out a home loan from Standard Chartered Bank in Ho Chi Minh City for 1.65 billion VND with a 20-year term (240 months).

In the first 3 years, the interest rate fluctuated between 7.5% – 8%/year. Around December 2023, after the preferential period, the bank increased the interest rate to 14%/year. Due to the high interest rate, Mr. N decided to pay off his loan.

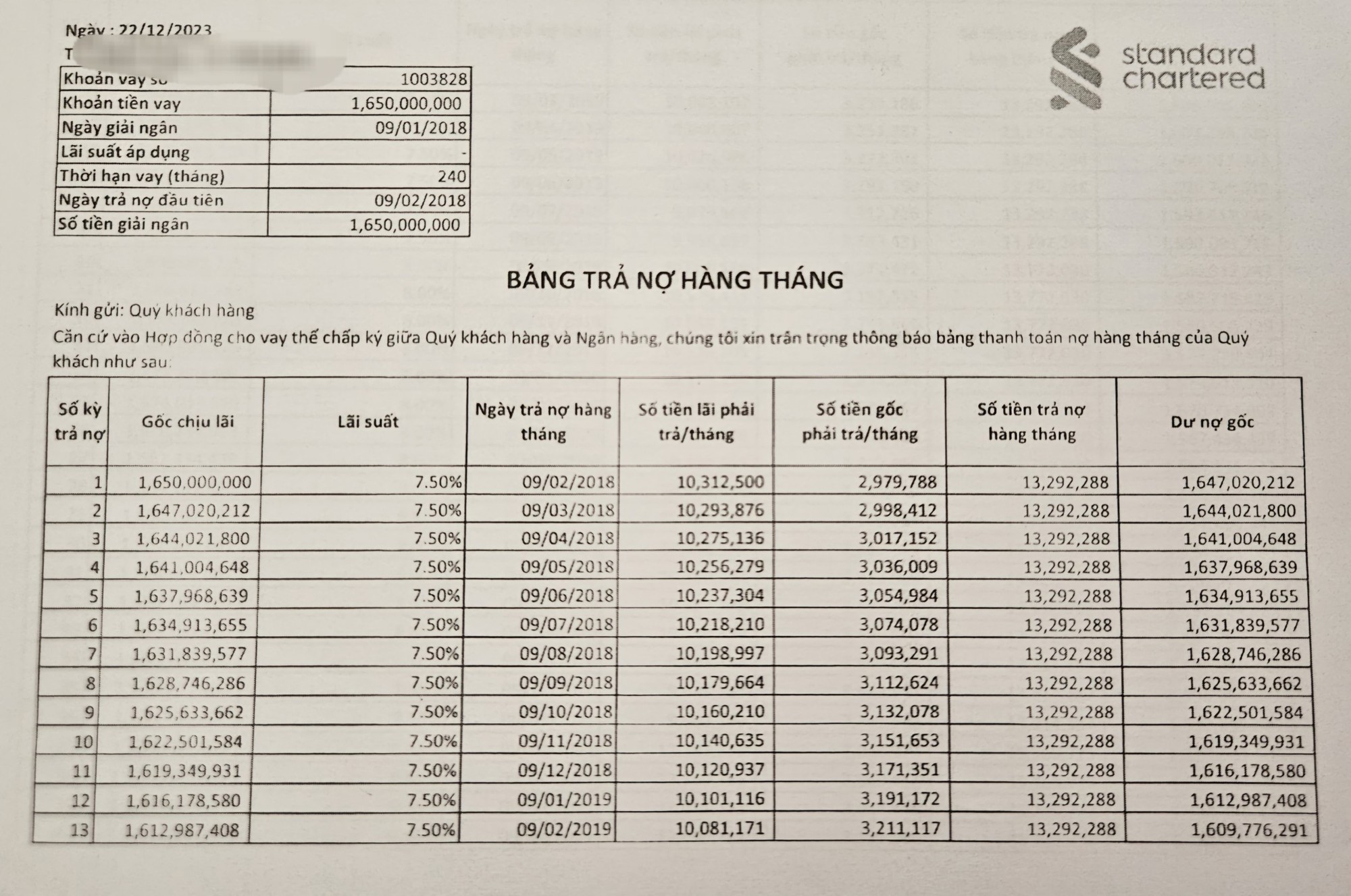

“After receiving the monthly interest calculation at the time of closing, I noticed an anomaly in the calculation of the principal paid off each month for 5 years. Specifically, the bank deducted a very small amount of principal each month, only from over 2 million VND to over 3 million VND/month, instead of deducting a fixed amount of 8.75 million VND/month as usual (total loan amount divided by the number of months: 1.65 billion VND/240 months). Therefore, the total principal they calculated in the 70 months that I paid was only about 250 million VND. Meanwhile, the interest calculated on the outstanding balance each month was very high. Did the bank keep the principal low to increase the interest they collected from me?” Mr. N was outraged.

After reporting to the bank and requesting a refund of the difference that the bank had incorrectly calculated (about 74 million VND), Mr. N was informed that the bank had calculated the principal and interest using the EMI (Equal Monthly Installment) formula.

Monthly interest and principal payment schedule for customers

“The loan agreement does not mention any method of calculating home loan interest according to the EMI formula, while it is the highest legal document between the customer and the lending bank. This contract also does not have any signed clauses stating that the bank will deduct 2.5 million VND or 3 million VND from my principal each month until I prepay the loan. Each month, they only announce the amount to be paid, including both principal and interest” – Mr. N argued.

According to this customer, calculating the principal differently each month is unilateral and unfair. With this method of calculation, this customer said he lost about 74 million VND compared to the usual method of calculating interest and principal (fixed principal and decreasing interest rate on outstanding balance – PV).

In response to Nguoi Lao Dong Newspaper, Standard Chartered Bank stated that after receiving the customer’s complaint, the bank reviewed and examined the entire transaction file and found that the bank had complied with all legal regulations as well as the loan agreement signed with the customer.

At the same time, the bank also affirmed that the loan calculation method is in accordance with legal regulations and market practices for loan products and is widely applied to all individual customers. All information is transparent and fully provided to customers before disbursement.