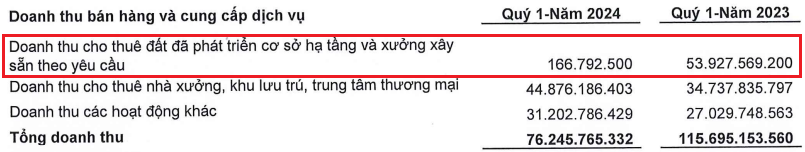

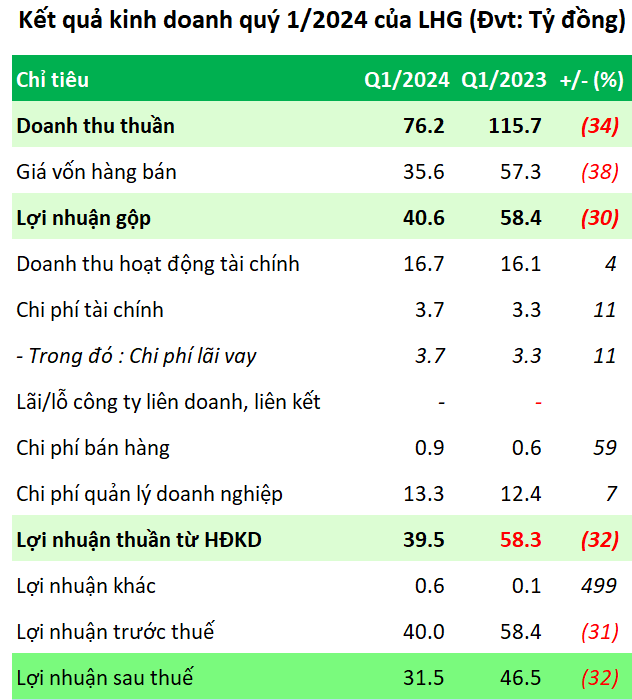

In Q1/2024, Long Hau Corporation (LHG) reported a net revenue of over VND 76 billion, a 34% decrease year-on-year, mainly due to a decline of over VND 53 billion in revenue from leasing developed land and build-to-suit factories, leaving only nearly VND 167 million. Meanwhile, financial activities grew slightly by 4% to nearly VND 17 billion.

|

Revenue structure of LHG in Q1/2024

Source: LHG

|

On the other hand, total expenses were nearly VND 18 billion, up 10%. Among them, management costs accounted for the majority with over VND 13 billion, up 7%; interest expense also increased by 11% to nearly VND 4 billion.

These headwinds brought down Long Hau Corporation’s net profit to nearly VND 32 billion, a 32% decrease compared to the same period last year.

Source: VietstockFinance

|

As of March 31, 2024, Long Hau Corporation had total assets of over VND 3,057 billion, which is almost unchanged compared to the beginning of the year. Notably, cash and cash equivalents decreased by 63% to over VND 89 billion, including nearly VND 50 billion in bank deposits. Short-term financial investments, being entirely bank deposits with a fixed term, recorded over VND 1,052 billion, an increase of 11%. With the above two items, Long Hau Corporation has over VND 1,000 billion “deposited” at banks.

Inventory was at VND 682 billion, up 5%, with the majority being the investment in construction of Long Hau industrial parks at over VND 647 billion. In contrast, construction in progress decreased by 39% to over VND 59 billion.

Source: LHG

|

On the liabilities side, LHG had VND 1,431 billion of payables. Short-term loans amounted to over VND 56 billion while long-term loans were nearly VND 118 billion.