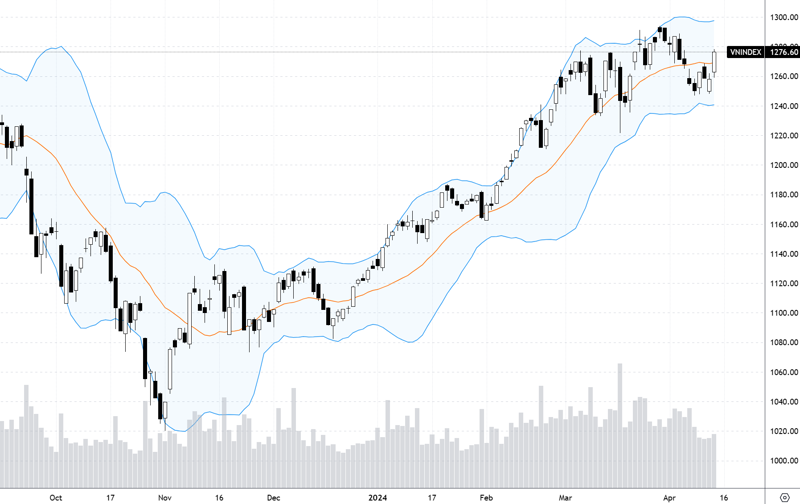

The VN-Index has lost 8% in the past week, marking the steepest weekly decline since October 2022. The rapid drop in prices has significantly increased losses for portfolios, putting immense pressure on stock positions using leverage.

Experts unanimously agree that the potential impact of margin trading on the market is substantial. With a 15% price drop becoming commonplace for stocks – which is often the liquidation threshold – a significant number of stocks are likely to be forcibly sold if the market continues to decline next week.

According to statistics from the first-quarter 2024 financial reports of the brokerage industry, while there is still ample room for margin lending due to capital increases by companies, the scale of margin trading is also at a record high. Experts merely “hope” that there has been a proactive reduction in margin during the volatile week in early April.

Although not optimistic about the short-term outlook, experts also believe that the market’s rapid and sharp correction will quickly release the backlog of stuck shares. The State Bank’s sale of foreign currency to intervene in exchange rates was anticipated, and investors should monitor the effectiveness of this measure. Some experts are still disbursing funds gradually according to specific support prices, but overall, they are maintaining a low equity weight.

Nguyen Hoang – VnEconomy

The market has suddenly shifted to a bearish scenario that you predicted two weeks ago. The VN-Index reached a low of 1,165 points during the last session, close to the level you anticipated before rebounding slightly. The downward momentum is very strong. Are you changing your scenario, or will this finally be the real bottom?

I believe the market may have confirmed a support bottom around the 1,160 – 1,165 range, although it is possible that it will continue to fluctuate around the 1,150 – 1,160 range in the early sessions of the week. The likelihood of an immediate recovery in the trading week before the extended holiday is high.

Mr. Le Duc Khanh

Mr. Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

I maintain my view that the market is still fluctuating in a disadvantageous zone and that it is still too early to start buying aggressively, as exchange rate tensions show no signs of abating and geopolitical risks remain. As I mentioned in previous issues, a healthy correction typically lasts for 1-3 weeks during a short- and medium-term uptrend. However, looking at the recent performance of the VN-Index, the momentum that has been driving the short-term uptrend is gradually fading, and investor sentiment is mostly pessimistic, with early bottom fishing sessions resulting in losses when stocks are credited to accounts, or with stock holders not being patient enough to hold on and instead selling at a loss as soon as stocks show signs of recovery.

Therefore, I believe it is premature to conclude that the market has bottomed out, and it is more likely that the index will enter a “sideway-down” phase while risk factors persist and the supply-demand relationship is more clearly tested.

Mr. Nguyen Viet Quang – Director of Yuanta Hanoi Business Center 3

Currently, the VN-Index has not shown any signs of confirming a bottom, and the downward momentum is very strong, with selling pressure remaining high. The index has now broken the first support level I predicted, which was around 1,187 points. The next support levels will be around 1,150 points and 1,100 points. We will closely monitor these two support levels and the market’s price action at those levels, as well as for signs of bottoming, to consider re-entering the market.

Ms. Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

The market has fallen straight to the 1,160-1,190 point range without any clear signs of recovery. During the last session, although the decline was still quite strong, I noticed a signal that should be taken into account: the candle’s range has narrowed compared to the previous declining candles, and it has a Spinning consolidation pattern, while volume has increased again. Selling pressure has increased, but the candle has a consolidation pattern, which leads me to believe that there is a signal of money flowing in to catch the falling knife. Therefore, I may still maintain the scenario that there will soon be a short-term recovery this week. However, to expect a real bottom for the entire decline is still a bit premature. We need to see signals of a weakening decline and selling pressure before we can consider this possibility.

Mr. Tran Ha Xuan Vu – Head of Individual Customer Investment Advisory, Rồng Việt Securities

The market is currently facing a dispute around the MA200 line, around 1,176 points. It is possible that the dispute will continue into the beginning of next week. However, it is still too early to determine the market’s bottom because, in general, supply pressure is still outweighing the support. If weak demand conditions emerge during the current stalemate, I believe the risk of further decline remains.

Margin debt/equity at record low, nearly 300,000 billion in excess lending room

Money flow trend: Correction over?

Mr. Le Duc Khanh – Director of Analysis, VPS Securities

I believe the market may have confirmed a support bottom around the 1,160 – 1,165 range, although it is possible that it will continue to fluctuate around the 1,150 – 1,160 range in the early sessions of the week. The likelihood of an immediate recovery in the trading week before the extended holiday is high.

Nguyen Hoang – VnEconomy

Over the past weekend, the market also received negative news, such as rising tensions in the Middle East and the State Bank being forced to use strong measures to intervene in exchange rates. However, the stock market rebounded quite well but was still heavily dumped at the end of the session. It seems that the market’s reaction is overly optimistic?

Mr. Nguyen Viet Quang – Director of Yuanta Hanoi Business Center 3

The VN-Index recovered slightly in the sixth session, close to the reference price, and this recovery occurred after news that “Iran denies being attacked by missiles.” As a result, many markets around the world recovered sharply. Due to the recovery caused by the news, it occurred quite quickly, and some investors jumped in to catch the falling knife. However, the factors of exchange rates, geopolitical tensions, and the lack of any bottoming signals, as well as the fact that the index has not yet issued any bottoming signals, made the sharp decline at the end of the sixth session quite normal.

Mr. Le Duc Khanh – Director of Analysis, VPS Securities

Investor sentiment can sometimes react strongly in both directions to macroeconomic news, whether positive or negative. The market has entered an oversold phase, and more pronounced recovery sessions will occur next week. The VN-Index has also reached the 200-day MA, so a rebound would not be too surprising.

Ms. Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

I believe that the recovery during the last session was driven more by hope than anything else. Investors hoped that the SBV’s sale of foreign currencies would help cool down the exchange rate, thereby reducing macroeconomic risks. This recovery attempt was not successful, but as I stated earlier