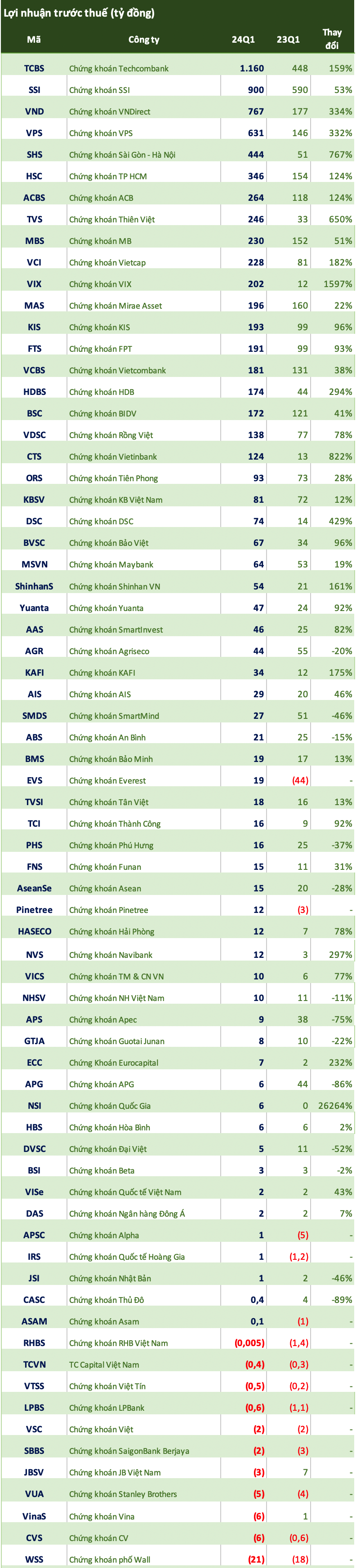

As of the morning of April 20, 70 securities companies had announced their Q1/2024 financial statements.

VPS Securities, the company that holds 1/5 of the brokerage market share on HoSE and nearly 1/4 of the brokerage market share on HNX in Q1/2024, recorded a 15% increase in its Q1 operating revenue compared to the same period last year, to VND 1,570 billion. Of which, brokerage revenue contributed VND 961 billion, up 134%; interest income from loans and receivables also increased by 93% to VND 395 billion.

In contrast, operating expenses decreased by 24% to VND 786 billion, mainly due to a sharp decrease in FVTPL asset losses from VND 588 billion to just over VND 29 billion. As a result, VPS Securities had a pre-tax profit of over VND 631 billion in Q1, up 332% over the same period last year. Profit after tax reached VND 505 billion.

VNDirect Securities has also announced its consolidated Q1 financial statements, recording a 7% increase in operating revenue to VND 1,395 billion. In which, income from FVTPL assets decreased by 15% compared to Q1/2023 to VND 664 billion, still accounting for the largest proportion of VNDirect’s revenue, while interest income on loans and receivables increased by 27% to VND 316 billion, and brokerage revenue increased by 56% to VND 228 billion.

Thanks to a reduction in losses from proprietary trading, VNDirect recorded a net profit in Q1 that was more than 4 times higher than the same period in 2023, reaching VND 767 billion.

At the end of Q1, VNDirect’s outstanding margin debt and UTTB decreased by nearly VND 320 billion compared to the end of last year, to approximately VND 9,960 billion.

Mirae Asset Securities reported a 22% increase in pre-tax profit in Q1 to VND 196 billion. During the period, operating revenue increased by 14% over the same period to VND 641 billion.

The group with billions of profits in the first quarter of the year included ACB Securities (ACBS), with net profit growth of 124% to VND 264 billion. In addition, Thien Viet Securities (TVS) recorded a net profit in Q1 that was 7.5 times higher than the same period last year, reaching VND 246 billion. Vietcap Securities (VCI) also had a similar increase in profit, with a 182% increase in net profit in Q1/2024 to VND 228 billion.

A positive signal was also recorded at Tan Viet Securities (TVSI), which reported a profit of VND 18 billion in the first quarter of the year, up 13% over the same period last year. Previously, TVSI was the company with the largest loss in the securities industry in 2023 with a loss of VND 394 billion. TVSI is known as a securities company with many relationships with SCB Bank and Van Thinh Phat Group. TVSI was one of the bond issuance advisors for An Dong Investment Group Joint Stock Company – a company related to Van Thinh Phat. In addition, TVSI has over VND 1,600 billion in funds blocked at SCB Bank, including investor deposits for securities trading and deposits for other payment obligations to customers.