On April 17th, SeABank will hold its 2024 Annual General Meeting of Shareholders in Da Nang City.

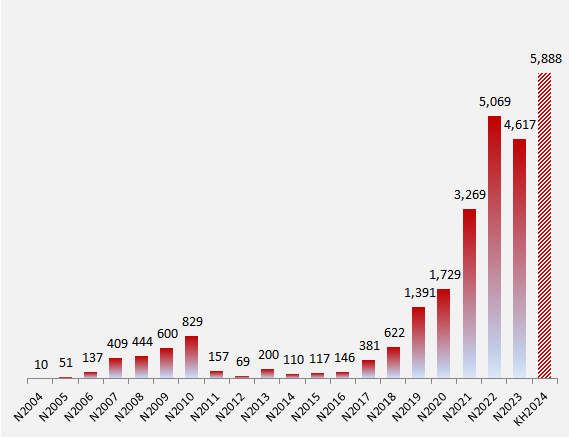

Pre-tax profit target for 2024 increases by 28% to VND 5,888 billion

According to SeABank’s assessment, the State Bank of Vietnam will temporarily pause lowering the operating interest rate until at least the first half of 2024. The impact of reducing banks’ NIM will gradually decrease due to reduced capital mobilization costs, combined with recovering credit demand. Real estate-related credit may increase in 2024 as interest rates on home loans return to favorable levels and projects are offered at the end of 2023. Non-interest income is expected to be more positive as the economy recovers. Bad debt risk still exists in 2024.

|

SeABank’s 2024 pre-tax profit plan. Unit: Billion VND

Source: VietstockFinance

|

Based on the assessment of the macroeconomic situation at the end of 2023 and the forecast for 2024, SeABank sets a pre-tax profit target for 2024 of VND 5,888 billion, an increase of 28% compared to the implementation in 2023.

The bank’s total assets are expected to increase by 10% to over VND 292,734 billion. In which, the credit growth target is 16.1% and the mobilization growth is 16% compared to 2023.

In 2023, SeABank achieved VND 4,616 billion in pre-tax profit, completing the set plan. ROE in 2023 reached 13.01%, ROA reached 1.48%. The bad debt ratio always remained below 3%.

As of December 31, 2023, total assets reached over VND 266,122 billion, an increase of 15% compared to the beginning of the year and exceeding 4% of the plan. SeABank’s credit growth reached 18.25%, in which outstanding loans to customers reached VND 179,752 billion, an increase of 17% compared to 2022 and exceeding 6% of the plan. Total customer deposits and issuance of valuable papers reached VND 161,686 billion, an increase of 18% compared to 2022 and exceeding 11% of the plan.

Increasing capital to VND 30,000 billion

In 2023, SeABank increased its charter capital by VND 4,554 billion according to the plan to issue 295.2 million shares to pay dividends for 2022 to shareholders at a rate of 14.5%, issue 118 million bonus shares at a rate of 5.8% and issue 42 million ESOP shares.

|

SeABank’s capital increase process. Unit: Billion VND

Source: VietstockFinance

|

In order to continue implementing the growth target, increasing financial capacity in the following years, SeABank’s Board of Directors also submitted to the General Meeting of Shareholders for consideration and approval of the plan to increase the bank’s charter capital in 2024 by an additional VND 5,043 billion, to VND 30,000 billion.

The capital increase is expected to be implemented through 4 forms: Issuing 329 million shares to pay dividends for 2023 at a rate of 13.2%; Issuing 10.3 million bonus shares at a rate of 0.41%; Offering 45 million ESOP shares at a rate of 1.8% of the number of outstanding shares; Private placement and/or issuance to convert nearly 120 million shares of debt with a maximum foreign ownership ratio of 9.2% after issuance.

Thus, the option of private placement and/or issuance to convert debt of nearly 120 million shares will replace the option of private placement of 94.6 million shares approved by the 2023 Annual General Meeting of Shareholders.

Wanting to become the parent company of Aseansc

SeABank said that the Vietnamese stock market (TTCK) continues to affirm its role as an effective capital channel for the economy. Despite facing many challenges and difficulties from the global and domestic economic context, capital mobilization activities through the stock market in 2023 have improved, with a total mobilized capital value of VND 418,271 billion, an increase of 34% compared to 2022. In 2024, the Vietnamese stock market is expected to continue to recover strongly, developing in both quality and quantity, with many supporting factors. In particular, the stock market aims to upgrade the market from frontier to emerging by 2025, a goal that is forecast to attract about USD 25 billion in indirect foreign investment into Vietnam each year.

With the development potential of the stock market, SeABank plans to acquire 100% of Asean Securities Company (Aseansc) shares so that this company becomes a subsidiary, contributing to further promoting SeABank’s business operations.

Aseansc has experienced nearly 18 years of establishment and development with the current charter capital reaching VND 1,000 billion. Aseansc is licensed to operate all 4 securities business lines including securities brokerage, securities trading, investment consulting, underwriting of securities issuance and other business activities as prescribed.

In addition, SeABank’s Board of Directors also submitted to the General Meeting for approval of a loan transaction with a maximum value of USD 35 million with conversion conditions with foreign investors to provide capital for SeABank. Thereby helping the bank to be proactive, diversify foreign capital sources to serve its business strategy and plan, enhance its financial capacity, governance, operation, and activities in accordance with international standards…