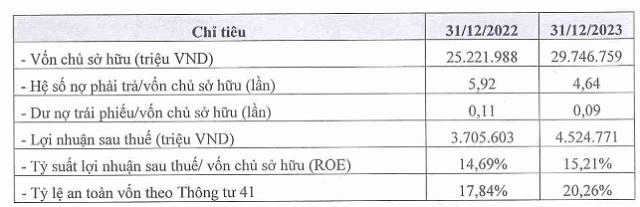

In 2023, Shinhan Bank Vietnam recorded a post-tax profit of nearly VND4,525 billion, an increase of 22% compared to the previous year.

As of December 31, 2023, Shinhan Bank’s equity was VND29,746 billion, an increase of 18% compared to the beginning of the year.

The debt-to-equity ratio decreased from 5.92 times at the beginning of the year to 4.64 times at the end of 2023. The outstanding bonds/equity ratio also decreased from 0.11 times to 0.09 times.

Return on equity (ROE) after tax in 2023 was 15.21%. The capital adequacy ratio in accordance with Circular 41 was 20.26%.

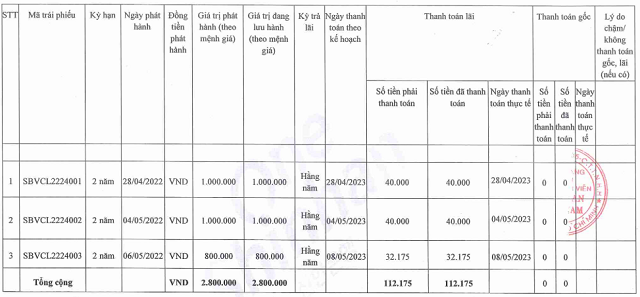

In other developments, according to data from HNX, Shinhan Bank Vietnam is currently circulating three bond issuances with a total value of VND2,800 billion, interest rate of 4%/year, interest payment term of once per year. The above bonds were issued by Shinhan Bank in April and May 2022, with a term of 2 years, and will mature in April-May 2024.

Shinhan Bank Vietnam Limited is a subsidiary bank of the Shinhan Bank of Korea – a member of the Shinhan Financial Group. Shinhan Bank Vietnam opened its first representative office in Ho Chi Minh City in 1993.