Technical Analysis of the Market

During the morning trading session on April 17, 2024, the VN-Index declined, accompanied by a significant drop in trading volume, indicating a cautious market sentiment.

Additionally, the index continued to test the 50% Fibonacci Retracement level (around 1,270-1,290 points) while the ADX oscillated within a gray area (20<>)

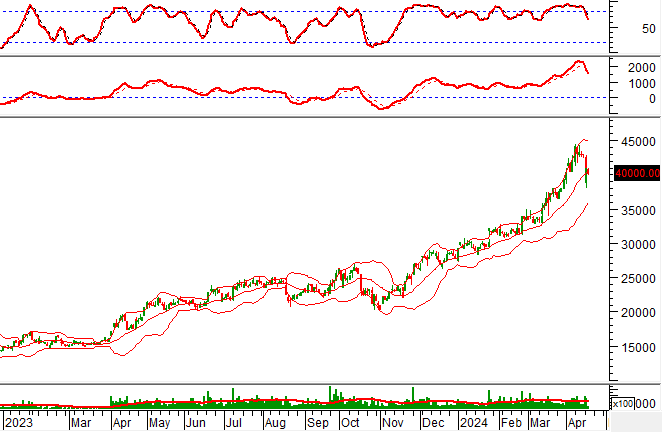

Technical Analysis of the HNX-Index

On April 17, 2024, the HNX-Index fell slightly, forming a High Wave Candle pattern with a notable decline in liquidity, suggesting a cautious investor sentiment.

Presently, the index is retesting the 23.6% Fibonacci Projection level (around 222-227) as the Stochastic Oscillator continues to trend downward towards the oversold area. This indicates that the short-term outlook remains uncertain.

NTL – Tu Liem Urban Development JSC

During the morning session on April 17, 2024, NTL fell, accompanied by a significant drop in trading volume, reflecting a pessimistic investor sentiment.

Currently, both the MACD and Stochastic Oscillator indicators are trending down after issuing sell signals, suggesting that a positive outlook is yet to emerge.

VRE – Vincom Retail JSC

On the morning of April 17, 2024, VRE rose slightly with a significant decrease in liquidity, indicating cautious investor sentiment.

The stock is currently retesting the February 2024 low (around 21,500-22,5000) while the Stochastic Oscillator remains in the oversold area. Should the indicator provide a buy signal and exit this zone, a recovery outlook may materialize.

Technical Analysis Department, Vietstock Advisory