Market Liquidity

The market liquidity experienced a slight increase compared to the previous trading session. The trading volume of matched orders on the VN-Index reached nearly 697 million shares, equivalent to a value of over 17 trillion VND; the HNX-Index reached nearly 76 million shares, equivalent to a value of nearly 1.6 trillion VND.

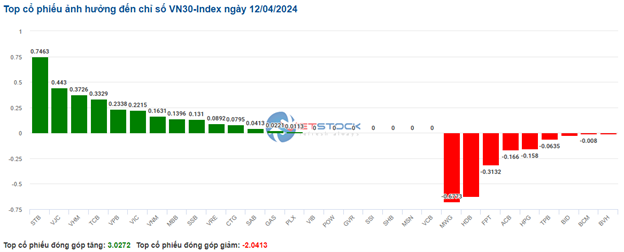

Impactful Stocks on VN-Index (12/04/2024) (Sorted by Points)

The VN-Index opened in the afternoon with a positive atmosphere as buying pressure appeared right from the start of the session, causing the index to continuously increase strongly and close near its highest point of the day. The banking stock group recorded the most positive impact on the VN-Index, with CTG, TCB, and MBB contributing the most with nearly 6.3 points gained. On the downside, MWG, DGC, and NVL negatively impacted the most by taking away about 0.2 points from the index.

The HNX-Index also experienced a similar trend, with the index positively impacted by LAS (4.17%), SHS (3.48%), HUT (2.73%), and DDG (2.7%).

The transportation and warehousing sector recorded the strongest recovery with 3.51%, primarily from VJC (+5.94%), HVN (+6.63%), and GMD (+3.03%). This was followed by the banking and securities sectors with increases of 2.3% and 1.83%, respectively. Conversely, the consulting and support services sector had the sharpest decline in the market at -1.43%, mostly from TV2 (-0.81%), VNC (-4.45%), and TV4 (-0.72%).

The banking sector recorded a positive recovery in the trading session on April 12, 2024, following news that the SBV proposed a 50% reduction in the required reserve ratio for banks receiving mandatory transfers of weak credit institutions.

Foreign Trading

Foreign investors continued to sell a net of over 538 billion VND on the HOSE floor, concentrated in VHM (231.77 billion), MSN (73.88 billion), HSG (60.82 billion), and PDR (58.98 billion). On the HNX floor, foreign investors bought a net of nearly 13 billion VND, focusing on IDC (25.12 billion) and LAS (4.95 billion).

Morning Session: Positive Sentiment Driven by Banking Stocks

The market ended the morning session with a positive gain. The VN-Index rose 5.95 points to 1,264.15 points. The HNX-Index gained 0.35 points to 239.42 points. In the VN30 basket, 19 stocks increased in price, including 9 banking stocks. The banking sector’s 0.63% increase today was one of the main factors contributing to the index’s growth.

The market surged positively from the start, and profit-taking pressure intensified, pushing the index back near the reference point. However, sustained enthusiasm helped the VN-Index close successfully above the 1,264-point level, although trading was challenging in the latter half of the morning session.

At the closing bell, the CTG (+2.2%) and TCB (+2%) duo led the market, contributing 1 and 0.78 points, respectively, to the VN-Index. Following these were MBB (+1.5%) with a 0.45-point contribution, and VHM (+0.9%) with a 0.42-point contribution. Conversely, the downward pressure from HDB (-1%), VCB (-0.1%), MWG (-0.8%), and GVR (-0.3%) slowed the index’s acceleration.

Foreign Trading

Foreign investors continued to sell a net of over 538 billion VND on the HOSE floor, concentrated in VHM (231.77 billion), MSN (73.88 billion), HSG (60.82 billion), and PDR (58.98 billion). On the HNX floor, foreign investors bought a net of nearly 13 billion VND, focusing on IDC (25.12 billion) and LAS (4.95 billion).

Morning Session: Positive Sentiment Driven by Banking Stocks

The market ended the morning session with a positive gain. The VN-Index rose 5.95 points to 1,264.15 points. The HNX-Index gained 0.35 points to 239.42 points. In the VN30 basket, 19 stocks increased in price, including 9 banking stocks. The banking sector’s 0.63% increase today was one of the main factors contributing to the index’s growth.

The market surged positively from the start, and profit-taking pressure intensified, pushing the index back near the reference point. However, sustained enthusiasm helped the VN-Index close successfully above the 1,264-point level, although trading was challenging in the latter half of the morning session.

At the closing bell, the CTG (+2.2%) and TCB (+2%) duo led the market, contributing 1 and 0.78 points, respectively, to the VN-Index. Following these were MBB (+1.5%) with a 0.45-point contribution, and VHM (+0.9%) with a 0.42-point contribution. Conversely, the downward pressure from HDB (-1%), VCB (-0.1%), MWG (-0.8%), and GVR (-0.3%) slowed the index’s acceleration.

10:40 AM: Real Estate Sector Positive

Continuing to be stuck in a tug-of-war as investor sentiment remains cautious. As of 10:30 AM, the VN-Index edged up 2.23 points, trading around 1,260 points. The HNX-Index increased 0.3 points, trading around 239 points.

Most stocks in the VN30 basket rallied. Among them, STB, TCB, VJC, and VHM contributed 0.75 points, 0.44 points, 0.37 points, and 0.33 points to the VN30 index, respectively. Conversely, MWG, HDB, FPT, and ACB continued to face selling pressure, reducing the index by more than 1 point.

Source: VietstockFinance

|

The real estate sector stocks turned green from the start of the session. Specifically, DIG climbed 1.97%, PDR increased by 1.11%, DXG added 1.3%, and VHM gained 0.79%. The remaining stocks stood at their prices, while some continued to face slight selling pressure, such as BCM, KHG, and KOS.

For DIG, in particular, the current price is moving within the long-term Bullish Price Channel and is supported by the 61.8% Fibonacci Projection (31,000-32,400). However, trading volume remains below the 20-day average, which, if it improves in upcoming sessions, will lead to a more sustained long-term outlook.

Source: stockchart.vietstock.vn

|

The banking sector followed, contributing to the market’s overall growth, with most stocks rising, such as VCB up 0.11%,