Domestic

stocks just ended their “worst” trading week since the beginning of the year, with the VN-Index losing nearly 8%, or more than 100 points.

Sellers

dominated, with strong selling pressure pushing liquidity up sharply compared to the gloomy session before the holiday. The trading value was nearly VND22,500 billion.

Large-cap stocks such as VIC, CTG, FPT, BCM, GVR, etc. were the main drivers negatively affecting the index. Influential sectors such as

banking

, real estate, securities, construction, and materials, etc. all plunged.

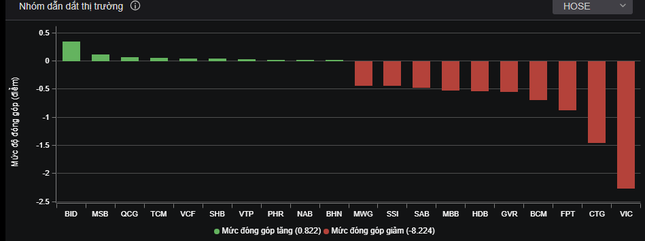

Large-cap stocks dragged down the index.

405 stocks on the HoSE decreased in price, and some codes fell to the floor price. Floor-priced

stocks

were concentrated in the securities group: BSI, AGR, CTS, VDS, APG. Almost the entire securities group declined in price, with common losses of over 3%. The sensitivity of securities stocks to the market continued to be reflected in today’s session.

Among the few stocks that “reversed the trend” of the market, bank stocks BID, MSB, SHB, NAB, etc. increased slightly. However, their contribution to the market was very modest, not enough to “offset” the

selling pressure

across the board.

The

exchange rate

is one of the major concerns for the stock market, causing negative effects. Today, at the press conference of the State Bank, the agency indicated that it will sell intervention foreign currencies to negative-status credit institutions. This move aims to reduce the pressure on the USD/VND exchange rate, which has increased significantly in recent times.

The VN-Index narrowed the downtrend towards the end of the session, and at one point, it attempted to recover and approach the reference point. However, strong selling pressure before the

ATC session

pushed the main index down further. At closing time, the VN-Index fell 18.16 points (1.52%) to 1,174.85 points. The HNX-Index decreased 5.4 points (2.39%) to 220.8 points. The UPCoM-Index lost 0.99 points (1.12%) to 87.16 points. Foreign investors net bought with a value of VND655 billion, focusing on VNM, DIG, VND, etc.

The analysis team of Saigon – Hanoi Securities (SHS) stated that the short-term momentum of the market has weakened and that the VN-Index is at risk of returning to a downtrend with a new support level at the low of 1,150 points. The VN-Index continued to decrease, and the risk of falling to deeper levels is increasing.

Short-term

investors

should take advantage of market recovery sessions to reduce their portfolio weight to a safe level. For medium to long-term investors, the market is moving back to a wide accumulation channel of 1,150 points – 1,250 points, and the accumulation phase may last. Therefore, medium-term investors should not disburse in the current context, but should patiently wait for a more reliable accumulation phase.

Experts from KB Vietnam Securities believe that the market is likely to continue the downtrend while negative sentiment continues to dominate investor trading status. Investors are advised to limit new purchases for their current positions, prioritize risk management, sell down positions, and restructure portfolios during early recovery sessions.