The congress has approved important contents, including the business plan, dividend payment plan, plan to increase charter capital by granting shares to shareholders and offering a private sale, plan to change the name to Group, and many other important contents.

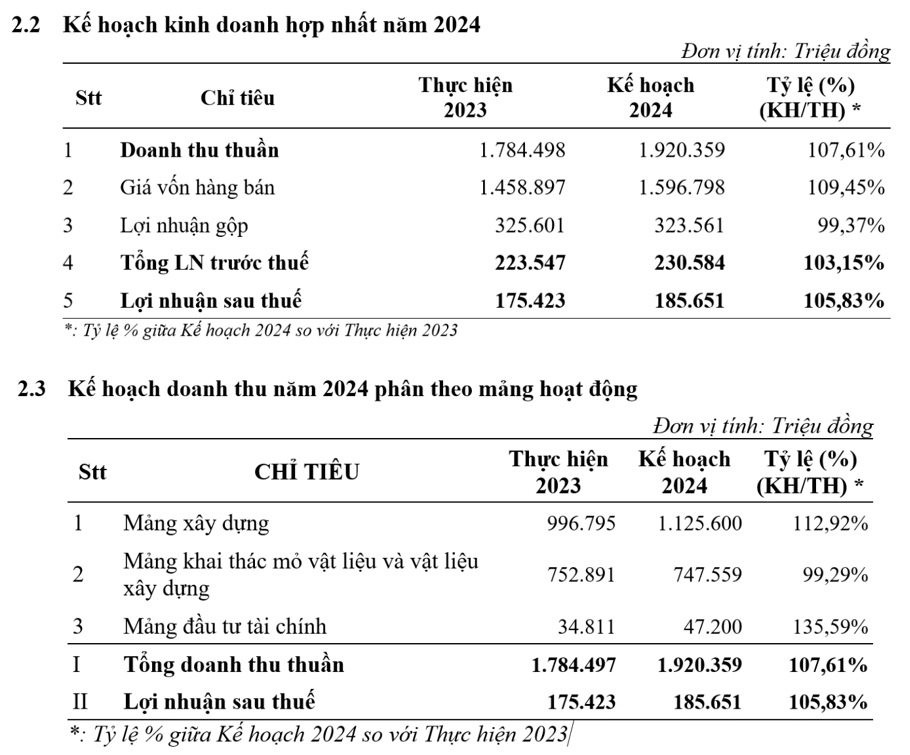

Regarding the business activities in 2023, TCD recorded revenue of 1,784.4 billion VND, after-tax profit of 175 billion VND. In 2024, TCD set a business plan with consolidated net revenue of 1,920 billion VND, an increase of 7.6% compared to the same period, after-tax profit expected to be 186 billion VND, an increase of 5.8% year on year.

By business segment, the construction sector from signed contracts and potential projects that the Company is bidding for with total expected revenue of 1,126 billion VND; Antraco’s stone mining and construction material mining segments are expected to reach revenue of 748 billion VND; financial investment activities (including Vinataxi’s transportation business and BOT toll collection activities) have a total expected revenue of 47.2 billion.

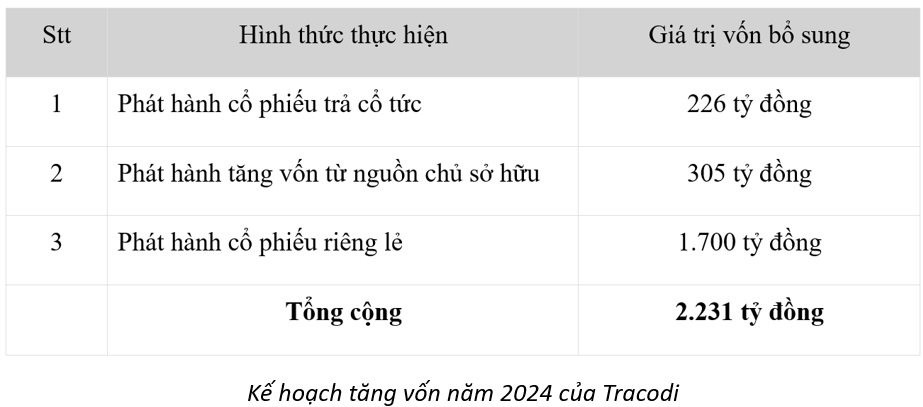

Tracodi’s General Meeting of Shareholders also approved the plan to issue 22,614,646 bonus shares, equivalent to 8% of the charter capital. The dividend payment is expected to be made in the second or third quarter of 2024.

To increase share capital from its own equity, TCD will issue 30,529,526 new shares, corresponding to a total additional value of 305 billion VND to make a bonus share offering to shareholders with a right exercise ratio of 100:10 (a person with 100 shares will receive 10 new shares). In addition, TCD also plans to issue 170 million private shares. If the issuance is successful, TCD’s charter capital will reach 5,058 billion VND.

In 2024, Tracodi will focus resources on implementing real estate projects that have won bids such as King Crown Infinity, Malibu Hoi An, Hoian d’Or. The traffic infrastructure projects that Tracodi will continue to implement in 2024 are: Phan Thiet Airport Project, Component 4 of the Highway Construction Project in the Southwest Region, Phase 1; Project of the road connecting the old National Highway 3 to Vo Nguyen Giap Street (Hanoi), Duc Thinh residential area project (Bac Giang); Renovation and upgrading expansion of DT830 and DT824 from An Thanh bridge to Duc Hoa town (Long An). At the same time, TCD continues to bid for potential projects.

Regarding the goals for the 2024-2028 period, Tracodi expects revenue to grow at an average rate of 12% per year, with revenue in 2028 reaching 3,816 billion VND. After-tax profit in 2028 is expected to reach 348 billion VND. The equity in 2028 is expected to reach 6,438 billion VND, and the total assets are expected to reach 13,130 billion VND.

In terms of personnel, Mr. Tan Bo Quan, Andy tendered his resignation from his position as a member of the BOD to focus on his new task, Mr. Bui Quang Nam was voted to be an independent BOD.

A notable content that Tracodi has presented and was approved by the congress is the conversion of the model into a Group. Tracodi will change the company’s name to Tracodi Construction Group Joint Stock Company. The new name is suitable for Tracodi’s current transformation into the Group management model, and at the same time, it emphasizes the company’s core construction business and promotes the strength of the Tracodi brand, which has a history of 34 years.