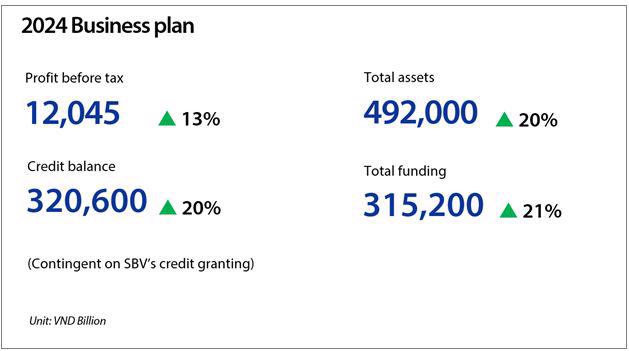

Vietnam International Bank (VIB) hosted its annual general meeting of shareholders (AGM) in Ho Chi Minh City on April 2, where plans to distribute dividends at a rate of 29.5 percent, comprising cash dividends and stock dividends, were approved, along with a pre-tax profit projection of VND12.045 trillion (approximately $482 million) for the fiscal year 2024.

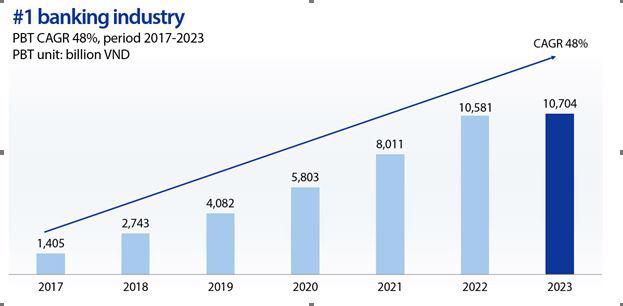

VIB stands out as a high-performing bank, boasting a compound annual growth rate (CAGR) in profit of 48 percent over the past seven years of its transformational journey.

According to a report presented by the Board of Directors at the AGM, VIB has established a solid foundation for exceptional growth across scale, quality, and brand value, positioning itself as the leading bank in terms of operational efficiency, asset and revenue growth, cost-effective management, and rigorous risk control.

VIB’s profits have achieved an impressive CAGR of 48 percent over the past seven years, with a return on equity (ROE) of 25 percent, placing it among the industry leaders for several consecutive years. Key metrics related to revenue growth, operational efficiency, and cost control have all surpassed the average of the top 10 listed banks.

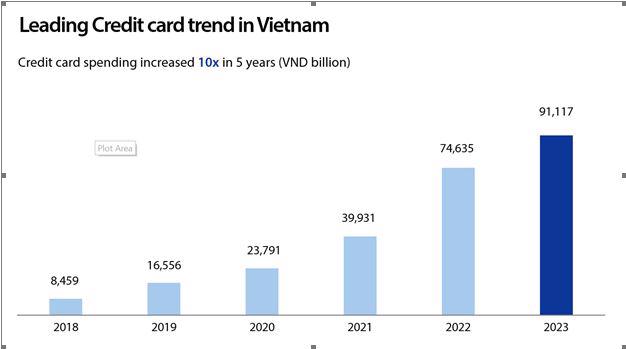

In line with its strategy to become Vietnam’s leading retail bank in terms of scale and quality, VIB currently holds the top position in retail banking, with over 85 percent of its credit portfolio dedicated to retail lending. The bank consistently maintains a leading market share in crucial business segments such as home loans, auto loans, and credit cards.

In 2023, with a pioneering strategy in credit cards, VIB continued to introduce innovative card lines to the market, featuring superior product attributes and unique offerings in Vietnam. After six years, the total number of credit cards in force surpassed 700,000, marking an eight-fold increase, with customer spending through VIB credit cards growing over ten-fold, reaching a total of $4 billion in 2023, solidifying its dominant position in MasterCard’s market share in Vietnam.

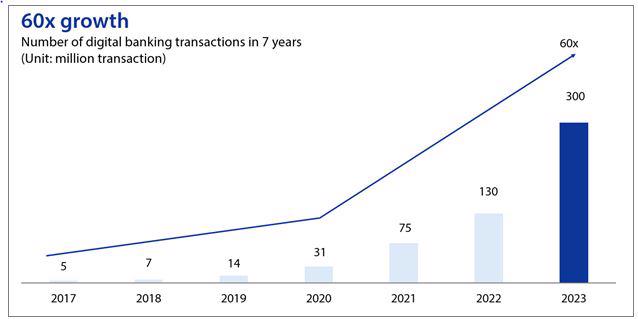

VIB’s digital banking ecosystem continues to expand, providing a diverse range of products and services to cater to varying customer needs. This expansion played a significant role in helping VIB acquire an additional 1 million new customers in 2023. The volume of transactions on the digital platform surpassed 300 million, representing growth of over 130 percent compared to 2022 and a staggering 60-fold increase over the past seven years. This has resulted in digital channels accounting for 94 percent of total retail transaction volumes.

Robust Risk Management, Ever-Strengthening Brand Reputation

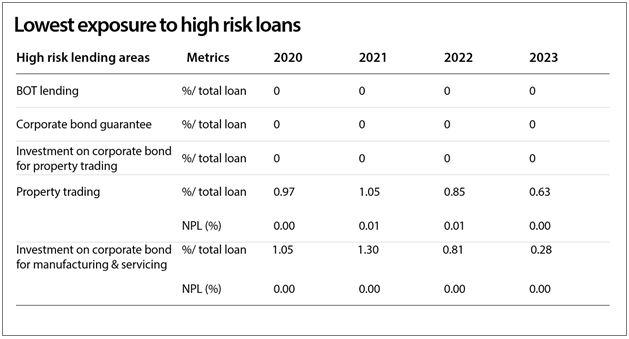

According to the Board of Directors’ report, VIB has the highest retail lending ratio in the industry, with over 85 percent of its lending allocated to retail. While maintaining the most favorable risk diversification profile in the market, VIB also demonstrates a prudent risk appetite by maintaining zero exposure in high-risk domains such as BOT lending, corporate bond guarantees, and real estate business bond investments over the past four years.

In 2023, the State Bank of Vietnam (SBV) reaffirmed VIB’s status within the highest industry group based on assessments of capital adequacy, asset quality, management capability, profitability, liquidity management, and sensitivity indicators. VIB consistently adheres to SBV regulations and proactively adopts international standards, including Basel II, Basel III, and IFRS.

Shareholders Approve Charter Capital Increase and Dividend Distribution Plan

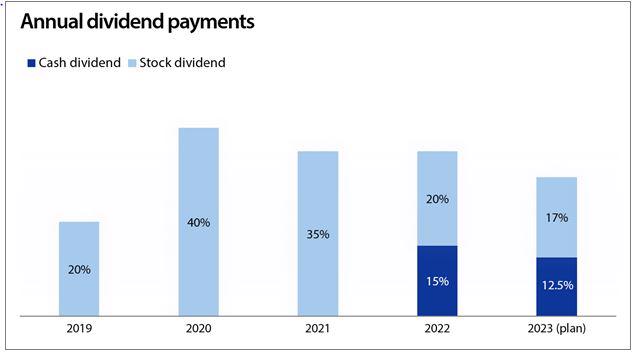

At the meeting, the proposal to increase charter capital to VND29.791 trillion (approximately $1.2 billion), representing an increase of 17.44 percent, was approved. Shareholders also consented to a dividend distribution of 29.5 percent, comprising a 12.5 percent cash dividend and a 17 percent stock dividend. VIB has consistently maintained a balanced and generous dividend distribution policy, fostering shareholder confidence and loyalty while providing the bank with essential resources to pursue its growth plans.

Endorsement of 2024 Business Plan and Implementation of New Strategic Directions

The meeting approved the proposed 2024 business plan presented by the Board of Directors, which includes goals for total assets, loan portfolio growth, capital mobilization, and profit. Notably, the lending growth target may be revised based on the availability determined by the State Bank of Vietnam.

- Innovative customer solutions and products of superior quality.

- Excellence in technology and digital banking.

- Empowerment and development of human resources.

- Establishment of a leading brand.

- Pioneering the adoption of international standards.

- Robust risk management and compliance.

During the AGM, VIB’s Chairman reaffirmed the bank’s commitment to aggressively expand its retail operations, striving to realize its vision of becoming Vietnam’s leading retail bank in both quality and scale. Additionally, VIB aims to become the preferred banking partner for businesses and maintain its reputation