Contrasting Landscape of Industrial Real Estate Hubs

VPBankS Research’s April 2024 report, titled “Industrial Real Estate: Riding the Waves,” paints a contrasting picture of the industrial real estate (IRE) markets in Northern and Southern Vietnam.

Supply Dynamics

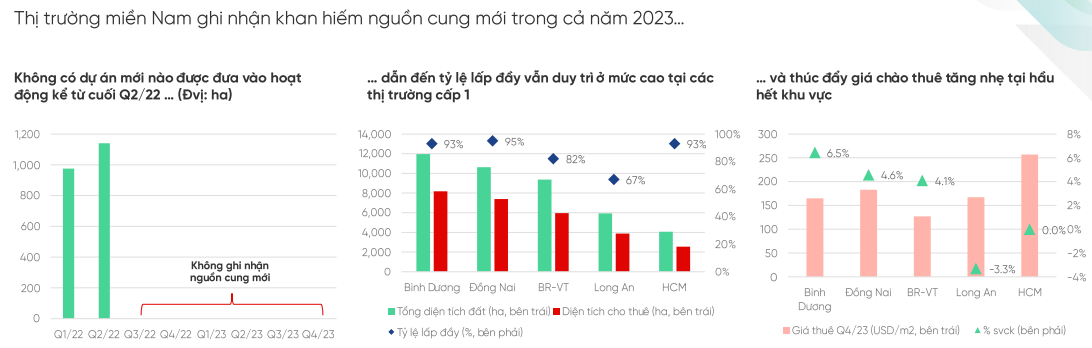

The report highlights a stark difference in supply dynamics between the two regions. In 2023, the Southern market faced a shortage of new supply, while the Northern market experienced ample new supply.

In the South, the entire market witnessed no new supply coming online in 2023. The total supply remained largely unchanged since late Q2 2022, with a total land area of 41,950 ha, of which 66.7% (27,948 ha) was available for leasing. The supply bottleneck was primarily attributed to delays in project approvals in most cities and provinces in Southern Vietnam.

The limited available supply for leasing led to sustained high occupancy rates in key provinces and cities such as Ho Chi Minh City, Binh Duong, and Dong Nai, all hovering above 93%. The overall market occupancy rate also rose by 1.1 percentage points to 88% as of Q4 2023.

Adding to this, elevated demand coupled with supply constraints pushed up rental rates in areas with high occupancy rates, such as Binh Duong (+6.5%) and Dong Nai (+4.6%).

In contrast to the South, the Northern market saw the arrival of over 1,000 hectares of new supply in 2023, contributed by five major projects in Hung Yen, Hai Phong, and Bac Ninh. The total supply in the region reached approximately 16,367 ha, with 70.3% (11,509 ha) designated for leasing.

Occupancy Levels and Rental Rates

The extensive new supply in 2023 resulted in a slight decline in the overall occupancy rate of the Northern market. Hung Yen, Hai Phong, and Bac Ninh experienced the most significant drops in occupancy rates, down by 5.1, 4.5, and 1.6 percentage points, respectively, compared to the previous year.

Except for Hanoi, which has exhausted its leasing capacity, the IRE market across the Northern region has witnessed rising rental rates. This trend is driven by high-quality new supply targeting electronics and component manufacturers.

Future Outlook

VPBank**S Research projects that IRE land will continue to grow significantly between 2025 and 2030, with expansion focused on areas considered IRE hubs that attract domestic and foreign investors, such as the Southeast, Red River Delta, and North Central and Central Coast regions.

However, the development of land to provide new supply remains highly dependent on the pace of approvals and alignment with provincial and municipal planning. In some provinces and cities, IRE land is approaching or exceeding the allocated quota for 2025.

Policy Developments

On March 12, 2024, the Prime Minister approved Decision 227/QD-TTg, adjusting land use quotas for 63 provinces and cities until 2025. This adds to and modifies the quotas outlined in the previous Decision 326/QD-TTg.

Notably, the adjustment grants significant increases in IRE land quotas until 2025 for several provinces and cities in Northern Vietnam, including Bac Ninh, Hung Yen, Hai Duong, and Quang Ninh. This opens up opportunities for project approvals and the development of new IRE in these regions.

Contrasting Market Dynamics

In contrast to the North, most IRE provinces and cities in the South have not witnessed changes in their land quotas until 2025. This further reinforces the expectation of a sustained supply crunch in Southern IRE in the short to medium term, as major provinces like Binh Duong, Dong Nai, and BR-VT approach their allocated quotas for 2025.

Emerging Opportunities

While future IRE land in Southern Vietnam is limited, the Northern IRE market is expected to continue welcoming new supply, not only in traditional Tier 1 areas but also in Tier 2 markets. VPBank**S estimates that the Northern IRE market will see new supply in Tier 1 and Tier 2 regions of 3,039 ha and 2,268 ha, respectively.

Emerging Tier 2 regions like Quang Ninh, Vinh Phuc, and Bac Giang are attracting FDI and are capable of providing high-quality supply at competitive rental rates, rivaling Tier 1 areas.

Competitive Advantages

VPBank**S believes that the Northern IRE market, which has a later development history compared to the South, possesses significant potential for expansion and stronger price appreciation due to improved infrastructure.

Notable upcoming projects poised for development come primarily from leading IRE developers such as **KBC**, **IDC**, and **Geleximco**.

Southern IRE Attracts Investors

Mr. **Giang Ngoc Phuong** – Deputy General Director of Hiệp Phước Industrial Zone Joint Stock Company (UPCoM: **HPI**)

|

In an interview, Mr. **Giang Ngoc Phuong**, Deputy General Director of Hiệp Phước Industrial Zone Joint Stock Company, provided insights into why the Northern IRE is perceived as more attractive than the Southern market.

Natural Advantages

Firstly, the Northern region has more favorable natural conditions and geographical locations compared to the South. In terms of natural conditions, the initial investment costs for IRE in the North are lower, even within the Southern region, where investments in Dong Nai are more advantageous than in Hiệp Phước.

Cost Advantages

Secondly, land costs and rentals for investors are lower in the North than in the South. The cost of infrastructure development is also lower, resulting in lower base rental costs for tenants. Consequently, lease rates for IRE are higher in the South.

Demographics

Thirdly, due to the higher level of industrial development in the South, the labor supply is no longer abundant, necessitating the recruitment of workers from other regions. As a result, the labor force in the South is now facing a shortage relative to the demand for industrial growth.

Government Support

Additionally, several Northern provinces are actively developing their industries and benefit from government support to drive economic and social development. These incentives for economically disadvantaged areas offer advantages that investors seek to capitalize on.

Southern Advantages

Despite the perceived advantages of the Northern IRE market, many investors still prefer to invest in the South. According to Mr. Phuong, Southern Vietnam offers proximity to the vibrant growth region of Southeast Asia, which includes Singapore, Thailand, and Indonesia, fostering trade and transportation.

Furthermore, the Southern region’s culture and workforce contribute to higher productivity rates, coupled with a large and receptive consumer base. As such, employers prioritize areas with higher labor productivity and greater customer potential.

Cát Lam