What is the major factor that has surged the price of Bitcoin and gold in recent months? Two experts explain what’s behind it all.

Surging U.S. government debt, which is projected to reach 106% of the nation’s gross domestic product (GDP) by 2028, is a contributing factor to the recent surge in the price of gold and Bitcoin (BTC), according to market observers.

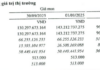

The U.S. budget deficit rose to $1.7 trillion in fiscal 2023 and is projected to reach $2.6 trillion by 2034, according to the Congressional Budget Office. The U.S. government’s public debt has climbed from $17 trillion in early 2020 and $5 trillion in 2007 to an estimated $27 trillion by 2034.

This worsening trend has increased demand for Bitcoin and gold, which are widely used as a hedge against inflation, analysts say.

“Concerns about the U.S. debt trajectory and the debasement of currencies, especially fiat currencies, are what’s driving the markets,” said Brad Bechtel, global head of FX at Jefferies.

The rising debt has prompted investors to allocate more of their portfolios to Bitcoin and gold.

“Concerns about the debasement of fiat currencies tend to be one of the drivers of investment in gold,” Bechtel added.