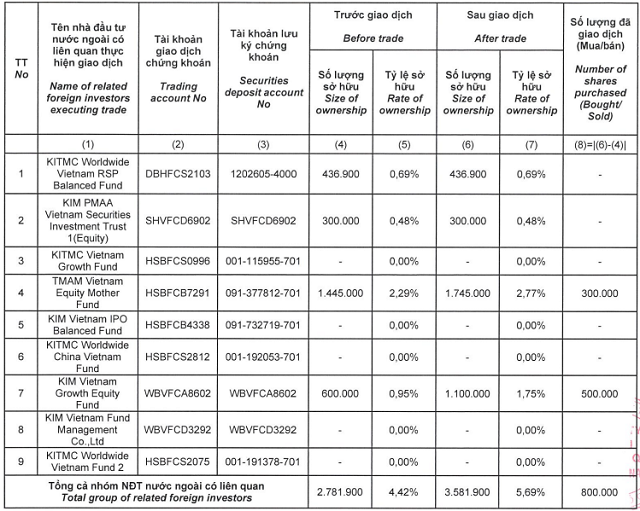

Specifically, two members of this fund, KIM Vietnam Growth Equity Fund and TMAM Vietnam Equity Mother Fund, purchased an additional 500 thousand and 300 thousand DPG shares, respectively, increasing KIM Vietnam’s total ownership to nearly 3.6 million shares, equivalent to a 5.69% stake, officially becoming a major shareholder in DPG.

|

KIM Vietnam’s DPG Share Transaction Results on April 16

Source: KIM Vietnam

|

The transaction was executed on April 16, 2024. Based on the closing price of VND 49,800 per share on that day, the KIM Vietnam group is estimated to have spent approximately VND 40 billion on the deal.

The buying occurred during a period of significant declines in DPG share prices, including several sessions of “floor greens” in recent days. Compared to the recent peak of VND 52,800 per share on April 12, DPG shares closed at VND 43,150 on April 19, representing an 18% decline in just a few sessions.

| DPG Share Price Performance from the Beginning of 2024 to Present |

In terms of business performance, DPG reported VND 3,450 billion in net revenue at the end of 2023, a 4% increase compared to 2022. However, its net profit was only VND 203 billion, a 47% decrease. For 2024, DPG has set a revenue target of VND 4,566 billion and a net profit target of VND 254 billion, representing increases of 32% and 25%, respectively, compared to its 2023 performance.

| DPG‘s Business Results from 2019-2023 |