Financial Firms Face Challenges in 2023

Amidst economic headwinds, the consumer finance market suffered in 2023, leading to significant decline in profits for financial companies.

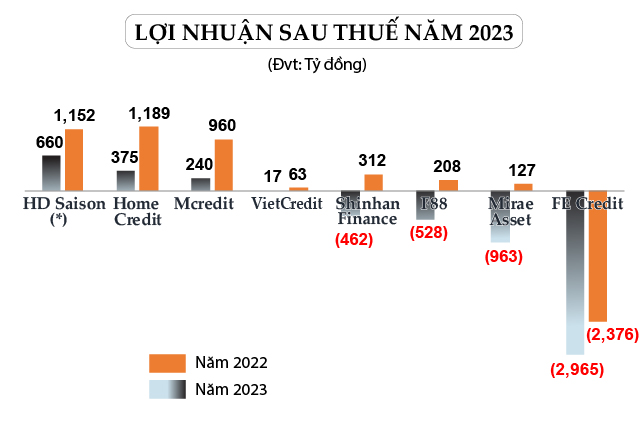

FE Credit (Vietnam Prosperity Bank SMBC Finance Company Limited) reported a net loss of over VND 2.965 trillion in 2023, compared to a loss of over VND 2.376 trillion in the previous year. Its equity capital declined by 22% to VND 10.275 trillion, resulting in a capital adequacy ratio of 14.33%.

MBS Research previously highlighted that FE Credit’s consecutive quarters of positive pre-tax profits and signs of improvement in asset quality indicate a potential decrease in provisioning pressure in future quarters. Additionally, the deceleration in loan growth and the trough reached in Q3/2023 raise expectations of positive growth resumption in 2024. MBS Research projects a loan growth of 16.1% for FE Credit in 2024.

Shinhan Finance (Shinhan Finance Company Limited Liability Company – Vietnam) also faced challenges, reporting a net loss of nearly VND 463 billion, after a profit of over VND 312 billion in 2022. This marked the first loss since Shinhan Finance’s entry into the Vietnamese market in 2019.

As of the end of 2023, Shinhan Finance’s equity capital reached nearly VND 2.450 trillion, down 16% from the beginning of 2023. Its return on equity (ROE) dropped from 11.33% in 2022 to -17.26% in 2023. Its capital adequacy ratio also decreased from 26.16% at the start of the year to 21.41%.

Mirae Asset Finance (Vietnam) Limited Liability Company previously announced a net loss of VND 963 billion in 2023, compared to a profit of VND 127 billion in 2022. By the end of 2023, the company’s equity capital stood at VND 1.744 trillion, slightly higher than the beginning of the year. Its capital adequacy ratio improved from 15% to 21.75%. ROE declined from 7.6% in the previous year to -55.2%.

HD Saison Finance recorded total assets of VND 17.5 trillion at the end of 2023, approximately the same as at the beginning of the year. Its loan balance reached VND 16.086 trillion, a 5% decrease compared to年初. The non-performing loan ratio remained at 7.6%, up from 7.1% at the beginning of the year. HD Saison reported a pre-tax profit of VND 660 billion in 2023, roughly 42% lower than in 2022.

MB Shinsei Finance (Mcredit) saw its net profit in 2023 plummet to VND 240 billion, a sharp 75% drop from 2022. By the end of 2023, the company’s equity capital increased by 6% to VND 3.008 trillion. Its ROE declined significantly from 40.65% to 8.2%. The capital adequacy ratio reached 13.99%.

VietCredit Finance (UPCoM: TIN) recorded a net profit of nearly VND 17 billion, a decline of approximately 74% compared to the previous year. VietCredit attributed the decline to the unfavorable macroeconomic conditions in 2023, which led to slow credit growth and a decrease in consumer demand for credit, affecting the company’s credit revenue. Additionally, significant fluctuations in funding costs in the capital market contributed to the decline in profits.

Home Credit Vietnam Finance Company Limited (Home Credit) also faced a 68% decrease in its net profit in 2023 compared to 2022, dropping to over VND 375 billion. As of the end of 2023, Home Credit Vietnam’s equity capital reached VND 6.753 trillion, up 6% from the start of the year. The capital adequacy ratio stood at 24.94%.

(*) Pre-tax profit

|

Causes of Profit Decline

Assoc. Prof. Dr. Nguyen Huu Huan of Ho Chi Minh City University of Economics believes that the primary reason for financial companies’ losses or significant profit declines is loan loss provisioning due to an increase in bad debt. Financial companies primarily provide unsecured loans to low-income earners with unstable incomes. Furthermore, economic challenges in the past year reduced borrowers’ repayment capacity, leading to increased consumer spending cuts.

Assoc. Prof. Dr. Dinh Trong Thinh, an economics expert, attributes the profit decline in 2023 to several factors.

Firstly, financial companies faced difficulties in debt recovery due to groups that coach people on loan avoidance and default, resulting in loan recovery challenges and subsequent loss of interest and principal.

Secondly, such debt defaults increase the need for provisioning, raising loan expenses.

Thirdly, the difficult debt recovery scenario caused financial companies to become more cautious and tighten loan standards, resulting in slower and more challenging lending processes.

Consumer Finance Market Recovery Outlook

Assoc. Prof. Dr. Dinh Trong Thinh anticipates an improvement in the consumer finance market this year compared to the previous year. With expectations of better economic growth and higher household incomes, consumer spending and borrowing are likely to increase.

Companies are also implementing mechanisms to enhance debt management and recovery while tightening default control measures, reducing non-repayment loans and boosting profits.

In addition, the government has introduced policy changes to address specific conditions related to borrowing behavior. Notably, the digitization of loan applications, repayments, and history ensures that individuals with poor repayment records face difficulties obtaining loans from other companies. These measures are projected to contribute to a better-performing consumer finance market in 2024.

However, Assoc. Prof. Dr. Nguyen Huu Huan predicts a slow recovery for the consumer finance market, emphasizing the need for time to achieve a breakthrough. While the economy shows signs of improvement, growth in the upcoming year is unlikely to be remarkable, despite potential growth exceeding the previous year. Global economic uncertainties will inevitably impact Vietnam’s recovery. Consumers will likely continue to prioritize spending cuts as a risk mitigation measure.

Author: Cat Lam