Over the weekend, the news that the KRX system is expected to be operational from the beginning of May, in just a few days, was well received by the market. Securities stocks performed well from the morning session, and in the afternoon, they surged strongly with many stocks hitting the ceiling price. However, the inflow of money cannot yet be considered excited as trading volume hit a 10-week low.

The liquidity of the two exchanges also improved slightly in the afternoon session, with an additional VND 8,335 billion traded, an increase of nearly 20% compared to the morning session. However, for the whole day, the total matched value of HoSE and HNX was only more than VND 15,300 billion, a decrease of 39% compared to the previous weekend session.

Despite the low inflow of money, the price increase was quite impressive. The VN-Index surpassed a new high in the afternoon session before retreating slightly. The closing index increased by 1.31%, equivalent to +15.37 points. This increase eased the loss of the previous week when the index lost up to 101.75 points.

The decrease in selling pressure this afternoon also provided an advantage for the recovery. In fact, there were still new waves of profit-taking, especially from around 2 pm onwards. Until near the end of the continuous matching order, the VN-Index increased by more than 12 points, significantly lower than the peak at 2.08 pm when it increased by 19 points. However, compared to the buyers, this selling pressure did not create much pressure, most stocks recovered in the ATC session, pulling the VN-Index higher at closing.

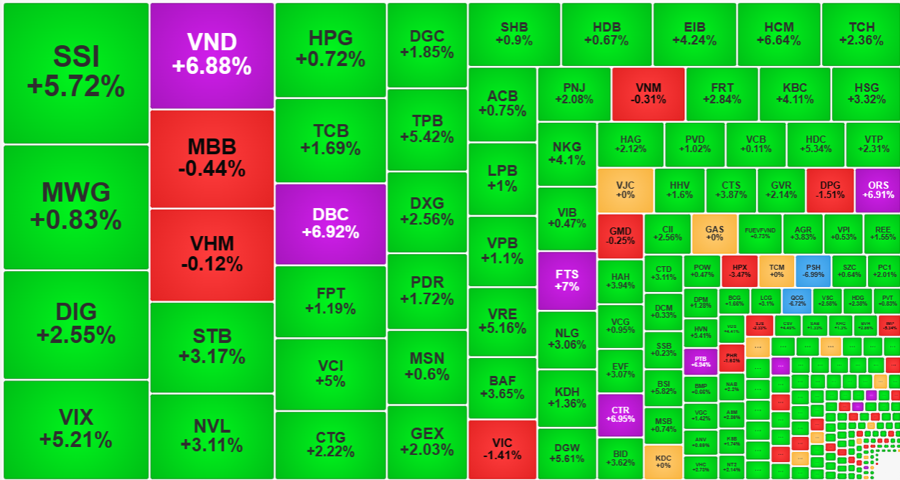

Securities stocks were the focus of trading this afternoon. BVS, FTS, VND, TVB, ORS closed at ceiling prices. The blue-chips of the group also performed well: SSI increased by 5.72%, HCM increased by 6.64%, VCI increased by 5%, SHS increased by 5.75%, MBS increased by 6.64%… In the whole group, there were 22 stocks increased by more than 5% and 8 others increased by more than 2%.

In terms of liquidity, SSI, VIX, and VND were among the top 5 most traded stocks in the market. SSI led with VND 674.6 billion, VIX was fourth with VND 474.8 billion, and VND was fifth with VND 434 billion. Foreign investors also jumped into buying securities stocks quite heavily: SSI was net bought VND 62 billion; VND + VND 141.1 billion; VCI + VND 48 billion; FTS + VND 23.7 billion, HCM + VND 22.6 billion.

Securities stocks traded actively today partly because the market was flooded with information over the weekend that the KRX system will be operational from May 2. The KRX story has repeatedly boosted securities stocks, but this time the information seems clearer and can be verified immediately after the holiday.

Securities stocks have small capitalization, so their impact on the index is limited. The largest SSI is not yet in the Top 20 capitalization of the VN-Index. This stock contributed about 0.7 points but supported the VN30-Index by nearly 2 points. The main motivation that this group brings is the excited psychology.

This afternoon, the market breadth was not much better than in the morning. The HoSE closed with 374 stocks increasing/114 stocks decreasing (the closing session in the morning was 313 stocks increasing/135 stocks decreasing), but the price level was much better. This was because stocks had regained their height and continued to increase further. This floor closed with 15 stocks hitting the ceiling price and nearly 200 stocks increasing by more than 1%.

Leading the index was still the group of pillars, with banks being the most notable. BID increased by 3.62%, CTG increased by 2.22%, TCB increased by 1.69%, TPB increased by 5.42%, STB increased by 3.17% are the stocks belonging to the Top 10 strongest pillars. In the whole banking group, only 2 stocks were red: MBB decreased by 0.44% and PGB decreased by 1.1%, 3 other stocks were referenced: ABB, NVB, and VBB, the rest all increased. 13 stocks in the group increased by more than 1% on the reference price.

The pull of the financial stock group could have helped the VN-Index to explode further if there were no three “dragons”: VIC decreased by 1.41%, VHM decreased by 0.12%, and VNM decreased by 0.31%. In addition, GAS was only referenced, VCB was too weak to increase by 0.11%, HPG increased by 0.72%, which also made the consensus not reach a better level.

However, today was still a strong increase for both indices and stocks. The top liquidity group, including 44 stocks with liquidity of VND 100 billion or more – accounting for 75% of the total matched value on the HoSE floor, had only 4 red stocks, the rest all increased, with 33 stocks increasing from 1% or more. In addition to securities stocks, it is worth noting that DBC increased by 6.92% with a trading volume of VND 297.2 billion; DGW increased by 5.61% with VND 101 billion; VRE increased by 5.16% with VND 156.7 billion; KBC increased by 4.11% with VND 128.4 billion; NKG increased by 4.1% with VND 125.7 billion…

The declining group had 114 stocks, but most had small liquidity or decreased insignificantly. PSH, QCG, POM, SJS, PHR, DPG, VIC are the stocks with a liquidity of over VND 20 billion and a price decrease of more than 1%.

Foreign investors traded balanced this afternoon, with net selling of only about VND 57.7 billion. In the morning session, this bloc collected VND 184.1 billion net. However, the main net selling was in FUEVFVND fund certificates with – VND 353.7 billion. Stocks with MWG – VND 89 billion, VIC – VND 63.5 billion, VHM – VND 61.1 billion, HDB – VND 47.3 billion, DIG – VND 28.6 billion.