Hoa Binh Construction Group (HoSE: HBC) has just published its annual report for 2023. Mr. Le Viet Hai, Chairman of the company’s Board of Directors, shared his insights on the business results and provided information on the group’s strategy for the future.

OWNER’S EQUITY REMAINS AT VND 93 BILLION

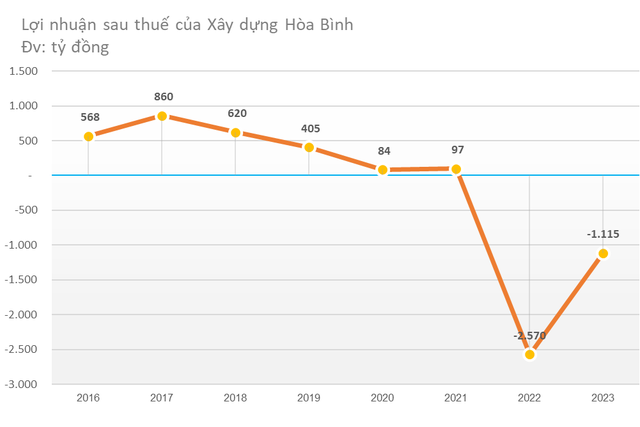

According to Mr. Le Viet Hai, Hoa Binh Construction has just gone through a turbulent 2023, during which challenges have been brewing since 2017, before many unfavorable events impacted the construction sector, especially in urban housing and resort tourism – two main construction sectors of Hoa Binh.

Amidst this challenging context, Hoa Binh started 2023 with an unexpected event – the “internal conflict” within the Board of Directors that took place on the eve of the Lunar New Year. He said that at that time, he had initially planned to step down but had to return to the position of Chairman of the Board of Directors to steer the Hoa Binh ship.

According to the audited financial statements for 2023, Hoa Binh achieved revenue of over VND 7,537.1 billion, reaching 60% of the set plan. After deducting expenses, the company incurred a loss of VND 1,115 billion. According to Mr. Hai, with the application of Vietnamese accounting standards from a very prudent perspective, the consolidated audited financial statements for 2023 also recorded a decline in Hoa Binh’s equity to only VND 93 billion.

“This figure is vastly different from reality. According to the management financial report prepared by the company’s finance and accounting department based on the specifics of construction activities and market data that is close to reality, Hoa Binh’s equity is around VND 5,539 billion, nearly 60 times higher than the equity in the audited financial statements”, said Mr. Le Viet Hai.

The Chairman of Hoa Binh Construction analyzed that there are four main reasons for this difference. Firstly, according to the management report, the prices of real estate are determined according to market prices, while in the audited financial statements, they are recorded at cost. For example, the headquarters at 235 Vo Thi Sau, District 3, Ho Chi Minh City, is recorded on the books at only VND 5 billion, but the current market price is not less than VND 75 billion, a difference of up to 15 times.

Secondly, the residual value of machinery and equipment recorded in the audited report does not correspond to reality because the depreciation value according to the current auditing regime does not accurately reflect the actual depreciation, and the market price depreciation also significantly impacts the residual value of machinery and equipment.

Thirdly, the provisions for bad debts according to the current accounting regime are determined based on the age of the debt, while according to the management report, the company assesses this based on the reason for the delay in payment, the quality assurance of the project, the completion level of the settlement and payment dossier, the customer’s financial capacity, and business operation risks, etc.

Fourthly, increasing the receivables according to the court’s decision will increase equity. Hoa Binh Construction’s assessments also rely on its historical experience in resolving debt collection lawsuits, a typical case being FLC’s debt of over 5 years. The difference in the amount of receivables between the book value and the court’s judgment value is VND 652 billion. According to Hoa Binh, this is a debt that is entirely collectible.

“However, as the leader, I would like to sincerely take responsibility for not leading Hoa Binh to develop in accordance with the goals and plans set by the Group in the past 2023”, Mr. Hai confided in his letter to shareholders.

HOA BINH CONSTRUCTION HAS OVERCOME ITS EXTREME DIFFICULTY

Mr. Le Viet Hai also said that the turmoil that Hoa Binh Construction faced in 2023 seemed insurmountable. However, the company has now overcome the “extreme difficulty, hanging on by a thread” situation. According to him, when working with partners and explaining the current difficulties, many close investors will create favorable conditions to assign the group new projects.

Strategic subcontractors and suppliers who have been accompanying the Group have also shown their understanding and shared the risks during this challenging period. As of April 18th, over 99 suppliers and subcontractors have agreed to sign a memorandum of understanding to exchange debts for HBC shares of Hoa Binh with a value of up to VND 660 billion.

Mr. Le Viet Hai further informed that in early 2024, Hoa Binh received a Letter of Intent to award 5 social housing construction projects from the Ministry of Lands, Public Works, Housing and Urban Development of Kenya with a total investment of USD 72 million. This is an initial success and proof of the company’s determination to achieve the goal of exporting comprehensive construction services to foreign countries.

He believes that Hoa Binh’s conquest of the foreign construction market is like the story of a bamboo tree. When planted in the ground, a bamboo tree only grows a few centimeters above the ground for a long time. During the first four years, it devotes all its energy to rooting hundreds of meters underground. When the roots are strong enough, from the fifth year onwards, it shoots up at an astonishing rate of 30 centimeters per day and takes only 6 weeks to reach a height of 15 meters.

“After Kenya, there will be projects in the US, Australia, Canada and many other countries. I affirm and once again ask for the understanding and empathy of shareholders regarding the challenges and difficulties I have gone through as well as the loss-making business results in the past year”, Mr. Hai confided.

In addition to expanding overseas, Hoa Binh Construction has also repaid its bank debts on time and has not been transferred to the bad debt group. The credit limit at the three main banks is currently VND 7,592 billion.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)