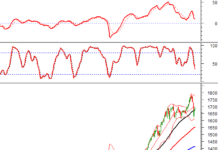

After a week of losing nearly 102 points, the market recovered slightly this morning, but cash flow was extremely cautious at high prices. The total matching value of the two listed exchanges was only over VND 6,900 billion, down 45% compared to the previous session. The market breadth was still positive, but most stocks started to decline in the last 30 minutes of the session.

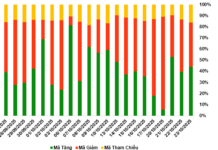

VN-Index increased to peak at 11 am, up more than 15.4 points. However, at the end of the session, the increase was only 7.92 points. The index breadth at the peak recorded 343 gainers/113 losers, and by the end of the session, there were 313 gainers/135 losers. Thus, the number of stocks changing colors is still small, but the phenomenon of price decline is widespread.

Statistics on HoSE show that up to 49% of the stocks with trading activities in the morning session have decreased by at least 1% compared to the peak of the day. Leading the index this morning was the banking group, with BID up 1.86%, CTG up 1.42%, VPB up 1.38%, and TCB up 1.12%. These 4 stocks contributed nearly 3 points to the total increase of 7.92 points of the VN-Index. However, even the strongest pillars were still pressured down to some extent: BID decreased by 0.4% compared to the peak; CTG decreased by 0.77%; VPB decreased by 0.54%; TCB decreased by 1.53%.

Statistics in the VN30 blue-chip basket show that all stocks except SSB decreased, with 17 stocks decreasing over 1%. In particular, GVR decreased by 2.45%, closing the session with an increase of only 0.71%; MWG decreased by 2.23%, up by 0.21%; VIC decreased by 2.2%, down by 1.29%. The VN30-Index closed the morning session up by 0.65% compared to the reference, with the breadth of 25 gainers/4 losers. Thus, this group has not yet been pressured too much and only a few stocks have changed color. All 10 stocks leading the index this morning belong to the VN30 basket.

Liquidity decreased by 45% compared to the previous morning session, although the index increased well throughout the session, indicating significant hesitation from buyers. Investors were not willing to chase high prices, so the price decline could only come from sellers. Since the market declined rapidly in the previous sessions, the increase this morning did not bring any profit to bottom fishers. Therefore, the selling this morning was to take advantage of a few percentage points to cut losses to escape.

This can be seen very clearly in the group of stocks with the largest trading volume in the market. MWG is leading in liquidity with VND 294.5 billion, and the price has decreased by 2.23% compared to the peak of the morning session. DIG, SSI, and VIX are the other 3 stocks traded over VND 200 billion, with prices decreasing by 1.6%, 1.3%, and 2.33% respectively compared to the peak. On the HoSE this morning, there were 16 stocks traded over VND 100 billion, and only STB had the lowest price decline of 0.9%, while the rest were over 1% to 2%.

With a still very good market breadth – the number of gainers was 2.3 times that of losers – the selling pressure is taking place at the green prices. This is a common loss-cutting strategy. With a very early recovery, investors can wait to sell at a higher price instead of having to sell off. However, if the uptrend starts to slow down and liquidity signals a lack of demand at high prices, the selling strategy may change. Moreover, this afternoon, there will be another amount of loss-making goods coming into the account.

The HoSE currently still has 160 stocks increasing by more than 1%, with liquidity accounting for about 57% of the total matched on this floor. This is a relatively high proportion, indicating a certain level of excitement. However, as mentioned above, the absolute liquidity figure is low. In addition, the additional liquidity is mainly concentrated in a few stocks: 40 stocks traded from VND 20 billion upwards, of which 10 stocks matched over VND 100 billion such as DIG, SSI, VIX, VND, TCB, NVL, VCI…