Margin pressure eased as equity reports from brokerage houses showed that outstanding loans were not stretched even though it had peaked mainly due to a sharp increase in equity over the past period. The index regained 15.37 points, advancing to the 1,190-point mark in the first session of the week. The market breadth was very positive, with 374 stocks increasing and 114 decreasing.

Securities became the group with the strongest increase thanks to the government’s request for the Ministry of Finance to urgently take measures to upgrade immediately in 2024. This group increased by 5.83%, with 5 stocks reaching the limit such as VND, FTS, BVS… SSI also increased by 5.72%; VCI increased by 5%; HCM and MBS increased by 6.64%… Most of the remaining groups also performed quite well. Banking increased by 1.37%; Information Technology increased by 1.67%; Seafood increased by 1.93%; Retail increased by 1.22%; Real Estate increased by 0.90%; Construction increased by 1.33%.

The most positive impact on the market today was BID, which contributed 2.44 points, along with CTG, SSI, TCB, VRE, GVR… However, cash flow was not strong, with the total order matching value on the three floors today at 17,800 billion VND, of which foreign investors sold a net amount of 241 billion VND, mainly in FUEVFVND and MWG.

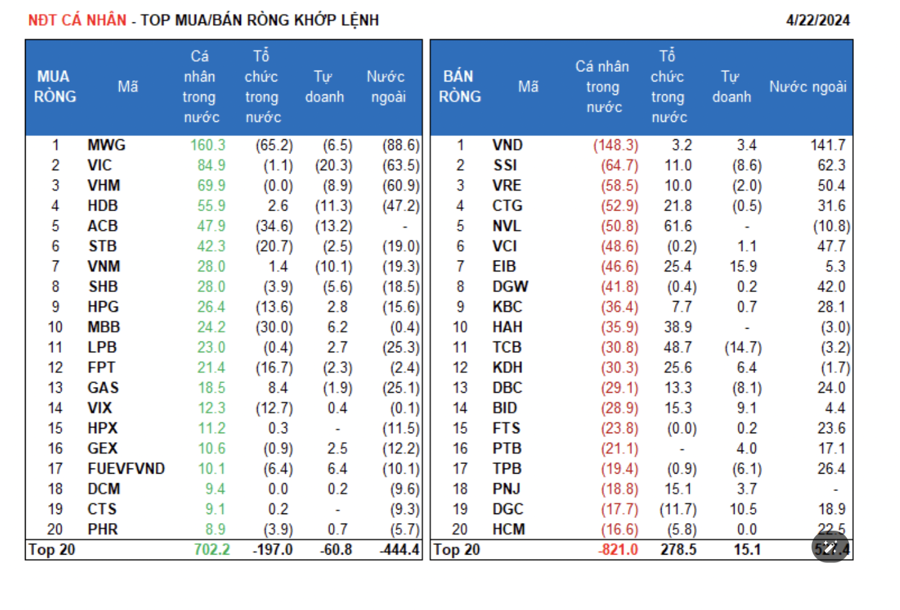

Foreign investors sold a net 169.8 billion VND, while in terms of order matching, they bought a net 81.6 billion VND. The main order-matching net purchases by foreign investors were in the Financial Services and Basic Resources groups. The top order-matching net purchases by foreign investors included VND, SSI, VRE, VCI, DGW, CTG, VPB, KBC, TPB, DBC.

Foreign investors’ order-matching net sellers were in the Real Estate group. The top order-matching net sellers by foreign investors included MWG, VIC, VHM, HDB, DIG, GAS, NLG, VNM, STB.

Individual investors sold a net 492.1 billion VND, of which they sold a net 176.9 billion VND through order matching. In terms of order matching, they bought a net of 8/18 sectors, mainly the Retail sector. The top net purchases by individual investors were in MWG, VIC, VHM, HDB, ACB, STB, VNM, SHB, HPG, MBB.

Order-matching net sellers: they sold a net of 10/18 sectors, mainly the Financial Services and Industrial Goods & Services sectors. Top net sellers included VND, SSI, VRE, CTG, NVL, VCI, DGW, KBC, HAH.

Self-employed investors bought a net 571.8 billion VND, while in terms of order matching, they sold a net 33.7 billion VND.

In terms of order matching, self-employed investors bought a net 8/18 sectors. The largest net buying group was Industrial Goods & Services and Chemicals. The top order-matching net purchases by self-employed investors today included EIB, NLG, DIG, FRT, DGC, CTR, ASM, BID, REE, GMD. The top net sellers were in the Banking group. The top stocks sold net included VIC, VPB, TCB, ACB, HDB, VNM, VCB, VHM, SSI, DBC.

Domestic institutional investors bought a net 159.8 billion VND, while in terms of order matching, they bought a net 129.0 billion VND.

In terms of order matching, domestic institutions sold a net of 6/18 sectors, with the largest value in the Retail group. Top net sellers included MWG, ACB, MBB, STB, FPT, HPG, VIX, DGC, VCB, VIB. The largest net purchases were in the Real Estate group. Top net purchases included NVL, TCB, HAH, KDH, EIB, CTG, BID, PNJ, DBC, VHC.

Negotiated transactions today reached 2,176.1 billion VND, up +62.7% compared to the end of last week and contributing 12.2% to the total added value.

The FUEVFVND fund certificate was traded by agreement between domestic self-employed investors (buyers) and foreign institutions (sellers).

In addition, some notable negotiated transactions in Bank stocks were VPB, MBB, EIB, SHB, TPB.

The proportion of cash flow increased in Securities, Banking, Retail, Aquaculture & Seafood, and Gas & Petroleum Distribution, while decreasing in Real Estate, Steel, Construction, Food, Chemicals, Oil & Gas Equipment and Services, Software, Electrical Equipment, Plastics, Rubber & Fiber.

In terms of order matching, the proportion of trading value increased in the large-cap VN30 group, while decreasing in the mid-cap VNMID and small-cap VNSML groups.