Illustrative image.

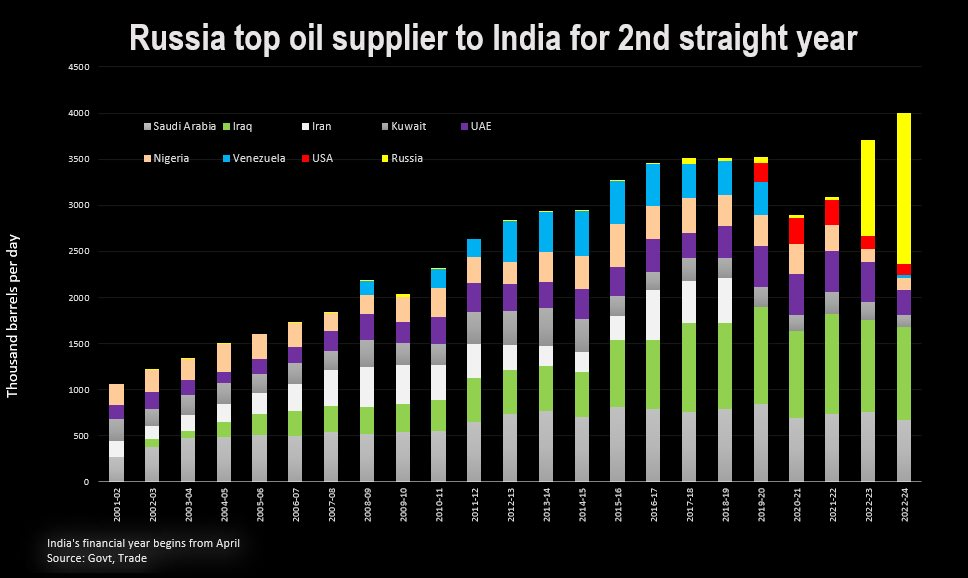

According to data from Reuters, Russia became the top oil supplier to India in the financial year 2023/24, pushing the market share of Middle Eastern and OPEC suppliers to a record low. This also marks the second consecutive year that Russia has been the leader in meeting the oil demand of the billion-plus nation.

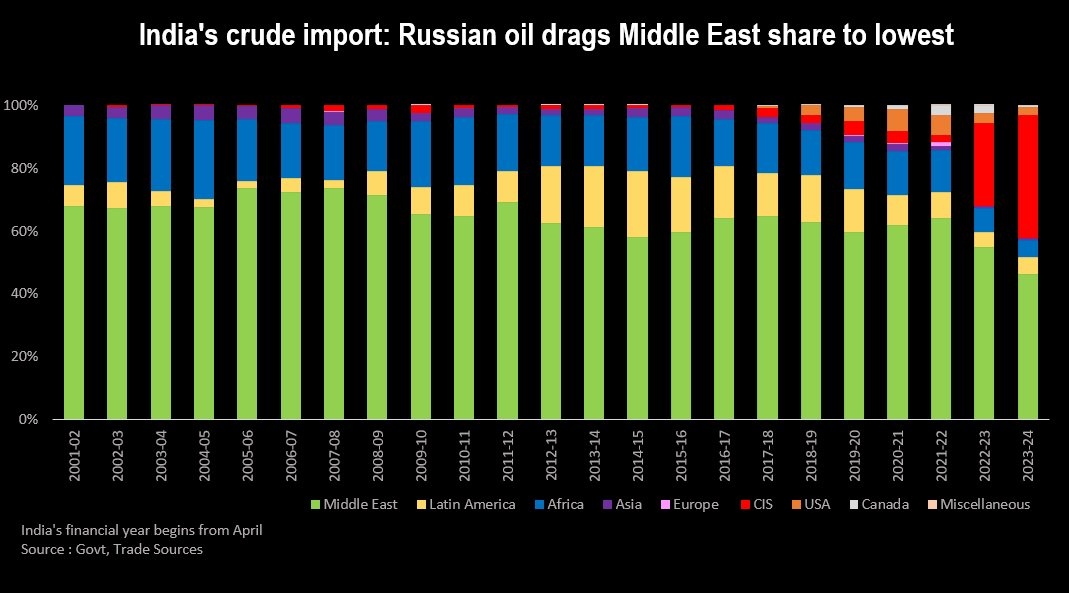

In specific, for the financial year 2023/2024 ended March 31, Middle Eastern suppliers saw their share in India’s overall oil imports fall to 46% – the lowest since 2001-2002. This is down from the 55% share of crude oil imports that Middle Eastern nations had in India’s oil basket in the previous financial year 2022/2023.

The reason behind this trend is attributed to New Delhi snapping up discounted Russian oil, after Western nations shunned purchases and imposed sanctions on Moscow over the conflict in Ukraine. As a result, Russia has emerged as the top supplier to the world’s third-largest oil importer.

India has kept buying Russian oil despite concerns raised by a flurry of sanctions aimed at squeezing Moscow’s oil revenues.

Russia is an ally of the Organization of the Petroleum Exporting Countries (OPEC), but it has taken away market share in India’s crude imports from OPEC’s core Middle Eastern producers.

Russian oil pushes Middle East’s share to lowest ever

Data shows that Russian oil accounted for about 35% of India’s total crude oil imports of about 4.7 million barrels per day (bpd) on average in the fiscal year to March 31, compared with about 22% a year ago. India imported about 1.64 million bpd from Russia in the financial year 2023/2024.

This raised the share of oil from Russia, Kazakhstan, and Azerbaijan, part of the Commonwealth of Independent States (CIS), in India’s imports to 39% in 2023/24, from 26% a year earlier. In contrast, the share of Middle Eastern oil in India’s imports declined from 55% to a record low of 46%.

With this development, India – which relies on imports to meet about 87% of its oil consumption – for the first time imported nearly equal volumes of crude oil from OPEC and non-OPEC producers, thanks to the 57% year-on-year jump in imports from Russia, a non-OPEC producer.

Meanwhile, Iraq remained India’s second-biggest supplier, followed by Saudi Arabia in the third position.

Higher official selling prices (OSPs) of Saudi crude and lower supplies from Kuwait, which has diverted some of its crude to a new refinery, also contributed to OPEC’s and the Middle East’s historically low share in India’s oil imports.

Russia has been the top oil supplier to India for 2 consecutive years

India’s crude oil imports were largely flat in the fiscal year 2023/2024, but the nation’s import bill fell by nearly 16%, aided by lower oil prices and record-high purchases of cheaper Russian crude oil.

While volumes were broadly unchanged, India’s spending on crude oil imports dropped by 16% to US$132.4 billion in 2023/2024, compared with US$157.5 billion in the financial year 2022/2023, based on provisional data from India’s Ministry of Petroleum.

Source: Oilprice