Financial Results for SCD in Q1 2024

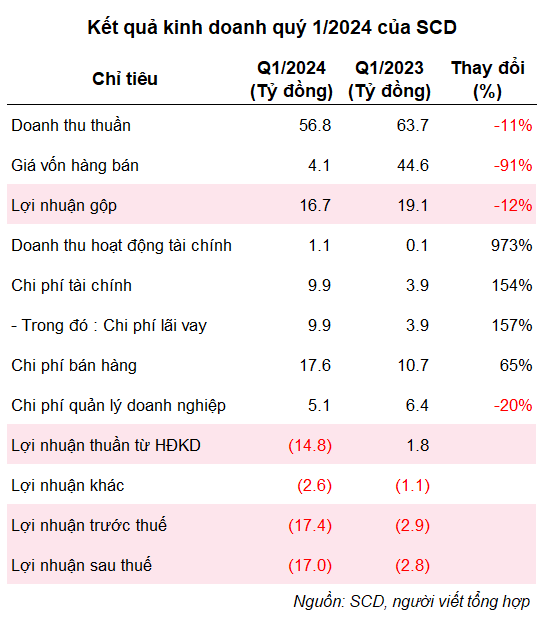

In the first quarter of 2024, SCD reported a net revenue of nearly 57 billion VND, an 11% decrease compared to the same period last year. After deducting the cost of goods sold, gross profit decreased by 12% to nearly 17 billion VND, and the gross profit margin decreased by 1 percentage point to 29%.

Financial revenue surged from 106 million VND in Q1 2023 to over 1 billion VND, but was not enough to offset the significant increase in expenses such as interest expense, which was close to 10 billion VND (a 157% increase), selling expenses were approximately 18 billion VND (a 65% increase), and other expenses such as land rent and depreciation more than doubled to nearly 3 billion VND.

As a result, the company incurred a net loss of nearly 17 billion VND in Q1 2024, a significant increase compared to the loss of nearly 3 billion VND in the same period last year.

For 2024, SCD targets net revenue of over 225 billion VND, a 78% increase compared to 2023. However, the company expects a net loss of over 73 billion VND, extending its four-year consecutive losing streak since 2021.

As of the end of March 2024, SCD’s accumulated losses amounted to nearly 218 billion VND, resulting in negative equity of 29 billion VND.

On the balance sheet, as of March 31, 2024, SCD’s total assets exceeded 681 billion VND, a slight decrease of 6 billion VND compared to the beginning of the year. Notably, total liabilities exceeded total assets by over 29 billion VND. Of which, total financial borrowings were 609 billion VND, accounting for 86% of total debt.

In early April 2023, the Ho Chi Minh City Stock Exchange (HOSE) decided to delist SCD shares from May 6 due to three consecutive years of losses and negative equity. According to the explanation, SCD’s management stated that the company is currently facing increasing costs of sugar and aluminum raw materials. Domestic consumer demand is also lower than before due to consumers’ belt-tightening mentalities. This, combined with higher land rent and interest expenses compared to the same period last year, has caused the company to incur losses.

”SCD will continue to focus on reducing operating costs, including advertising and promotion costs, to ensure more efficient spending. In addition, the company remains committed to optimizing production costs by working with suppliers for better pricing and constantly exploring opportunities for competitive pricing and expanding its reach to increase output,” said a representative of SCD.

| SCD Stock Price Movement Year-to-Date 2024 |

After nearly 18 years of listing on the stock exchange, the news of the delisting caused SCD’s stock price to plummet, but it has since shown signs of recovery. At the end of the trading session on April 22, SCD’s market price was 12,950 VND/share, a 10% decrease in one month and a 20% decrease from the beginning of the year, corresponding to a market capitalization of nearly 110 billion VND.

Prior to the delisting of the stock, PYN Elite, a foreign fund from Finland, announced its exit from the position of major shareholder after selling 22.3 thousand SCD shares on April 4 and reducing its ownership from 5.17% to 4.9% (415.6 thousand shares). It is estimated that the foreign fund earned approximately 270 million VND from this transaction.