Positive Revenue and Earnings for TRC in Q1/2024

| TRC’s revenue and profit surges in Q1/2024 |

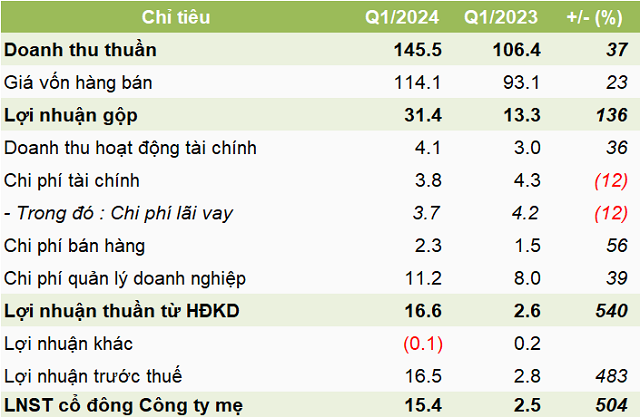

Closing the first quarter, TRC recorded a net revenue of nearly 146 billion VND, reflecting a remarkable 37% increase compared to the same period last year, reaching the highest level in the past decade. Gross profit witnessed a significant surge of 136% to 31 billion VND, with a 9.1 percentage point improvement in gross profit margin to 21.6%.

Total sales and administration expenses rose by 42% to over 13 billion VND, predominantly driven by increased packaging material costs and management staff expenses. However, its impact remained marginal as the ratio to net revenue only marginally increased by 0.3 percentage points to 9.2%, attributed to the robust revenue growth.

|

Tay Ninh – Siem Reap Rubber Development Company, a wholly-owned subsidiary of TRC, primarily operates in rubber plantation, exploitation, and processing. Headquartered in Trapeng Prasat district, Oddar Meanchey province, Cambodia. As of March 31, 2024, TRC’s investment in this subsidiary amounted to approximately 969 billion VND. |

Ultimately, TRC’s net income surpassed 15 billion VND, representing a six-fold increase year-over-year and its highest in three years. TRC attributed this positive result to a 4.7 million VND/ton increase in the average rubber price, with Q1/2024 recording 38.1 million VND/ton compared to 33.4 million VND/ton in Q1/2023, thereby boosting profit from rubber exploitation.

Additionally, during Q1/2024, the subsidiary Tay Ninh – Siem Reap Rubber Development Company turned a profit, whereas it had incurred losses during the same period last year.

Previously, in Q4/2023, this subsidiary’s profitability had also contributed to TRC’s accelerated completion of its 2023 profit plan.

Cambodian subsidiary turns profitable, propelling Tay Ninh Rubber to achieve 2023 profit target

|

TRC’s Q1/2024 Business Results

Unit: Billion VND

Source: VietstockFinance

|

As of March 31st, TRC’s total assets exceeded 1989 billion VND, remaining relatively unchanged from the beginning of the year. Fixed assets accounted for over 949 billion VND (48%), primarily comprising the value of rubber plantations.

Another significant component within the asset structure is long-term work in progress, valued at approximately 503 billion VND (25%), mainly reflecting the construction costs of rubber plantation development in Vietnam and Cambodia.

Regarding the funding structure, debt only represented 8%, equivalent to 163 billion VND, marking a 22% reduction compared to the start of the year.

In the stock market, TRC’s share price closed at 41,450 VND/share on April 19, 2024, indicating a 33% increase year-to-date, with an average liquidity of over 8 thousand shares per day. Moreover, TRC’s market price has increased by 56% over the past year.

| TRC’s stock performance over the past year |

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)