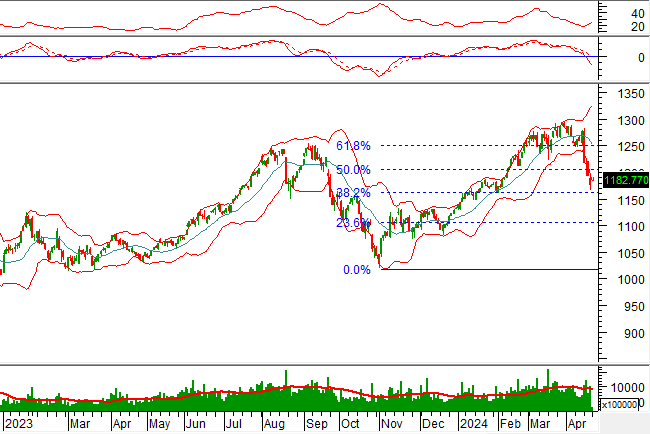

Technical Signals of VN-Index

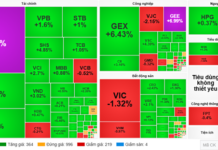

During the morning trading session on April 22, 2024, **VN-Index** surged with a slight decrease in trading volume, indicating a cautious sentiment among investors.

Furthermore, the index continues to test the Fibonacci Projection 38.2% level (corresponding to the 1,265-1,285 point range) while ADX is moving within the gray zone (20

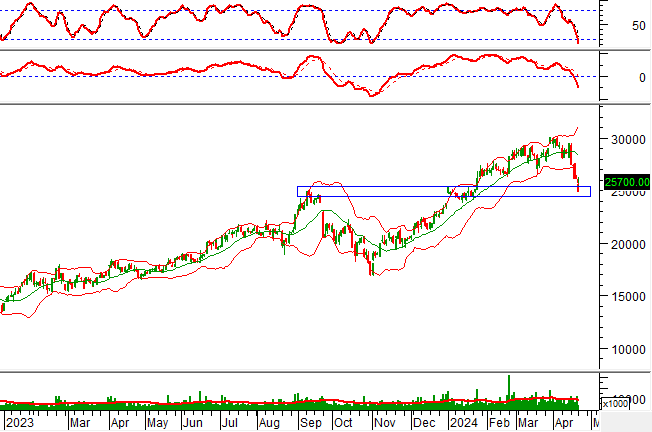

Technical Signals of HNX-Index

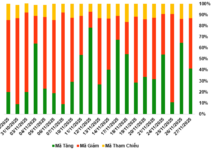

In the trading session on April 22, 2024, the **HNX-Index** rose sharply, but liquidity experienced a significant decline during the morning session, indicating investors’ indecisiveness.

Moreover, the index remains close to the Lower Band of Bollinger Bands, while the MACD indicator continues to weaken after crossing below the 0 level, suggesting that the short-term outlook is still unlikely to turn optimistic.

HCM – Ho Chi Minh City Securities Corporation

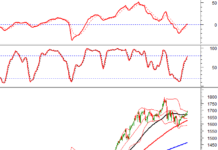

During the morning session on April 22, 2024, **HCM** surged significantly, accompanied by a High Wave Candle pattern, but trading volume did not improve markedly, indicating investors’ uncertainty.

Currently, the stock is retesting its previous high breakout from September 2023 (corresponding to the 24,400-25,400 range) while the Stochastic Oscillator continues to penetrate the oversold zone. In the following sessions, if a buy signal emerges, and the indicator rises above this zone, the short-term outlook would become less pessimistic.

HDC – Ba Ria – Vung Tau Housing Development Corporation

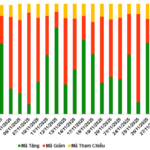

In the morning session on April 22, 2024, **HDC** increased with a slight increase in trading volume, suggesting reduced pessimism among investors.

Currently, the MACD indicator continues to decline and remains below 0 after giving a sell signal, indicating that the short-term correction is still ongoing.

Furthermore, **HDC** is retesting the lower edge of the Descending Triangle pattern (corresponding to the 28,500-29,500 range), which also represents the previous low in March 2024. In a more pessimistic scenario, if the stock price breaks below this zone, the price target would be in the 14,500-16,800 range.

Technical Analysis Department, Vietstock Consulting Room