The stock market has just closed what has been the “worst” trading week since the beginning of the year. The strong profit-taking pressure during the 3 trading sessions caused the VN-Index to be blown away by nearly 8%, equivalent to over 100 points. This is also the index’s strongest losing week since October 2022. The market capitalization of HOSE also thereby “flew away” by nearly 413,700 billion (~$17 billion) after a week. The market fluctuated strongly, and a series of stocks also recorded decreases of over 20% in just one week.

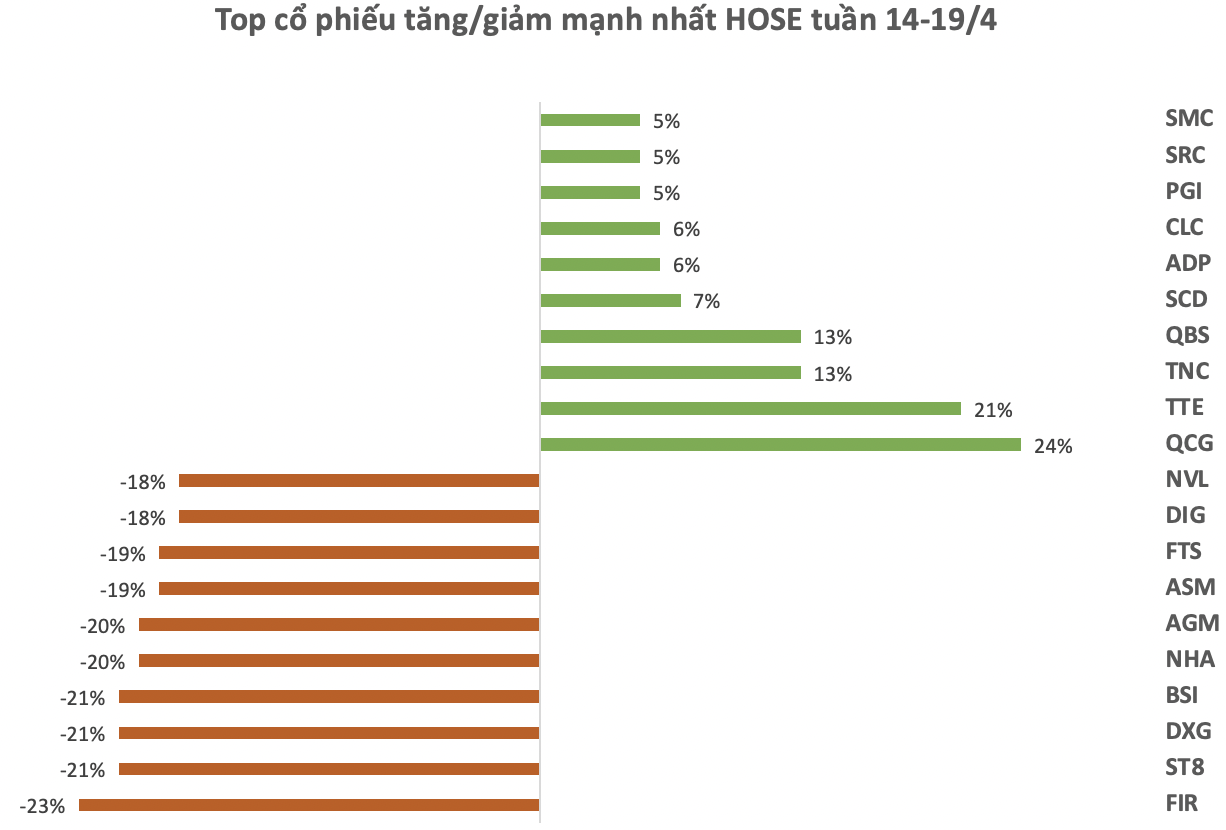

On the HOSE floor, the top 10 stocks with the strongest increase had a narrow increase range, with the highest being 24% and the lowest being 5%.

Going completely against the trend of the general market, stock QCG increased for 4 consecutive trading sessions to record a 24% increase after one week. Looking further, stock QCG has nearly doubled (+94%) in the past month and is now more than 3 times higher (+329%) than the price a year ago.

The recent sudden increase in stock QCG’s stock price occurred in the context of the corporation having just been ordered by the court to refund over 2,800 billion VND to Ms. Truong My Lan.

QCG is also the leading stock in the top 5 stocks that increased the most in price on the HoSE floor during the week. Following QCG are TTE (up 21.3%), TNC (up 13.3%), QBS (up 12.8%) and finally SCD (7.4%).

On the declining side, a series of stocks on HOSE also recorded a decrease of over 18%. Profit-taking pressure appeared in many real estate stocks, including FIR (-23%), DXG (-21%), NHA (-20%), DIG (-18%), NVL (-18%).

Meanwhile, the group of stock companies saw the appearance of two names, BSI and FRT, with a decrease of over and under 20%. The others also decreased deeply in value, such as AGR, TVB, ORS, HCM, VIX, VDS, with a decrease of 15-17%.

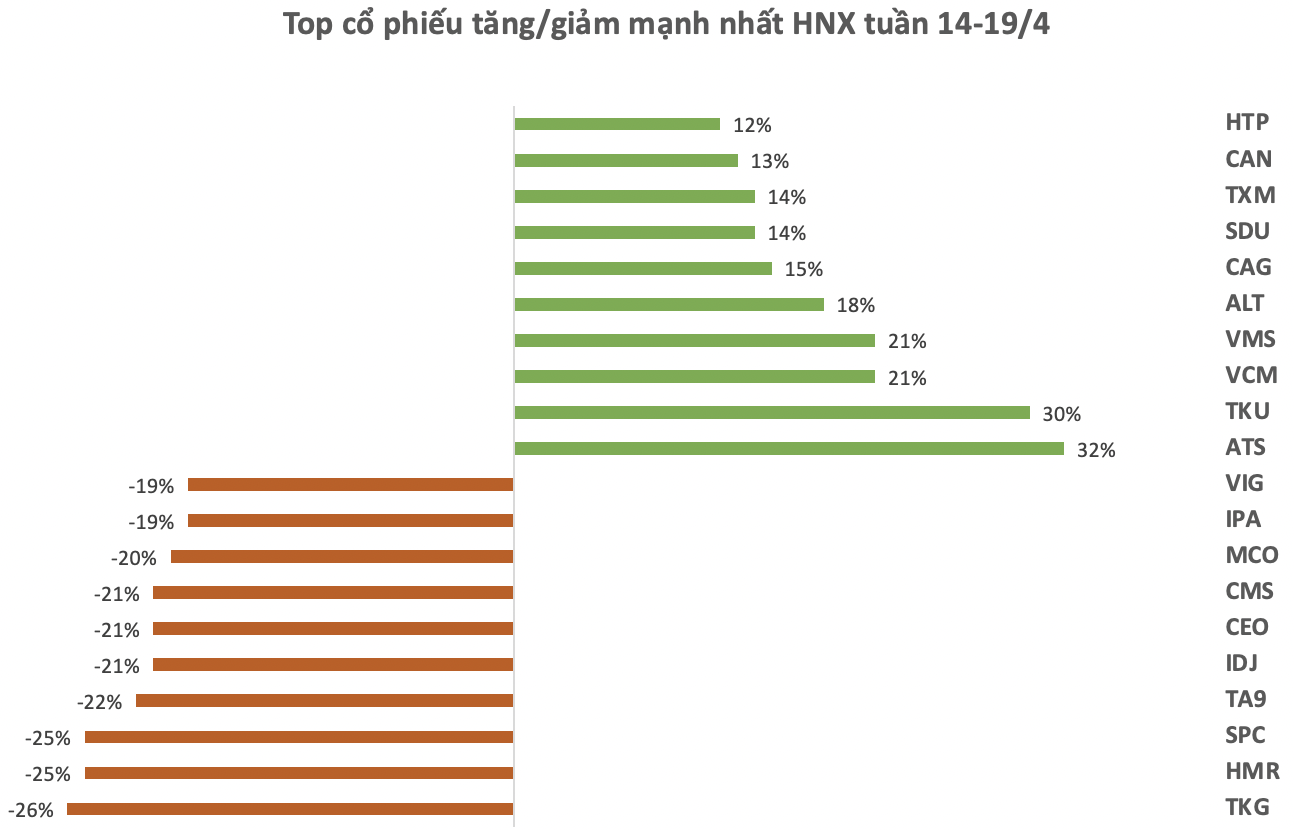

On the HNX floor, the top 10 stocks that increased in price also had an increase ranging from 12-32%. However, the stocks that increased strongly were mainly medium and small stocks with low liquidity, such as ATS, TKU, VCM, ALT, CAG,…

On the price decline side, many stocks also recorded a decrease of 19% – 26% on HNX in the past week.

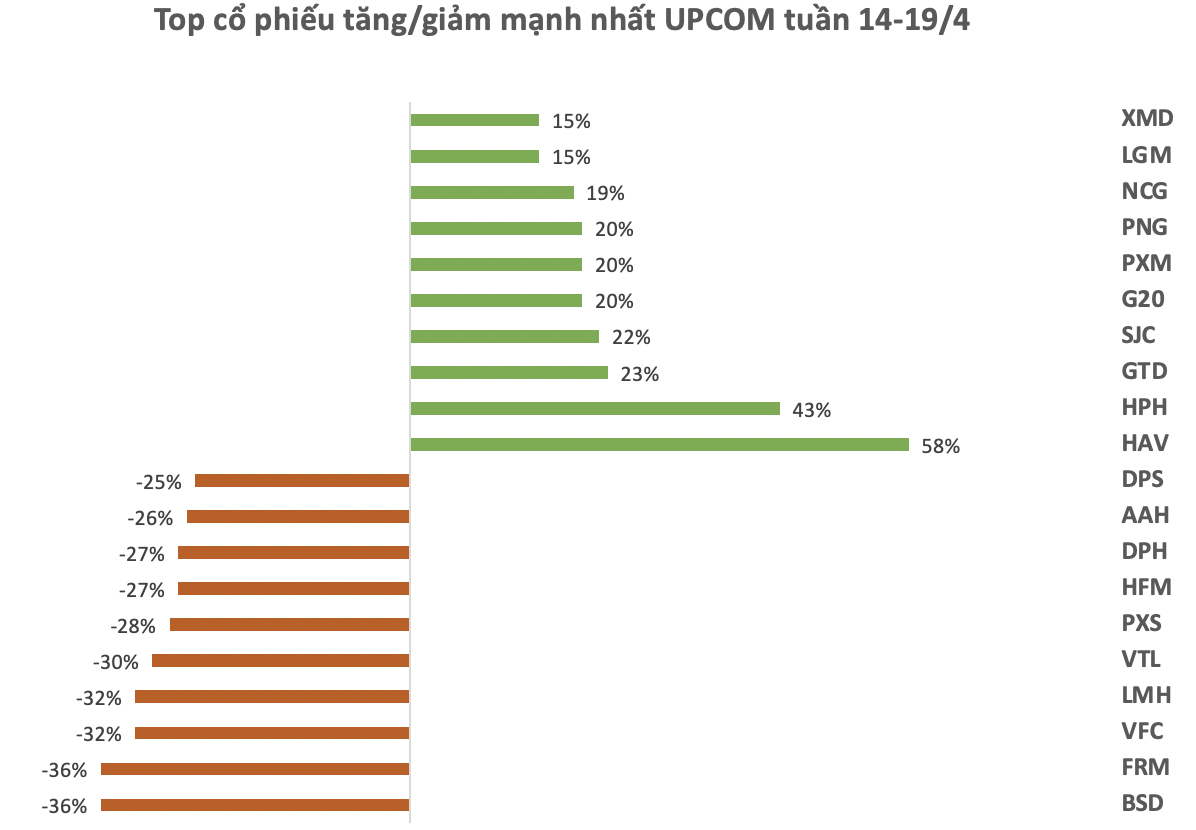

On UPCOM, the trading range was wider, so a series of stocks also increased strongly by 15%-58% in the past week.

The most prominent was HAV of the Hapro Wine Joint Stock Company. Extending the previous increase, HAV increased to the ceiling price in all 5 trading sessions during the week, pushing the stock price up to 6,300 VND/share. Since the beginning of April to date, the stock price of this stock has doubled. However, the liquidity of this stock is quite low, with only a few thousand to tens of thousands of order-matching units.

Conversely, many stocks on UPCOM also recorded a decrease of 25% – 36% in the past week.