Illustrative image

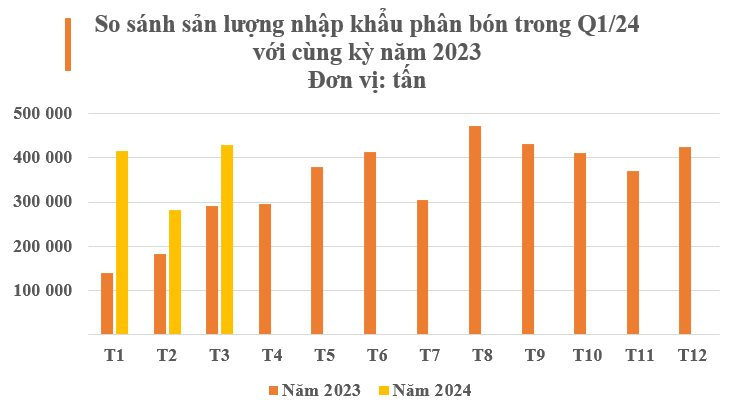

According to preliminary statistics from the General Department of Customs, in March 2024, Vietnam imported 428,853 tons of fertilizer with a value of more than 123 million USD, an increase of 52.3% in volume and 34.7% in value compared to the previous month. The average price reached $287/ton, down 11.6% compared to February 2024.

Accumulated in the first quarter of 2024, Vietnam spent more than 351 million USD to import more than 1.12 million tons of fertilizer, up 82.8% in volume and 48% in value compared to the first quarter of last year. The average import price was 314 USD/ton, down 19%.

In terms of the market, China is the largest fertilizer supplier to Vietnam with 466,409 tons in the first quarter, worth over 104 million USD, up 54% in volume but down 3.1% in value compared to the same period last year. The import price was 223 USD/ton, down 37% and accounting for 42% of the suppliers to Vietnam.

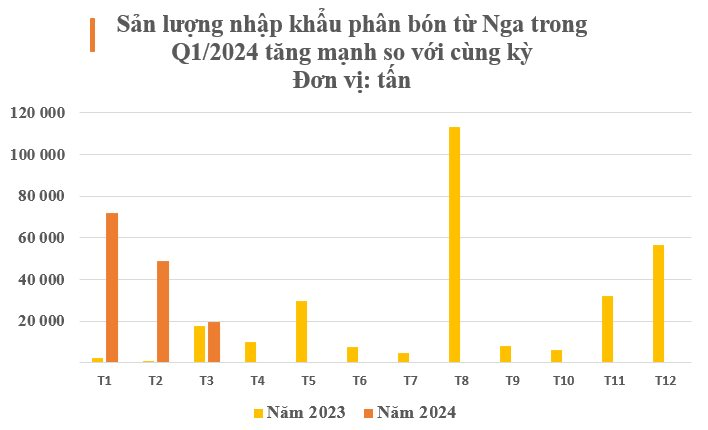

Notably, Russia has risen to become the second largest fertilizer supplier to Vietnam in the first quarter with an output of 140,435 tons, equivalent to more than 83 million USD, up 573% in volume and 574% in value, equivalent to an increase of more than 6 times compared to the same period last year. The import price increased slightly by 0.2% compared to the same period, reaching 596 USD/ton.

Wheat and fertilizer are two ‘treasures’ of the Birch Country because they make Europe heavily dependent on this country. Specifically, Europe receives 25% of urea, 15% of ammonium nitrate, 1/3 of phosphate fertilizers and 35% of potash from the Russian Federation. Russia’s potash market share in the US is 6%, phosphate is 20% and urea accounts for 13%. Not only Europe, the US is also a major importer of Russia. According to the latest data from the US Census Bureau, between January and July 2023, the US imported a record amount of fertilizer from Russia – worth $944 million.

Besides the US, German farmers’ purchases of Russian fertilizer increased by about 334%, from 38.5 thousand tons in July 2022 to 167 thousand tons by June 2023. Urea fertilizer imports alone increased by 304% in the first half of 2023 compared to the same period last year. As a result, Russia’s share of this country’s total fertilizer imports has increased from 5.6% to nearly 18%.

According to the Food and Agriculture Organization (FAO), the output of major agricultural commodities is likely to increase in the 2023-2024 season, including corn (up 4.5%), soybeans (up 7.3%) and rice (up 1%). Agricultural prices (excluding rice and sugar have increased significantly in 2023) are also recovering soon, boosting the demand for cultivation in the coming time leading to increased demand for fertilizers.

Experts predict that the supply of fertilizers will be increasingly tightened as two of the world’s largest suppliers, China and Russia, restrict exports. This could cause fertilizer prices in 2024 to rise slightly compared to previous years. The global urea market is expected to be more active from the second half of 2024 when major consumers including China, India, the US, Brazil and Europe will return to bidding to secure fertilizer supplies for the upcoming summer – autumn sowing peak season.